Buy now pay later (BNPL) integration offers consumers flexible, interest-free installments that enhance purchasing power and improve conversion rates for merchants, contrasting with traditional credit card payment integration which relies on immediate full payment and often incurs higher processing fees. BNPL solutions cater to younger demographics seeking budget-friendly options, while credit cards provide widespread acceptance and reward programs. Explore the benefits and limitations of each payment method to identify the best fit for your business needs.

Why it is important

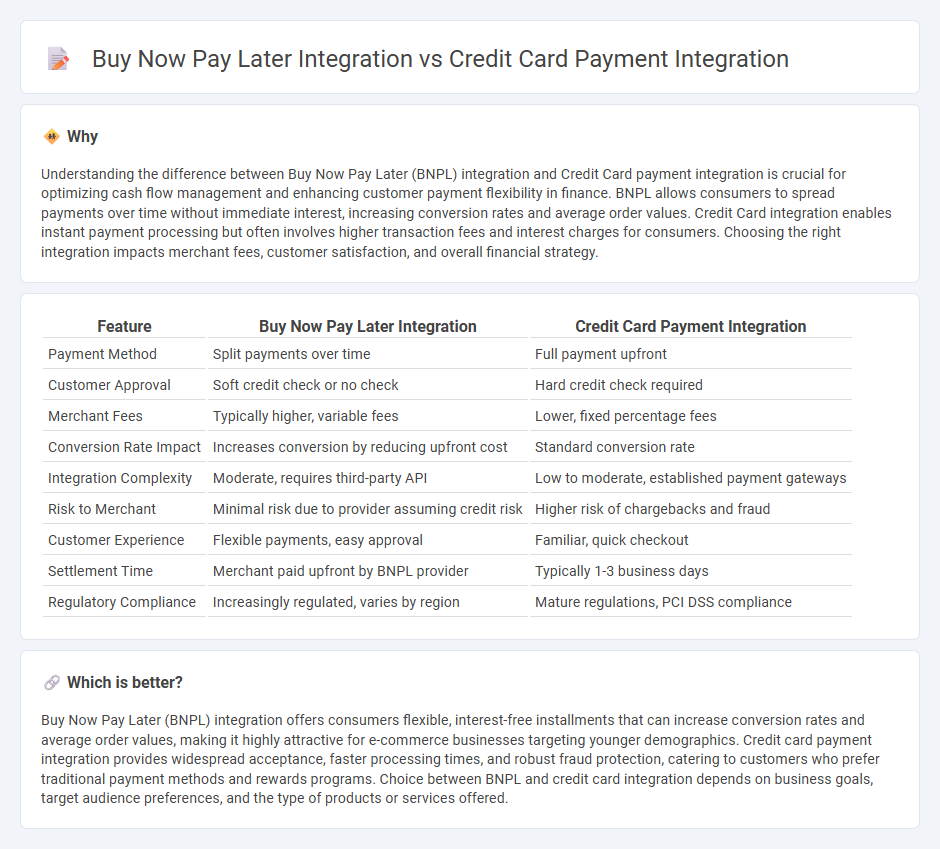

Understanding the difference between Buy Now Pay Later (BNPL) integration and Credit Card payment integration is crucial for optimizing cash flow management and enhancing customer payment flexibility in finance. BNPL allows consumers to spread payments over time without immediate interest, increasing conversion rates and average order values. Credit Card integration enables instant payment processing but often involves higher transaction fees and interest charges for consumers. Choosing the right integration impacts merchant fees, customer satisfaction, and overall financial strategy.

Comparison Table

| Feature | Buy Now Pay Later Integration | Credit Card Payment Integration |

|---|---|---|

| Payment Method | Split payments over time | Full payment upfront |

| Customer Approval | Soft credit check or no check | Hard credit check required |

| Merchant Fees | Typically higher, variable fees | Lower, fixed percentage fees |

| Conversion Rate Impact | Increases conversion by reducing upfront cost | Standard conversion rate |

| Integration Complexity | Moderate, requires third-party API | Low to moderate, established payment gateways |

| Risk to Merchant | Minimal risk due to provider assuming credit risk | Higher risk of chargebacks and fraud |

| Customer Experience | Flexible payments, easy approval | Familiar, quick checkout |

| Settlement Time | Merchant paid upfront by BNPL provider | Typically 1-3 business days |

| Regulatory Compliance | Increasingly regulated, varies by region | Mature regulations, PCI DSS compliance |

Which is better?

Buy Now Pay Later (BNPL) integration offers consumers flexible, interest-free installments that can increase conversion rates and average order values, making it highly attractive for e-commerce businesses targeting younger demographics. Credit card payment integration provides widespread acceptance, faster processing times, and robust fraud protection, catering to customers who prefer traditional payment methods and rewards programs. Choice between BNPL and credit card integration depends on business goals, target audience preferences, and the type of products or services offered.

Connection

Buy Now Pay Later (BNPL) integration and credit card payment integration are connected through their roles in providing flexible payment options that enhance customer purchasing power and merchant sales volume. Both systems require secure transaction processing, compliance with financial regulations, and seamless integration with e-commerce platforms and point-of-sale systems. The combined use of BNPL and credit card payment solutions enables businesses to cater to diverse consumer preferences, optimize cash flow management, and reduce cart abandonment rates.

Key Terms

Transaction Processing

Credit card payment integration processes transactions instantly by verifying credit limits and fraud checks through card networks like Visa or Mastercard, ensuring immediate authorization and fund transfer. Buy Now Pay Later (BNPL) integration splits payments into installments, involving risk assessments and third-party financing partners that handle deferred payments and customer credit evaluation. Explore the detailed differences in transaction workflows and processing efficiencies to choose the best payment solution for your business.

Risk Assessment

Credit card payment integration involves real-time credit checks and fraud detection algorithms to assess risk before transaction approval, leveraging established financial data and credit scores. Buy Now Pay Later (BNPL) integration uses alternative risk assessment models based on soft credit inquiries, purchase behavior, and repayment history, often extending credit with limited upfront vetting to increase conversion rates. Explore detailed comparisons to understand which risk assessment strategy best suits your business needs.

Settlement Mechanism

Credit card payment integration facilitates immediate settlement through card networks such as Visa or Mastercard, ensuring funds are transferred to merchants typically within one to three business days. Buy Now Pay Later (BNPL) integration involves a deferred settlement process where the BNPL provider pays merchants upfront and collects payments from consumers over time, often interest-free or with flexible terms. Explore more about how these settlement mechanisms impact cash flow and customer experience.

Source and External Links

Credit Card Payment Integration - Credit card payment integration connects a merchant's POS or website with a payment processor to enable seamless credit/debit card transactions, using encryption and fraud detection for online payments and EMV and contactless tech for in-person sales.

Credit Card Payment Integration-2025 Guide - Credit card payment integration automates payment collection and reconciliation with features like fraud prevention, retry logic, and reporting portals; typically involves transaction fees with no integration cost.

How to Accept Credit Card Payments on Your Website - Accept credit card payments online by integrating a payment gateway via API or plugins, ensuring SSL encryption and compliance with PCI DSS standards for security.

dowidth.com

dowidth.com