Private credit involves non-bank lending to companies and often targets middle-market or large businesses seeking flexible financing options, while microfinance focuses on providing small loans and financial services to low-income individuals or entrepreneurs in underserved communities. Both sectors address funding gaps but differ significantly in scale, risk profiles, and target borrowers. Explore further to understand how these distinct financial models impact economic growth and social development.

Why it is important

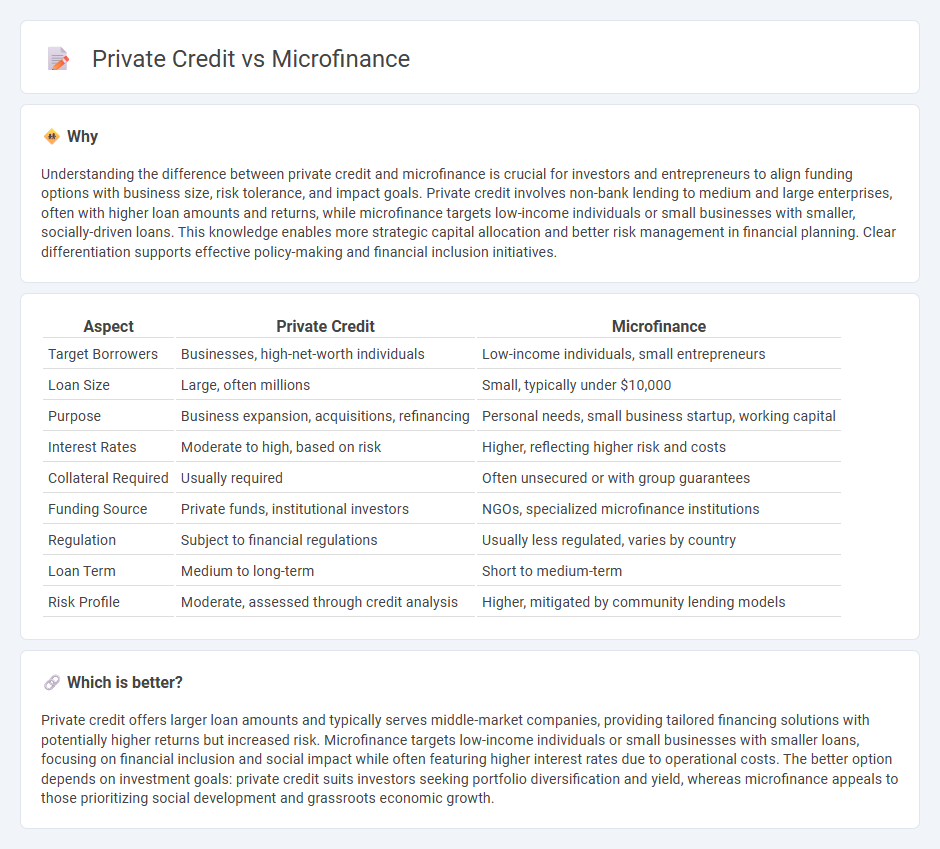

Understanding the difference between private credit and microfinance is crucial for investors and entrepreneurs to align funding options with business size, risk tolerance, and impact goals. Private credit involves non-bank lending to medium and large enterprises, often with higher loan amounts and returns, while microfinance targets low-income individuals or small businesses with smaller, socially-driven loans. This knowledge enables more strategic capital allocation and better risk management in financial planning. Clear differentiation supports effective policy-making and financial inclusion initiatives.

Comparison Table

| Aspect | Private Credit | Microfinance |

|---|---|---|

| Target Borrowers | Businesses, high-net-worth individuals | Low-income individuals, small entrepreneurs |

| Loan Size | Large, often millions | Small, typically under $10,000 |

| Purpose | Business expansion, acquisitions, refinancing | Personal needs, small business startup, working capital |

| Interest Rates | Moderate to high, based on risk | Higher, reflecting higher risk and costs |

| Collateral Required | Usually required | Often unsecured or with group guarantees |

| Funding Source | Private funds, institutional investors | NGOs, specialized microfinance institutions |

| Regulation | Subject to financial regulations | Usually less regulated, varies by country |

| Loan Term | Medium to long-term | Short to medium-term |

| Risk Profile | Moderate, assessed through credit analysis | Higher, mitigated by community lending models |

Which is better?

Private credit offers larger loan amounts and typically serves middle-market companies, providing tailored financing solutions with potentially higher returns but increased risk. Microfinance targets low-income individuals or small businesses with smaller loans, focusing on financial inclusion and social impact while often featuring higher interest rates due to operational costs. The better option depends on investment goals: private credit suits investors seeking portfolio diversification and yield, whereas microfinance appeals to those prioritizing social development and grassroots economic growth.

Connection

Private credit and microfinance both focus on providing alternative lending solutions that target underserved markets and individuals lacking access to traditional banking services. Private credit funds increasingly allocate resources to microfinance institutions, enabling small-scale entrepreneurs and low-income borrowers to obtain essential financing. This connection boosts financial inclusion by supporting economic growth in emerging markets and fostering the development of small businesses.

Key Terms

Microfinance:

Microfinance provides small loans, savings, and financial services to low-income individuals typically excluded from traditional banking, fostering entrepreneurship and poverty alleviation. It emphasizes social impact, financial inclusion, and community development, contrasting with private credit's focus on higher loan amounts and institutional borrowers. Discover how microfinance drives economic empowerment and financial access in underserved populations.

Microloans

Microloans, a key component of microfinance, provide small, low-interest loans targeting underserved individuals and small businesses lacking collateral or credit history. Private credit, in contrast, involves larger loans from non-bank lenders to businesses with established financial records, offering flexible but often higher-interest financing. Explore deeper insights on microloan benefits, eligibility, and impact on financial inclusion.

Financial Inclusion

Microfinance mainly targets low-income individuals and underserved communities, providing small loans to promote financial inclusion and economic empowerment. Private credit typically serves mid-sized enterprises or individuals with established credit histories, often requiring collateral and higher creditworthiness. Explore how both sectors are shaping inclusive financial ecosystems worldwide.

Source and External Links

Microfinance 101: All you need to know - Microfinance provides financial services such as loans, savings, and insurance to individuals and small businesses who lack access to traditional banking due to factors like poverty, lack of collateral, or systemic inequality, serving over 1.7 billion unbanked adults worldwide.

Microfinancing Basics - My Own Business Institute - Microfinance delivers small loans and increasingly savings and insurance to entrepreneurs who cannot access traditional financial services, helping them start or grow businesses with tailored lending options and support.

UNRWA Microfinance - The UNRWA department provides credit and financial services aimed at creating income-generation opportunities and jobs for marginalized groups, including Palestine refugees, with a focus on women, youth, and informal business operators in poor urban areas.

dowidth.com

dowidth.com