Synthetic risk transfer enables financial institutions to manage credit risk through derivatives such as credit default swaps, providing off-balance-sheet risk mitigation without transferring legal ownership of assets. Insurance-linked securities (ILS) allow investors to assume insurance risks by purchasing bonds linked to catastrophic events, offering diversely sourced capital that is uncorrelated with traditional markets. Explore deeper insights into how these innovative risk management tools reshape financial strategies.

Why it is important

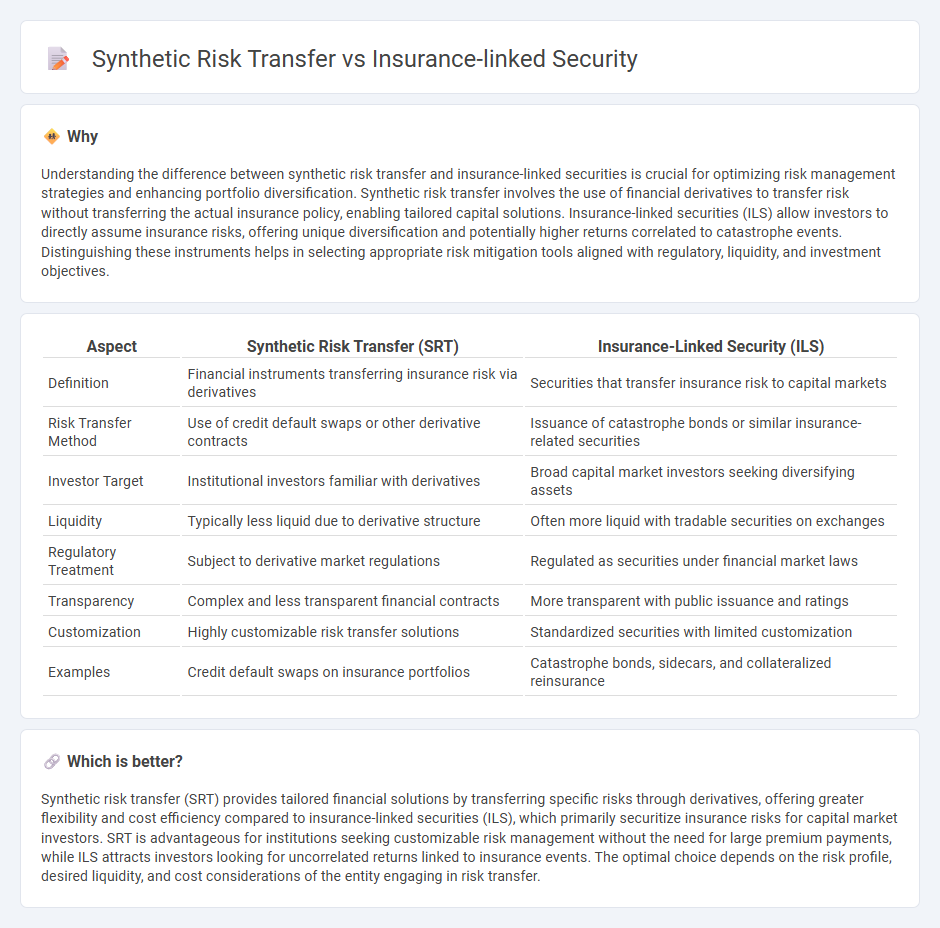

Understanding the difference between synthetic risk transfer and insurance-linked securities is crucial for optimizing risk management strategies and enhancing portfolio diversification. Synthetic risk transfer involves the use of financial derivatives to transfer risk without transferring the actual insurance policy, enabling tailored capital solutions. Insurance-linked securities (ILS) allow investors to directly assume insurance risks, offering unique diversification and potentially higher returns correlated to catastrophe events. Distinguishing these instruments helps in selecting appropriate risk mitigation tools aligned with regulatory, liquidity, and investment objectives.

Comparison Table

| Aspect | Synthetic Risk Transfer (SRT) | Insurance-Linked Security (ILS) |

|---|---|---|

| Definition | Financial instruments transferring insurance risk via derivatives | Securities that transfer insurance risk to capital markets |

| Risk Transfer Method | Use of credit default swaps or other derivative contracts | Issuance of catastrophe bonds or similar insurance-related securities |

| Investor Target | Institutional investors familiar with derivatives | Broad capital market investors seeking diversifying assets |

| Liquidity | Typically less liquid due to derivative structure | Often more liquid with tradable securities on exchanges |

| Regulatory Treatment | Subject to derivative market regulations | Regulated as securities under financial market laws |

| Transparency | Complex and less transparent financial contracts | More transparent with public issuance and ratings |

| Customization | Highly customizable risk transfer solutions | Standardized securities with limited customization |

| Examples | Credit default swaps on insurance portfolios | Catastrophe bonds, sidecars, and collateralized reinsurance |

Which is better?

Synthetic risk transfer (SRT) provides tailored financial solutions by transferring specific risks through derivatives, offering greater flexibility and cost efficiency compared to insurance-linked securities (ILS), which primarily securitize insurance risks for capital market investors. SRT is advantageous for institutions seeking customizable risk management without the need for large premium payments, while ILS attracts investors looking for uncorrelated returns linked to insurance events. The optimal choice depends on the risk profile, desired liquidity, and cost considerations of the entity engaging in risk transfer.

Connection

Synthetic risk transfer (SRT) and insurance-linked securities (ILS) both provide alternative risk management solutions by transferring insurance risks to the capital markets. SRT uses financial derivatives like credit default swaps to isolate and transfer risk without the physical transfer of assets, while ILS involve the issuance of securities such as catastrophe bonds, allowing investors to assume specific insurance risks. Both mechanisms enhance liquidity, diversify risk exposure, and increase the capacity of insurers and reinsurers to underwrite more policies.

Key Terms

Catastrophe bond (Cat bond)

Catastrophe bonds (Cat bonds) represent a form of insurance-linked security (ILS) that transfers specific catastrophe risks from insurers to capital market investors, providing risk capital based on predefined triggering events such as hurricanes or earthquakes. Synthetic risk transfer utilizes derivatives, such as industry loss warranties or catastrophe swaps, to mimic insurance risk exposures without transferring actual claims liabilities, often allowing faster and more flexible risk management solutions. Explore detailed comparisons of Cat bonds and synthetic risk transfer structures to understand their unique risk profiles and capital market interactions.

Credit default swap (CDS)

Insurance-linked securities (ILS) transfer insurance risk to capital markets through tradable instruments, while synthetic risk transfer uses credit default swaps (CDS) to hedge credit exposure without actual asset transfer. CDS contracts provide protection against default on debt instruments by enabling risk transfer via derivatives, complementing ILS approaches that primarily cover natural disaster risks. Explore how these instruments optimize risk management strategies in financial portfolios.

Risk premium

Insurance-linked securities (ILS) transfer insurance risk to capital markets, allowing investors to earn a risk premium often higher than traditional bonds due to the uncorrelated nature of insured catastrophic events. Synthetic risk transfer uses derivatives like catastrophe swaps to transfer risk without the need for issuing securities, often involving a risk premium dependent on counterparty credit risk and market conditions. Explore the nuances of risk premium dynamics in ILS and synthetic contracts to optimize risk management strategies.

Source and External Links

Insurance-linked security - Wikipedia - An insurance-linked security (ILS) is a financial asset whose value is driven by insurance loss events, enabling insurers to transfer risk and investors to earn returns uncorrelated with other markets.

What are insurance-linked securities (or ILS)? - Artemis.bm - ILS are financial instruments linked to insurance risks like natural disasters that allow insurance companies to transfer risk to capital markets and provide institutional investors with unique, low-correlation investment opportunities.

The rising importance of insurance linked securities - Ocorian - ILS have evolved from alternative investments for catastrophe risk to a broader asset class used for diverse risks, offering investors uncorrelated returns and insurers improved capital efficiency and resilience via innovations like parametric triggers.

dowidth.com

dowidth.com