Tokenization of real-world assets transforms physical and financial assets into digital tokens on a blockchain, enabling enhanced liquidity and transparency. Fractional ownership allows multiple investors to share a stake in high-value assets, lowering barriers to entry and spreading risk. Explore how these innovative financial models redefine investment opportunities and asset management.

Why it is important

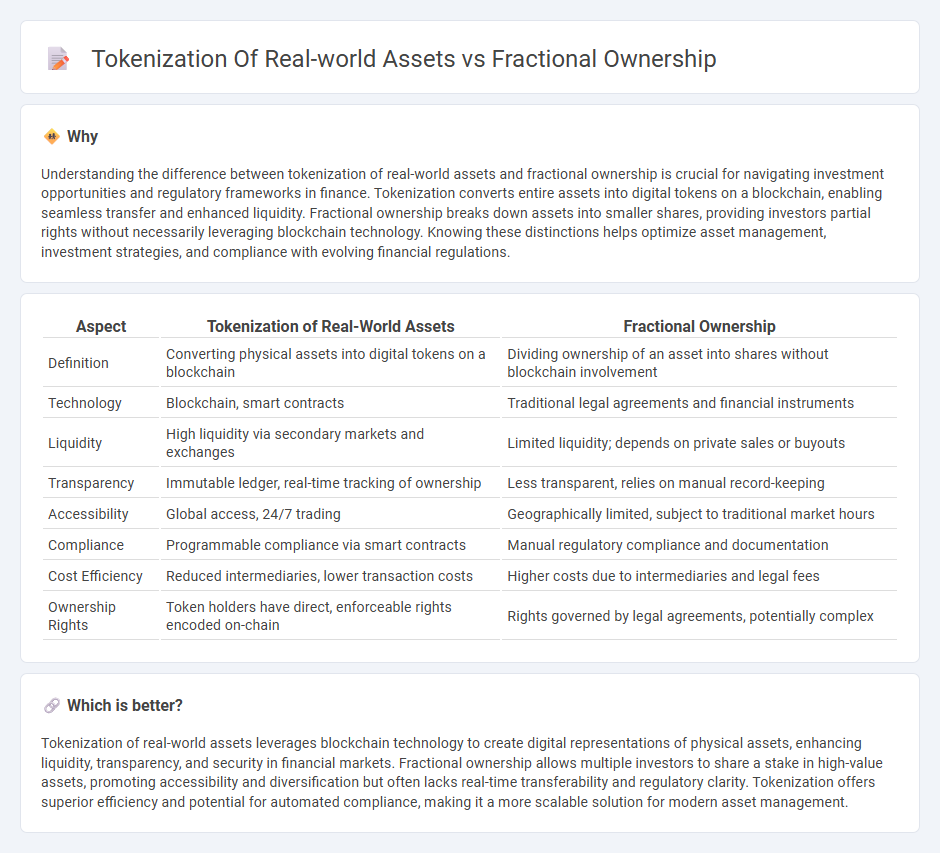

Understanding the difference between tokenization of real-world assets and fractional ownership is crucial for navigating investment opportunities and regulatory frameworks in finance. Tokenization converts entire assets into digital tokens on a blockchain, enabling seamless transfer and enhanced liquidity. Fractional ownership breaks down assets into smaller shares, providing investors partial rights without necessarily leveraging blockchain technology. Knowing these distinctions helps optimize asset management, investment strategies, and compliance with evolving financial regulations.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Fractional Ownership |

|---|---|---|

| Definition | Converting physical assets into digital tokens on a blockchain | Dividing ownership of an asset into shares without blockchain involvement |

| Technology | Blockchain, smart contracts | Traditional legal agreements and financial instruments |

| Liquidity | High liquidity via secondary markets and exchanges | Limited liquidity; depends on private sales or buyouts |

| Transparency | Immutable ledger, real-time tracking of ownership | Less transparent, relies on manual record-keeping |

| Accessibility | Global access, 24/7 trading | Geographically limited, subject to traditional market hours |

| Compliance | Programmable compliance via smart contracts | Manual regulatory compliance and documentation |

| Cost Efficiency | Reduced intermediaries, lower transaction costs | Higher costs due to intermediaries and legal fees |

| Ownership Rights | Token holders have direct, enforceable rights encoded on-chain | Rights governed by legal agreements, potentially complex |

Which is better?

Tokenization of real-world assets leverages blockchain technology to create digital representations of physical assets, enhancing liquidity, transparency, and security in financial markets. Fractional ownership allows multiple investors to share a stake in high-value assets, promoting accessibility and diversification but often lacks real-time transferability and regulatory clarity. Tokenization offers superior efficiency and potential for automated compliance, making it a more scalable solution for modern asset management.

Connection

Tokenization of real-world assets enables the conversion of physical assets into digital tokens on a blockchain, facilitating fractional ownership by allowing investors to buy and trade portions of these assets. This process enhances liquidity, reduces barriers to entry, and democratizes access to diverse investment opportunities such as real estate, art, and commodities. Fractional ownership through tokenization ensures transparent, secure, and efficient tracking of asset shares, transforming traditional finance models.

Key Terms

Liquidity

Fractional ownership allows multiple investors to hold shares of a tangible asset, often limited by traditional market constraints and requiring intermediaries, which can restrict liquidity. Tokenization leverages blockchain technology to convert real-world assets into digital tokens, enabling seamless, transparent, and highly liquid trading on global platforms. Explore the advantages of tokenization to understand how it revolutionizes asset liquidity and investment accessibility.

Divisibility

Fractional ownership traditionally allows investors to divide real-world assets such as real estate or luxury items into shares, providing direct ownership rights but often involving complex legal frameworks and limited liquidity. Tokenization leverages blockchain technology to create digital tokens representing asset fractions, enabling seamless transferability, enhanced liquidity, and precise divisibility down to minimal units. Explore how these approaches revolutionize asset accessibility and investment strategies.

Smart Contracts

Fractional ownership enables multiple investors to hold a share in a real-world asset, such as real estate or art, while tokenization leverages blockchain technology to create digital tokens representing these shares through smart contracts. Smart contracts automate transactions, enforce ownership rights, and ensure transparent, secure, and efficient management of asset ownership without intermediaries. Discover how smart contracts are transforming fractional ownership by enhancing liquidity and accessibility in the digital economy.

Source and External Links

Fractional ownership - Fractional ownership involves multiple parties sharing ownership of high-value assets like jets, yachts, or resort properties, splitting costs and usage rights.

The Definitive Guide to Fractional Ownership - This guide explains how fractional ownership works, particularly for co-owning properties, and outlines the benefits of shared costs and benefits.

Fractional Ownership - Answers To Frequently Asked Questions - Provides answers to common questions about fractional ownership, addressing its use in vacation homes, and distinguishing it from other shared ownership models.

dowidth.com

dowidth.com