Hard rug pulls involve the abrupt and complete withdrawal of funds by project creators, leaving investors with worthless assets and causing significant financial losses. Spoofing is a deceptive trading practice where fake orders are placed and quickly canceled to manipulate market prices and mislead other traders. Explore the nuances and impacts of these fraudulent activities to safeguard your investments effectively.

Why it is important

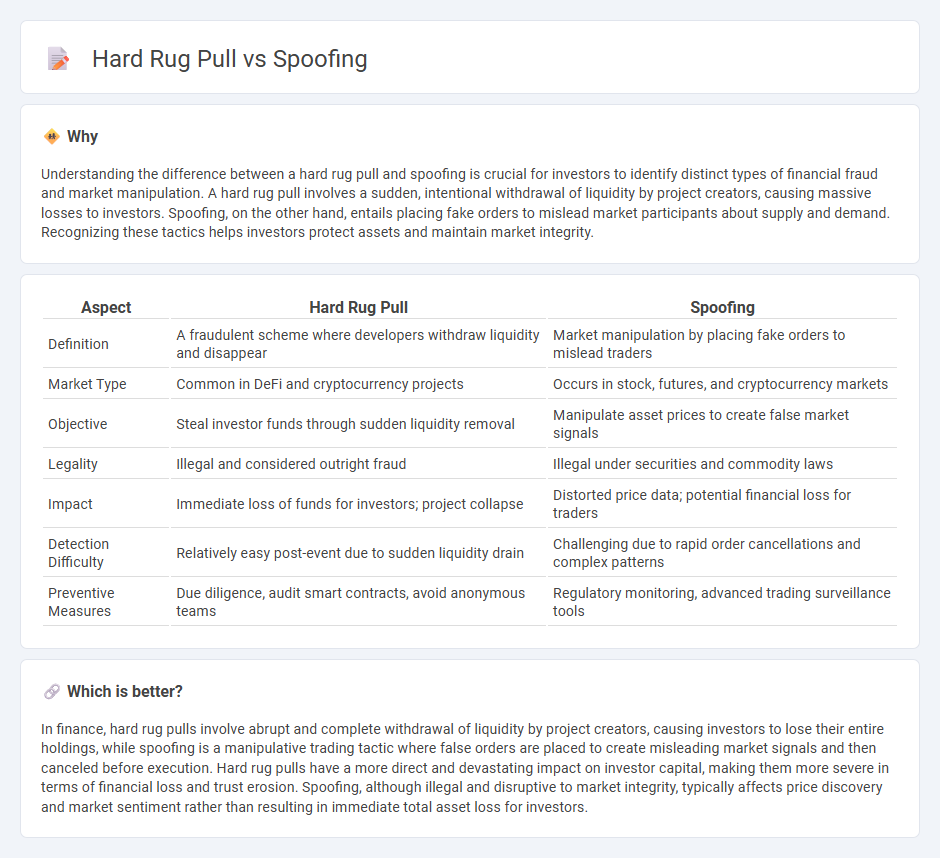

Understanding the difference between a hard rug pull and spoofing is crucial for investors to identify distinct types of financial fraud and market manipulation. A hard rug pull involves a sudden, intentional withdrawal of liquidity by project creators, causing massive losses to investors. Spoofing, on the other hand, entails placing fake orders to mislead market participants about supply and demand. Recognizing these tactics helps investors protect assets and maintain market integrity.

Comparison Table

| Aspect | Hard Rug Pull | Spoofing |

|---|---|---|

| Definition | A fraudulent scheme where developers withdraw liquidity and disappear | Market manipulation by placing fake orders to mislead traders |

| Market Type | Common in DeFi and cryptocurrency projects | Occurs in stock, futures, and cryptocurrency markets |

| Objective | Steal investor funds through sudden liquidity removal | Manipulate asset prices to create false market signals |

| Legality | Illegal and considered outright fraud | Illegal under securities and commodity laws |

| Impact | Immediate loss of funds for investors; project collapse | Distorted price data; potential financial loss for traders |

| Detection Difficulty | Relatively easy post-event due to sudden liquidity drain | Challenging due to rapid order cancellations and complex patterns |

| Preventive Measures | Due diligence, audit smart contracts, avoid anonymous teams | Regulatory monitoring, advanced trading surveillance tools |

Which is better?

In finance, hard rug pulls involve abrupt and complete withdrawal of liquidity by project creators, causing investors to lose their entire holdings, while spoofing is a manipulative trading tactic where false orders are placed to create misleading market signals and then canceled before execution. Hard rug pulls have a more direct and devastating impact on investor capital, making them more severe in terms of financial loss and trust erosion. Spoofing, although illegal and disruptive to market integrity, typically affects price discovery and market sentiment rather than resulting in immediate total asset loss for investors.

Connection

Rug pulls and spoofing are connected through their impact on market manipulation and investor deception in finance. Rug pulls involve project creators abruptly withdrawing liquidity or funds, causing severe losses, while spoofing manipulates order books to create false market signals and trigger price movements. Both tactics undermine market integrity, exploiting trader trust and liquidity vulnerabilities.

Key Terms

Market Manipulation

Spoofing involves placing fake orders to deceive market participants and manipulate asset prices without the intention of executing those trades, creating false market demand or supply. In contrast, a hard rug pull is a sudden and complete withdrawal of liquidity by project creators, resulting in market collapse and massive investor losses. Learn more about how these deceptive practices impact market integrity and investor trust.

Exit Scam

Exit scams in the crypto world often involve spoofing tactics, where fraudsters create fake transactions to lure investors, while hard rug pulls abruptly drain liquidity from a project's pool without warning. Spoofing manipulates market perception by faking demand or supply, misleading traders, whereas hard rug pulls exploit trust, instantly collapsing a token's value and leaving investors with worthless assets. Explore more about how these exit scams impact decentralized finance and safeguard your investments effectively.

Order Book

Order book spoofing manipulates market perception by placing fake buy or sell orders to create false demand or supply without intent to execute, destabilizing price discovery. Hard rug pulls involve abrupt withdrawal of liquidity or assets from decentralized protocols, leaving investors unable to execute trades or access funds, causing severe market disruption. Explore further to understand detection methods and protection strategies in the order book ecosystem.

Source and External Links

What is Spoofing & How to Prevent it - Spoofing is a cybercrime where attackers masquerade as trusted entities to trick victims into actions like transferring money or stealing credentials, often using fake emails or websites combined with social engineering tactics.

What is Spoofing? Spoofing Attacks Defined - Spoofing involves cybercriminals disguising themselves as trusted sources through various techniques such as email, IP, DNS, or GPS spoofing, aiming to steal information, extort money, or install malware.

Spoofing | Spoof Calls | What is a Spoofing Attack - Spoofing is when attackers pretend to be legitimate entities to gain trust, access systems, steal data or money, or spread malware, taking many forms including email, website, caller ID, GPS, and man-in-the-middle attacks.

dowidth.com

dowidth.com