Dark pool trading offers institutional investors private venues to execute large orders with minimal market impact, enhancing anonymity and reducing price slippage compared to traditional exchanges. Electronic Communication Networks (ECNs) provide transparent, fast, and automated trading platforms that match buy and sell orders in real time, improving market liquidity and price discovery. Explore the nuances between dark pools and ECNs to optimize your trading strategy and execution efficiency.

Why it is important

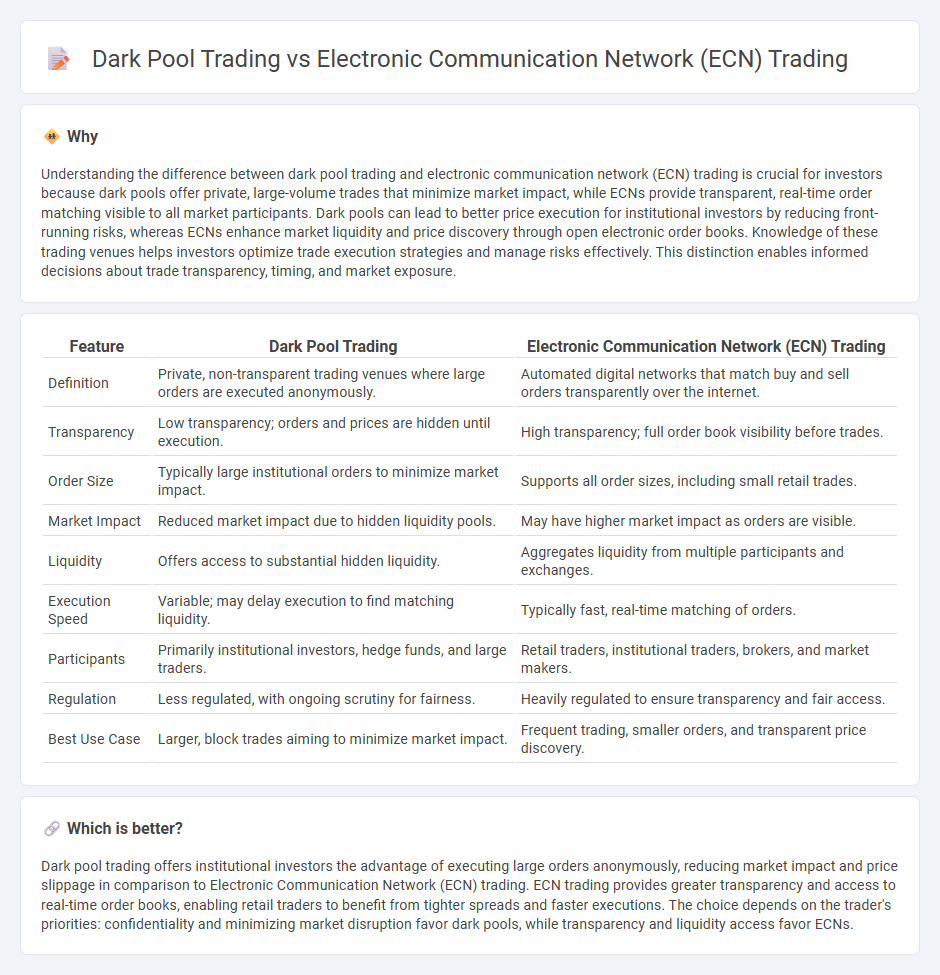

Understanding the difference between dark pool trading and electronic communication network (ECN) trading is crucial for investors because dark pools offer private, large-volume trades that minimize market impact, while ECNs provide transparent, real-time order matching visible to all market participants. Dark pools can lead to better price execution for institutional investors by reducing front-running risks, whereas ECNs enhance market liquidity and price discovery through open electronic order books. Knowledge of these trading venues helps investors optimize trade execution strategies and manage risks effectively. This distinction enables informed decisions about trade transparency, timing, and market exposure.

Comparison Table

| Feature | Dark Pool Trading | Electronic Communication Network (ECN) Trading |

|---|---|---|

| Definition | Private, non-transparent trading venues where large orders are executed anonymously. | Automated digital networks that match buy and sell orders transparently over the internet. |

| Transparency | Low transparency; orders and prices are hidden until execution. | High transparency; full order book visibility before trades. |

| Order Size | Typically large institutional orders to minimize market impact. | Supports all order sizes, including small retail trades. |

| Market Impact | Reduced market impact due to hidden liquidity pools. | May have higher market impact as orders are visible. |

| Liquidity | Offers access to substantial hidden liquidity. | Aggregates liquidity from multiple participants and exchanges. |

| Execution Speed | Variable; may delay execution to find matching liquidity. | Typically fast, real-time matching of orders. |

| Participants | Primarily institutional investors, hedge funds, and large traders. | Retail traders, institutional traders, brokers, and market makers. |

| Regulation | Less regulated, with ongoing scrutiny for fairness. | Heavily regulated to ensure transparency and fair access. |

| Best Use Case | Larger, block trades aiming to minimize market impact. | Frequent trading, smaller orders, and transparent price discovery. |

Which is better?

Dark pool trading offers institutional investors the advantage of executing large orders anonymously, reducing market impact and price slippage in comparison to Electronic Communication Network (ECN) trading. ECN trading provides greater transparency and access to real-time order books, enabling retail traders to benefit from tighter spreads and faster executions. The choice depends on the trader's priorities: confidentiality and minimizing market disruption favor dark pools, while transparency and liquidity access favor ECNs.

Connection

Dark pool trading and electronic communication network (ECN) trading are interconnected through their shared goal of facilitating anonymous and efficient trade execution outside traditional public exchanges. Both platforms utilize advanced technology to provide liquidity and reduce market impact, with ECNs matching buy and sell orders electronically, while dark pools allow large institutional investors to execute substantial trades discreetly. The integration of ECNs within dark pools enhances price discovery and market transparency by aggregating orders from diverse sources without exposing them to immediate public view.

Key Terms

Transparency

Electronic Communication Network (ECN) trading offers a high level of transparency by displaying real-time order book information, allowing participants to see bids and offers openly. Dark pool trading, in contrast, operates privately with limited pre-trade transparency to minimize market impact and reduce information leakage. To explore the distinct transparency features and their impact on trading strategies, learn more about ECN and dark pool dynamics.

Order Matching

Electronic Communication Network (ECN) trading offers transparent order matching through automated systems that display orders to market participants, enabling real-time price discovery and immediate execution. Dark pool trading involves private order books where large-block trades occur anonymously, minimizing market impact but reducing transparency and price visibility. Explore the differences in order matching mechanisms to understand their distinct advantages in trading strategies.

Liquidity

Electronic communication networks (ECNs) offer transparent liquidity by matching buy and sell orders directly on public exchanges, providing real-time order book visibility and tighter bid-ask spreads. Dark pools provide liquidity away from public markets, allowing large traders to execute sizable orders anonymously without impacting market price but with less transparency. Explore the distinct liquidity advantages of ECNs and dark pools to optimize your trading strategy.

Source and External Links

What is ECN Trading? - ECN EXECUTION - ECN Trading is a system that pairs buy and sell orders globally without intermediaries, mostly used in forex, stocks, and CFDs, with orders automatically matched by a computerized network for secure, fast transactions.

What is an electronic communication network (ECN)? - Databento - An ECN is a type of alternative trading system enabling direct, automated trading between buyers and sellers, often used in OTC markets and some listed securities, differing from exchanges by lacking central clearing and operating quote-driven markets.

Electronic communication network - Wikipedia - An ECN is a computerized network that facilitates trading of financial products like stocks and currencies outside traditional exchanges, increasing competition by providing full order book access, lowering costs, and enabling after-hours trading.

dowidth.com

dowidth.com