Laddered bond ETFs invest in bonds with staggered maturities, helping to manage interest rate risk and provide consistent income streams. Aggregate bond ETFs offer diversified exposure across multiple bond sectors, including government, corporate, and mortgage-backed securities, aiming for broad market representation. Explore the differences to determine which strategy aligns best with your investment goals.

Why it is important

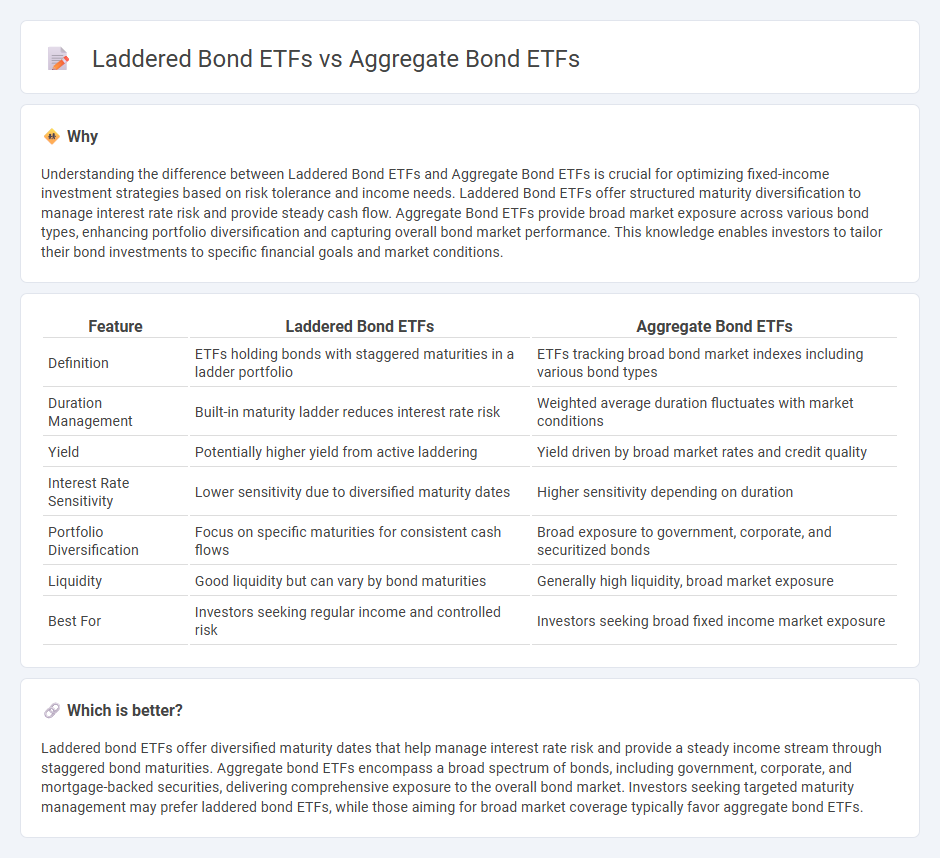

Understanding the difference between Laddered Bond ETFs and Aggregate Bond ETFs is crucial for optimizing fixed-income investment strategies based on risk tolerance and income needs. Laddered Bond ETFs offer structured maturity diversification to manage interest rate risk and provide steady cash flow. Aggregate Bond ETFs provide broad market exposure across various bond types, enhancing portfolio diversification and capturing overall bond market performance. This knowledge enables investors to tailor their bond investments to specific financial goals and market conditions.

Comparison Table

| Feature | Laddered Bond ETFs | Aggregate Bond ETFs |

|---|---|---|

| Definition | ETFs holding bonds with staggered maturities in a ladder portfolio | ETFs tracking broad bond market indexes including various bond types |

| Duration Management | Built-in maturity ladder reduces interest rate risk | Weighted average duration fluctuates with market conditions |

| Yield | Potentially higher yield from active laddering | Yield driven by broad market rates and credit quality |

| Interest Rate Sensitivity | Lower sensitivity due to diversified maturity dates | Higher sensitivity depending on duration |

| Portfolio Diversification | Focus on specific maturities for consistent cash flows | Broad exposure to government, corporate, and securitized bonds |

| Liquidity | Good liquidity but can vary by bond maturities | Generally high liquidity, broad market exposure |

| Best For | Investors seeking regular income and controlled risk | Investors seeking broad fixed income market exposure |

Which is better?

Laddered bond ETFs offer diversified maturity dates that help manage interest rate risk and provide a steady income stream through staggered bond maturities. Aggregate bond ETFs encompass a broad spectrum of bonds, including government, corporate, and mortgage-backed securities, delivering comprehensive exposure to the overall bond market. Investors seeking targeted maturity management may prefer laddered bond ETFs, while those aiming for broad market coverage typically favor aggregate bond ETFs.

Connection

Laddered bond ETFs and aggregate bond ETFs both diversify fixed-income investments by spreading risk across multiple bonds with varying maturities and credit qualities. Laddered bond ETFs focus on staggered maturity dates to manage interest rate risk, while aggregate bond ETFs encompass a broad range of bonds, including government, corporate, and securitized debt, to provide comprehensive market exposure. Both strategies enhance portfolio stability and income consistency amid fluctuating interest rates.

Key Terms

Diversification

Aggregate Bond ETFs offer broad diversification by encompassing a wide range of bonds across various sectors, maturities, and credit qualities, providing a comprehensive exposure to the bond market. Laddered Bond ETFs strategically invest in bonds with staggered maturities to mitigate interest rate risk and enhance income consistency, but typically achieve less sectoral diversification compared to aggregate ETFs. Explore the nuances of each approach to optimize your fixed-income diversification strategy.

Interest Rate Risk

Aggregate Bond ETFs offer broad exposure to various bonds, balancing interest rate risk through diversified maturities and sectors. Laddered Bond ETFs reduce interest rate risk by holding bonds with staggered maturities, providing predictable cash flows and minimizing price volatility as rates change. Explore more to understand which bond strategy aligns best with your investment goals and risk tolerance.

Maturity Structure

Aggregate bond ETFs offer broad exposure to diverse fixed-income securities with varying maturities, providing average duration that balances interest rate risk and yield. Laddered bond ETFs structure their holdings across staggered maturities, enhancing liquidity and reducing interest rate sensitivity by managing reinvestment risk effectively. Explore in-depth analysis to understand which maturity strategy aligns best with your investment goals.

Source and External Links

Madison Aggregate Bond ETF - Actively managed ETF aiming for superior long-term risk-adjusted returns by diversifying across fixed income sectors and optimizing credit risk and yield curve exposure.

AGGH Simplify Aggregate Bond ETF - Actively managed to maximize total return with enhanced yield through structural income strategies like option writing and curve positioning.

SCHZ | Schwab U.S. Aggregate Bond ETF - Low-cost ETF designed to closely track the total return of the broad U.S. investment-grade bond market, providing core portfolio fixed income exposure.

dowidth.com

dowidth.com