Nonfungible tokens (NFTs) fractionalization enables dividing a single digital asset into multiple fungible tokens, allowing investors to buy shares and gain exposure without full ownership. Split ownership refers to legally dividing physical or digital assets among multiple parties, each holding distinct, defined rights and responsibilities. Explore further to understand how these financial structures impact investment strategies and asset liquidity.

Why it is important

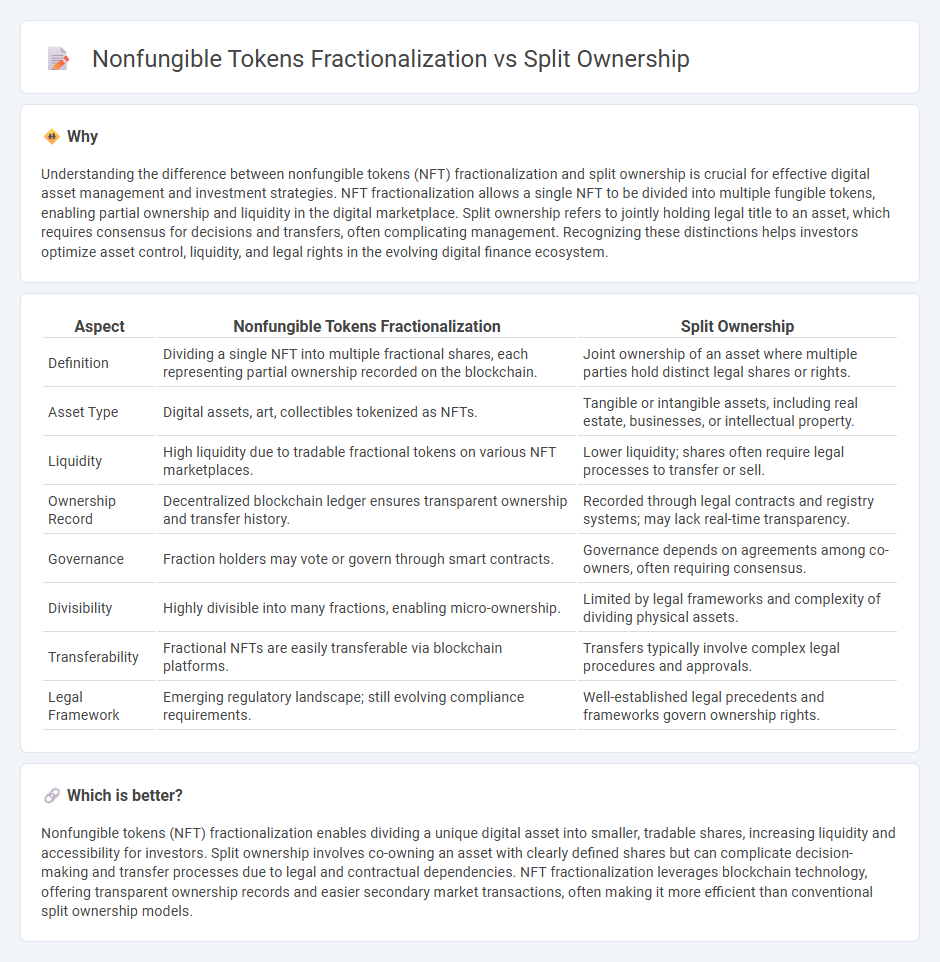

Understanding the difference between nonfungible tokens (NFT) fractionalization and split ownership is crucial for effective digital asset management and investment strategies. NFT fractionalization allows a single NFT to be divided into multiple fungible tokens, enabling partial ownership and liquidity in the digital marketplace. Split ownership refers to jointly holding legal title to an asset, which requires consensus for decisions and transfers, often complicating management. Recognizing these distinctions helps investors optimize asset control, liquidity, and legal rights in the evolving digital finance ecosystem.

Comparison Table

| Aspect | Nonfungible Tokens Fractionalization | Split Ownership |

|---|---|---|

| Definition | Dividing a single NFT into multiple fractional shares, each representing partial ownership recorded on the blockchain. | Joint ownership of an asset where multiple parties hold distinct legal shares or rights. |

| Asset Type | Digital assets, art, collectibles tokenized as NFTs. | Tangible or intangible assets, including real estate, businesses, or intellectual property. |

| Liquidity | High liquidity due to tradable fractional tokens on various NFT marketplaces. | Lower liquidity; shares often require legal processes to transfer or sell. |

| Ownership Record | Decentralized blockchain ledger ensures transparent ownership and transfer history. | Recorded through legal contracts and registry systems; may lack real-time transparency. |

| Governance | Fraction holders may vote or govern through smart contracts. | Governance depends on agreements among co-owners, often requiring consensus. |

| Divisibility | Highly divisible into many fractions, enabling micro-ownership. | Limited by legal frameworks and complexity of dividing physical assets. |

| Transferability | Fractional NFTs are easily transferable via blockchain platforms. | Transfers typically involve complex legal procedures and approvals. |

| Legal Framework | Emerging regulatory landscape; still evolving compliance requirements. | Well-established legal precedents and frameworks govern ownership rights. |

Which is better?

Nonfungible tokens (NFT) fractionalization enables dividing a unique digital asset into smaller, tradable shares, increasing liquidity and accessibility for investors. Split ownership involves co-owning an asset with clearly defined shares but can complicate decision-making and transfer processes due to legal and contractual dependencies. NFT fractionalization leverages blockchain technology, offering transparent ownership records and easier secondary market transactions, often making it more efficient than conventional split ownership models.

Connection

Nonfungible tokens (NFTs) fractionalization divides a single NFT into multiple shares, enabling split ownership among different investors who each hold a portion of the digital asset. This process enhances liquidity and accessibility by allowing smaller investments in high-value NFTs that were previously indivisible. Blockchain technology ensures secure management of fractionalized tokens, facilitating transparent ownership and transferability within decentralized finance ecosystems.

Key Terms

Fractional Ownership

Fractional ownership allows multiple investors to hold real estate, artwork, or other high-value assets through legal shares or equity, enabling shared usage rights and profit distribution without transferring entire ownership. Unlike NFT fractionalization, which divides a unique digital token into smaller fractions to broaden access, fractional ownership typically involves tangible assets with formal legal frameworks. Explore how fractional ownership structures offer practical benefits and secure asset control for co-investors.

Tokenization

Tokenization enables the division of asset ownership into digital tokens, offering precise, programmable rights compared to traditional split ownership that often relies on legal agreements and physical documentation. NFT fractionalization facilitates liquidity by allowing multiple investors to hold partial shares of a unique digital asset through standardized smart contracts on blockchain platforms like Ethereum. Explore deeper insights into how tokenization transforms asset management and investment opportunities.

Liquidity

Split ownership divides asset rights among multiple holders, each controlling a distinct portion, often leading to challenges in transferability and liquidity due to complexity in coordination. Nonfungible token (NFT) fractionalization transforms a single NFT into multiple fungible tokens, enabling easier trading on decentralized markets and significantly enhancing liquidity by allowing partial ownership to be bought and sold freely. Explore the mechanisms behind NFT fractionalization to understand its impact on improving liquidity in digital asset markets.

Source and External Links

How to Split Ownership in an LLC (Fair & Effective Methods) - To split ownership in an LLC, the key steps are to consult and draft an operating agreement outlining profit, loss, and voting rights distribution, adhere to state laws, and divide ownership interest based primarily on members' capital contributions and agreed percentages.

Methods for splitting equity in real estate - Real estate equity can be split through methods like joint tenancy (equal shares with right of survivorship) or tenancy-in-common (customizable shares), allowing owners to divide ownership as suits their needs, with joint tenancy common for spouses and tenancy-in-common for varied ownership interests.

Untangling the Web: Dividing Co-Ownership of Property - When co-owners want to divide or liquidate shared property, legal remedies such as partition allow formal division or sale of the property according to ownership shares, and co-owners can also claim rental value rights when others occupy the property.

dowidth.com

dowidth.com