Sovereign debt restructuring involves renegotiating the terms of a nation's debt to improve its fiscal sustainability, often through extended maturities, reduced interest rates, or partial debt forgiveness. Fiscal consolidation focuses on reducing budget deficits and debt accumulation via increased revenues and decreased public spending to restore economic stability. Explore the distinctions and impacts of these strategies on national economies to understand their roles in financial management.

Why it is important

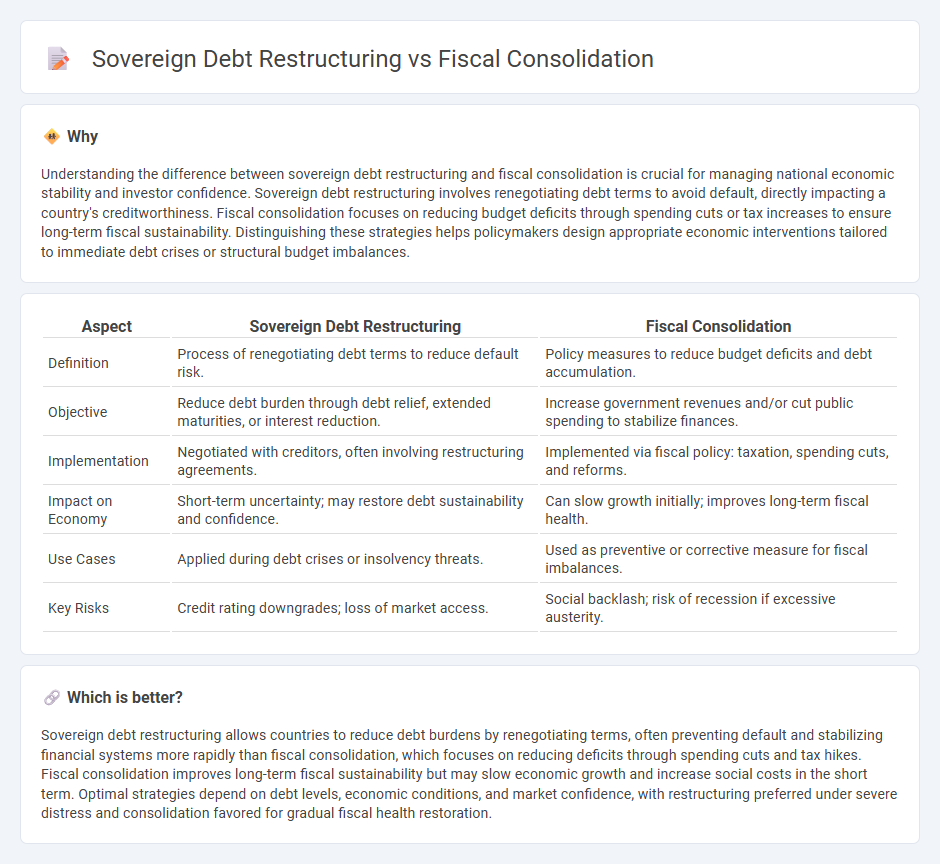

Understanding the difference between sovereign debt restructuring and fiscal consolidation is crucial for managing national economic stability and investor confidence. Sovereign debt restructuring involves renegotiating debt terms to avoid default, directly impacting a country's creditworthiness. Fiscal consolidation focuses on reducing budget deficits through spending cuts or tax increases to ensure long-term fiscal sustainability. Distinguishing these strategies helps policymakers design appropriate economic interventions tailored to immediate debt crises or structural budget imbalances.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Fiscal Consolidation |

|---|---|---|

| Definition | Process of renegotiating debt terms to reduce default risk. | Policy measures to reduce budget deficits and debt accumulation. |

| Objective | Reduce debt burden through debt relief, extended maturities, or interest reduction. | Increase government revenues and/or cut public spending to stabilize finances. |

| Implementation | Negotiated with creditors, often involving restructuring agreements. | Implemented via fiscal policy: taxation, spending cuts, and reforms. |

| Impact on Economy | Short-term uncertainty; may restore debt sustainability and confidence. | Can slow growth initially; improves long-term fiscal health. |

| Use Cases | Applied during debt crises or insolvency threats. | Used as preventive or corrective measure for fiscal imbalances. |

| Key Risks | Credit rating downgrades; loss of market access. | Social backlash; risk of recession if excessive austerity. |

Which is better?

Sovereign debt restructuring allows countries to reduce debt burdens by renegotiating terms, often preventing default and stabilizing financial systems more rapidly than fiscal consolidation, which focuses on reducing deficits through spending cuts and tax hikes. Fiscal consolidation improves long-term fiscal sustainability but may slow economic growth and increase social costs in the short term. Optimal strategies depend on debt levels, economic conditions, and market confidence, with restructuring preferred under severe distress and consolidation favored for gradual fiscal health restoration.

Connection

Sovereign debt restructuring involves renegotiating a country's debt terms to restore financial stability, which directly impacts fiscal consolidation efforts aimed at reducing budget deficits and public debt levels. Effective restructuring can lower debt servicing costs, providing fiscal space for governments to implement consolidation measures such as expenditure cuts and revenue enhancements. The synergy between these processes is critical for achieving sustainable public finances and regaining market confidence.

Key Terms

Budget Deficit

Fiscal consolidation aims to reduce the budget deficit through spending cuts and increased revenues to stabilize public finances without altering debt terms. Sovereign debt restructuring involves renegotiating existing debt obligations to alleviate repayment burdens, which directly impacts the budget deficit by lowering debt servicing costs. Explore further insights to understand the strategic differences and economic implications of these approaches.

Debt Sustainability

Fiscal consolidation involves government policies aimed at reducing budget deficits through spending cuts or increased taxes to stabilize public debt levels. Sovereign debt restructuring entails renegotiating the terms of existing debt obligations to restore debt sustainability when repayment becomes unsustainable. Explore in-depth strategies and implications to better understand maintaining sovereign debt sustainability.

Haircut

Fiscal consolidation involves reducing government deficits through spending cuts and tax increases, aiming to stabilize debt levels without altering the debt's principal value. Sovereign debt restructuring often includes a "haircut," which refers to the reduction in the face value of debt owed to creditors, effectively lowering the government's repayment burden. Explore further to understand how haircuts impact creditor negotiations and long-term financial stability.

Source and External Links

What is Fiscal Consolidation - Know Its Evolution & Importance - Fiscal consolidation involves government policies aimed at reducing deficits and debt accumulation by increasing revenue and reducing expenditure, improving fiscal health without necessarily eliminating debt entirely.

Glossary:Fiscal consolidation - Statistics Explained - Eurostat - Fiscal consolidation is defined as government policy intended to lower budget deficits and reduce the build-up of public debt.

Fiscal consolidation: What can we learn from the past? - PFM Blog - Fiscal consolidation refers to government measures to decrease fiscal deficits and public debt, often involving strengthening fiscal institutions and implementing credible medium-term fiscal frameworks to ensure success.

dowidth.com

dowidth.com