Zero day options expire on the same trading day they are purchased, offering traders a highly speculative tool for short-term profit based on intraday price movements. European options, in contrast, can only be exercised at expiration, making them suitable for strategies with a defined holding period and less sensitivity to intraday volatility. Explore the nuances between zero day and European options to optimize your trading strategy.

Why it is important

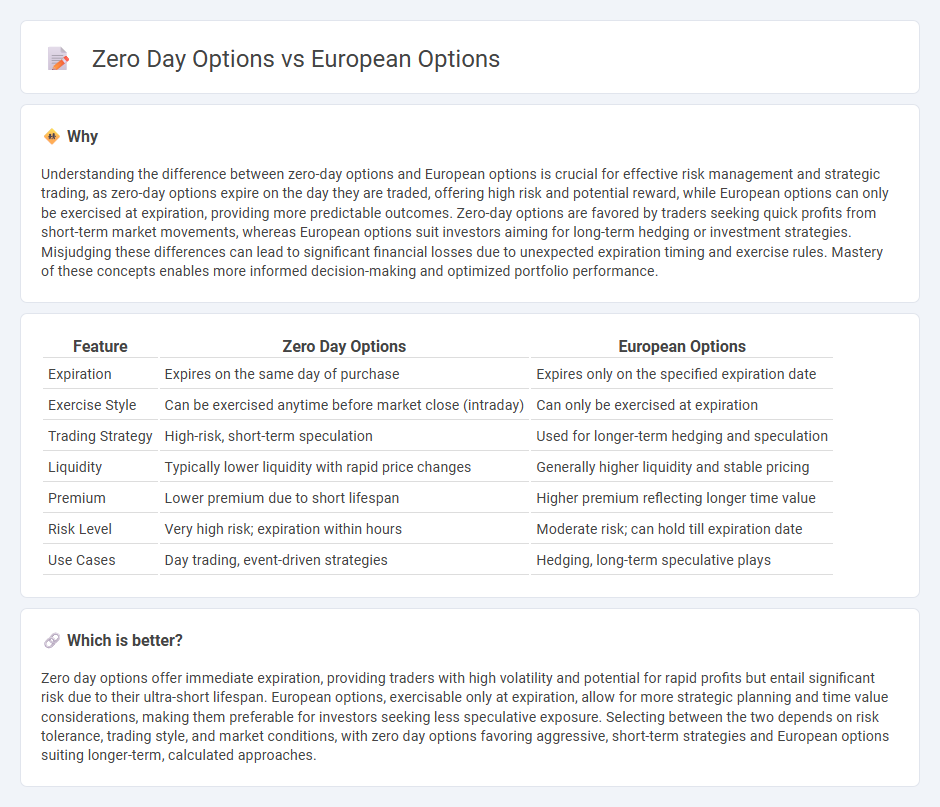

Understanding the difference between zero-day options and European options is crucial for effective risk management and strategic trading, as zero-day options expire on the day they are traded, offering high risk and potential reward, while European options can only be exercised at expiration, providing more predictable outcomes. Zero-day options are favored by traders seeking quick profits from short-term market movements, whereas European options suit investors aiming for long-term hedging or investment strategies. Misjudging these differences can lead to significant financial losses due to unexpected expiration timing and exercise rules. Mastery of these concepts enables more informed decision-making and optimized portfolio performance.

Comparison Table

| Feature | Zero Day Options | European Options |

|---|---|---|

| Expiration | Expires on the same day of purchase | Expires only on the specified expiration date |

| Exercise Style | Can be exercised anytime before market close (intraday) | Can only be exercised at expiration |

| Trading Strategy | High-risk, short-term speculation | Used for longer-term hedging and speculation |

| Liquidity | Typically lower liquidity with rapid price changes | Generally higher liquidity and stable pricing |

| Premium | Lower premium due to short lifespan | Higher premium reflecting longer time value |

| Risk Level | Very high risk; expiration within hours | Moderate risk; can hold till expiration date |

| Use Cases | Day trading, event-driven strategies | Hedging, long-term speculative plays |

Which is better?

Zero day options offer immediate expiration, providing traders with high volatility and potential for rapid profits but entail significant risk due to their ultra-short lifespan. European options, exercisable only at expiration, allow for more strategic planning and time value considerations, making them preferable for investors seeking less speculative exposure. Selecting between the two depends on risk tolerance, trading style, and market conditions, with zero day options favoring aggressive, short-term strategies and European options suiting longer-term, calculated approaches.

Connection

Zero day options, which expire on the same day they are traded, share a critical characteristic with European options in that both can only be exercised at expiration. This alignment restricts the exercise flexibility compared to American options, impacting strategies involving hedging and speculation. Traders leverage the limited exercise window of zero day and European options to optimize timing and risk management in volatile markets.

Key Terms

Expiry Date

European options can only be exercised at the expiration date, which provides a fixed timeline for decision-making and risk management. Zero day options expire on the same day they are traded, offering high-risk, high-reward opportunities for traders with precise timing strategies. Explore further to understand how expiry dates impact option pricing and trading strategies.

Time Decay

European options experience time decay, known as theta, more predictably due to their fixed expiration at a specific date, causing their extrinsic value to erode steadily as maturity approaches. Zero day options, expiring within the same trading day, exhibit an accelerated time decay, with theta increasing exponentially, especially in the final hours and minutes, significantly impacting their pricing and risk management. Explore detailed analyses of time decay patterns in these derivatives to optimize trading strategies effectively.

Exercise Style

European options restrict exercise strictly to the expiration date, providing a clear exercise timeline that impacts hedging strategies and risk management. Zero day options, expiring within a single trading day, require rapid decision-making and typically feature heightened volatility and time decay sensitivity. Explore the distinct exercise mechanics and strategic considerations of both option types to optimize your trading approach.

Source and External Links

European Option - Overview, Types, and its Benefits - A European option allows investors to exercise their right to buy or sell the underlying asset only on the expiration date, offering less flexibility but more predictability compared to American options.

European Option Explained: Key Features and Investment - European options restrict execution to the expiration date, providing the holder with the right--but not the obligation--to purchase or sell the underlying asset at a set strike price only at maturity.

American Option vs European Option: What is the - European options are generally cheaper and can be exercised only at expiration, often settling in cash and mostly linked to indices rather than individual stocks.

dowidth.com

dowidth.com