Carbon trading involves buying and selling carbon emission allowances to limit greenhouse gases, creating a financial incentive for companies to reduce pollution. Socially responsible investing (SRI) focuses on selecting investments based on environmental, social, and governance (ESG) criteria, promoting ethical business practices alongside financial returns. Explore further to understand how these strategies impact sustainable finance and investment decisions.

Why it is important

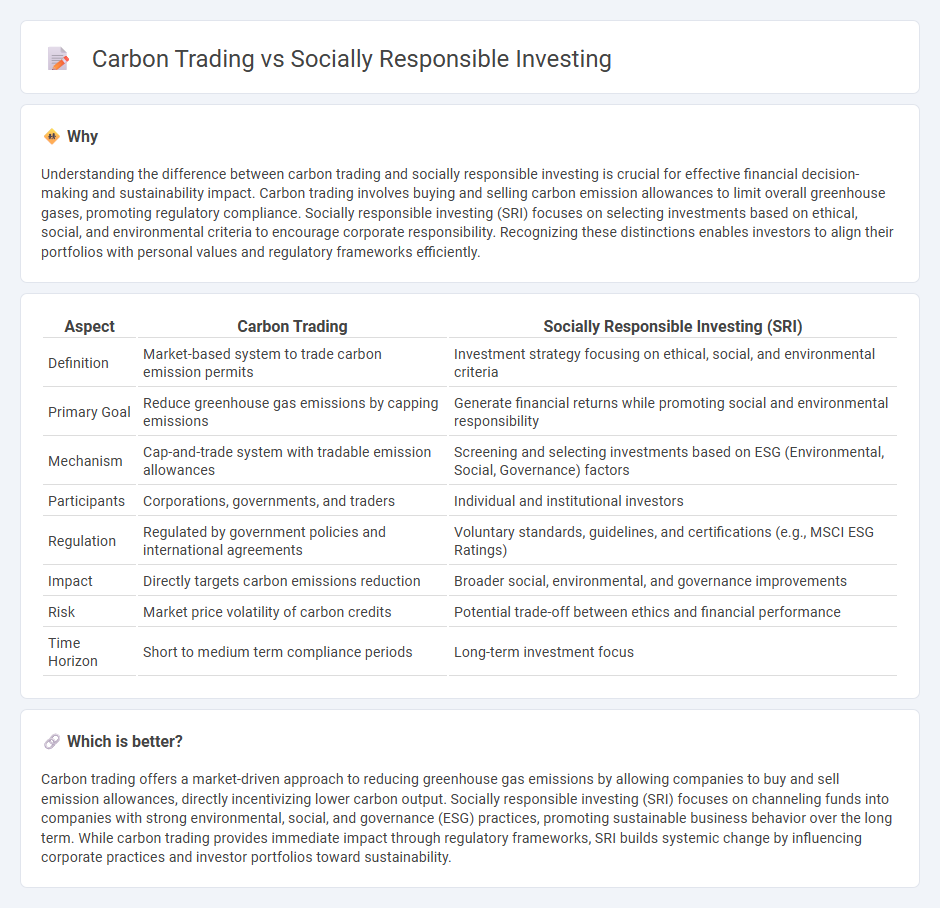

Understanding the difference between carbon trading and socially responsible investing is crucial for effective financial decision-making and sustainability impact. Carbon trading involves buying and selling carbon emission allowances to limit overall greenhouse gases, promoting regulatory compliance. Socially responsible investing (SRI) focuses on selecting investments based on ethical, social, and environmental criteria to encourage corporate responsibility. Recognizing these distinctions enables investors to align their portfolios with personal values and regulatory frameworks efficiently.

Comparison Table

| Aspect | Carbon Trading | Socially Responsible Investing (SRI) |

|---|---|---|

| Definition | Market-based system to trade carbon emission permits | Investment strategy focusing on ethical, social, and environmental criteria |

| Primary Goal | Reduce greenhouse gas emissions by capping emissions | Generate financial returns while promoting social and environmental responsibility |

| Mechanism | Cap-and-trade system with tradable emission allowances | Screening and selecting investments based on ESG (Environmental, Social, Governance) factors |

| Participants | Corporations, governments, and traders | Individual and institutional investors |

| Regulation | Regulated by government policies and international agreements | Voluntary standards, guidelines, and certifications (e.g., MSCI ESG Ratings) |

| Impact | Directly targets carbon emissions reduction | Broader social, environmental, and governance improvements |

| Risk | Market price volatility of carbon credits | Potential trade-off between ethics and financial performance |

| Time Horizon | Short to medium term compliance periods | Long-term investment focus |

Which is better?

Carbon trading offers a market-driven approach to reducing greenhouse gas emissions by allowing companies to buy and sell emission allowances, directly incentivizing lower carbon output. Socially responsible investing (SRI) focuses on channeling funds into companies with strong environmental, social, and governance (ESG) practices, promoting sustainable business behavior over the long term. While carbon trading provides immediate impact through regulatory frameworks, SRI builds systemic change by influencing corporate practices and investor portfolios toward sustainability.

Connection

Carbon trading markets incentivize companies to reduce greenhouse gas emissions by assigning monetary value to carbon credits, directly influencing investment decisions. Socially responsible investing (SRI) integrates environmental, social, and governance (ESG) criteria, encouraging investors to favor companies with strong carbon management practices. The alignment of carbon trading with SRI promotes sustainable finance by driving capital toward low-carbon technologies and responsible corporate behavior.

Key Terms

**Socially Responsible Investing (SRI):**

Socially Responsible Investing (SRI) prioritizes investments in companies with strong environmental, social, and governance (ESG) criteria, aiming to generate both financial returns and positive societal impact. It excludes sectors like fossil fuels and tobacco, promoting sustainable business practices and ethical corporate behavior. Explore how SRI can align your portfolio with your values and drive meaningful change.

ESG (Environmental, Social, and Governance)

Socially responsible investing (SRI) integrates ESG factors to promote sustainable and ethical business practices, focusing on long-term value creation and risk mitigation. Carbon trading, a market-based mechanism, incentivizes companies to reduce greenhouse gas emissions by buying and selling carbon credits, directly targeting environmental impact within the ESG framework. Explore the nuances of ESG strategies to understand how SRI and carbon trading drive sustainability in diverse ways.

Negative Screening

Negative screening in socially responsible investing (SRI) involves excluding companies or industries that do not align with ethical or environmental criteria, such as fossil fuel producers or firms with poor labor practices. Carbon trading, by contrast, is a market-based mechanism aimed at reducing greenhouse gas emissions, allowing companies to buy or sell emission allowances but not necessarily excluding companies based on broader social criteria. To explore the nuances and effectiveness of these approaches in addressing climate and social goals, learn more about their strategies and outcomes.

Source and External Links

Socially responsible investing - Socially responsible investing (SRI) is an investment strategy that balances financial return with ethical, social, and environmental goals, often linked to ESG criteria, and includes practices such as impact investing and shareholder advocacy.

Socially Responsible Investing - SRI integrates personal values with investment decisions, favoring companies with transparency, community involvement, positive environmental policies, and respect for human rights, while avoiding firms with poor social or environmental records.

What is Socially Responsible Investing (SRI)? - Socially responsible funds invest in companies with strong ESG practices and can be actively or passively managed; these investments seek to align with values while offering potential financial returns.

dowidth.com

dowidth.com