Retail algorithmic trading leverages automated systems and complex mathematical models to execute trades at high speeds, optimizing market entry and exit points with minimal human intervention. Social trading enables investors to replicate the trades of experienced peers, fostering community-driven decision-making and strategy sharing. Explore the nuances of both methods to understand their unique advantages in the evolving financial landscape.

Why it is important

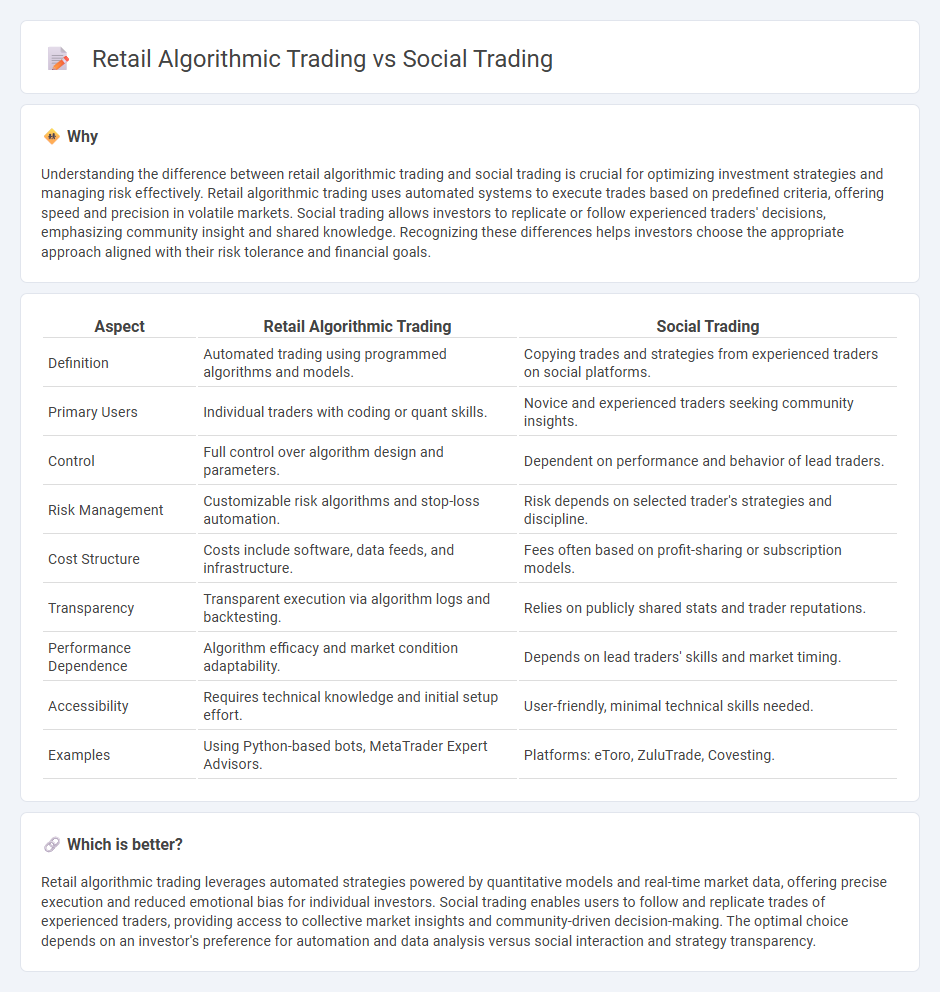

Understanding the difference between retail algorithmic trading and social trading is crucial for optimizing investment strategies and managing risk effectively. Retail algorithmic trading uses automated systems to execute trades based on predefined criteria, offering speed and precision in volatile markets. Social trading allows investors to replicate or follow experienced traders' decisions, emphasizing community insight and shared knowledge. Recognizing these differences helps investors choose the appropriate approach aligned with their risk tolerance and financial goals.

Comparison Table

| Aspect | Retail Algorithmic Trading | Social Trading |

|---|---|---|

| Definition | Automated trading using programmed algorithms and models. | Copying trades and strategies from experienced traders on social platforms. |

| Primary Users | Individual traders with coding or quant skills. | Novice and experienced traders seeking community insights. |

| Control | Full control over algorithm design and parameters. | Dependent on performance and behavior of lead traders. |

| Risk Management | Customizable risk algorithms and stop-loss automation. | Risk depends on selected trader's strategies and discipline. |

| Cost Structure | Costs include software, data feeds, and infrastructure. | Fees often based on profit-sharing or subscription models. |

| Transparency | Transparent execution via algorithm logs and backtesting. | Relies on publicly shared stats and trader reputations. |

| Performance Dependence | Algorithm efficacy and market condition adaptability. | Depends on lead traders' skills and market timing. |

| Accessibility | Requires technical knowledge and initial setup effort. | User-friendly, minimal technical skills needed. |

| Examples | Using Python-based bots, MetaTrader Expert Advisors. | Platforms: eToro, ZuluTrade, Covesting. |

Which is better?

Retail algorithmic trading leverages automated strategies powered by quantitative models and real-time market data, offering precise execution and reduced emotional bias for individual investors. Social trading enables users to follow and replicate trades of experienced traders, providing access to collective market insights and community-driven decision-making. The optimal choice depends on an investor's preference for automation and data analysis versus social interaction and strategy transparency.

Connection

Retail algorithmic trading leverages automated strategies and real-time data to execute trades efficiently on behalf of individual investors, enhancing decision-making speed and accuracy. Social trading platforms integrate these automated systems with community insights, enabling users to follow and replicate successful traders' algorithms, which amplifies collective market intelligence. This connection fosters democratized access to sophisticated trading tools and strategies previously available only to institutional traders.

Key Terms

Copy Trading

Copy trading is a popular form of social trading where investors replicate the trades of experienced traders to benefit from their expertise and strategies. Retail algorithmic trading involves using automated trading systems and algorithms to execute trades based on predefined criteria, offering speed and precision without emotional bias. Explore the differences, advantages, and best practices of copy trading to enhance your investment approach.

Trading Algorithms

Trading algorithms in social trading leverage crowd-sourced insights and sentiment analysis to execute trades based on collective investor behavior, while retail algorithmic trading relies on personalized strategies, technical indicators, and automated rule-based systems to optimize individual portfolio performance. Social trading platforms often integrate copy trading features, allowing users to replicate successful traders' algorithms in real time, whereas retail algorithmic traders develop and backtest proprietary algorithms tailored to specific market conditions. Explore comprehensive guides on trading algorithms to understand the nuances and practical applications of both methodologies.

Execution Platforms

Social trading platforms enable users to follow and copy the trades of experienced investors, providing a community-driven approach to market execution with real-time insights and shared strategies. Retail algorithmic trading platforms offer programmable, automated execution strategies that utilize historical data and technical indicators to optimize trade performance without manual intervention. Explore the key features and benefits of these execution platforms to determine which aligns best with your trading goals.

Source and External Links

Social trading - Social trading is a form of investing where investors observe and replicate the trades of peers and expert traders to inform their own decisions.

Social Trading Explained for Beginners at JustMarkets - Social trading allows traders to follow and copy successful peers' strategies while maintaining control over their own accounts, offering a less complicated entry into trading.

Social Trading: Everything You Need To Know - Social trading platforms enable investors to mimic experienced traders, offering features like copy trading, community insights, and the ability to monitor and adjust copied trades with highlighted risks involved.

dowidth.com

dowidth.com