Payment for order flow (PFOF) involves brokers receiving compensation from market makers for directing client orders to them, increasing order execution volume and liquidity. Internalization occurs when brokers fill client orders using their own inventory, offering potentially faster execution and reduced market impact. Explore these trading mechanisms further to understand their influence on trade transparency and investor costs.

Why it is important

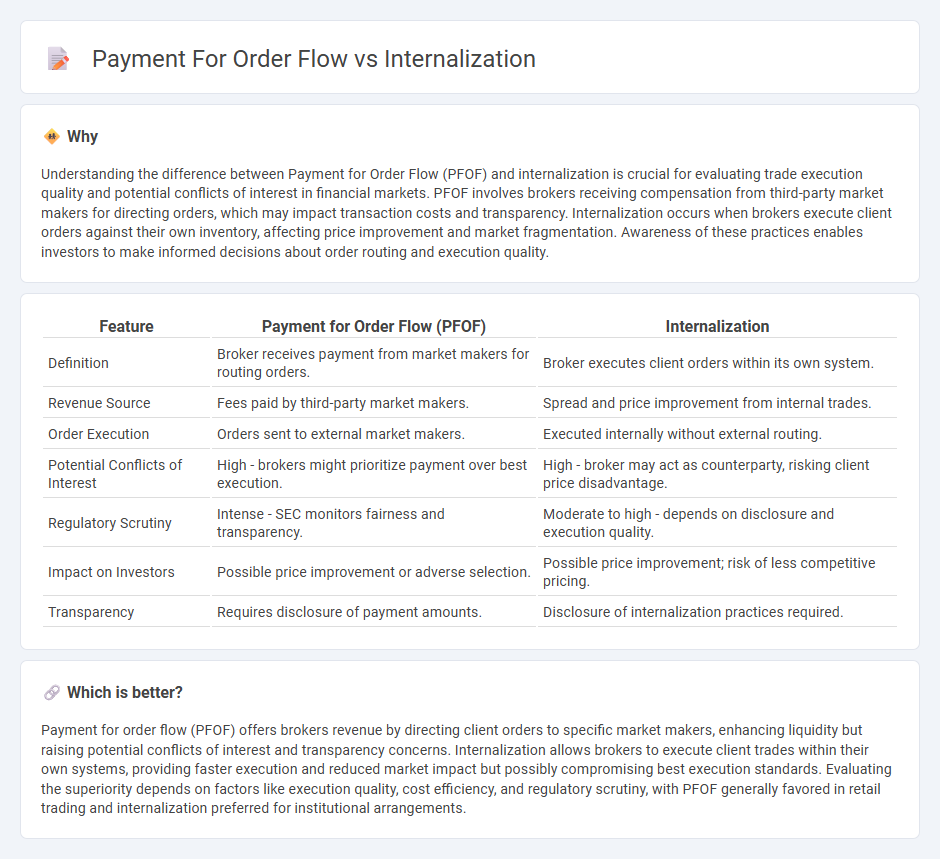

Understanding the difference between Payment for Order Flow (PFOF) and internalization is crucial for evaluating trade execution quality and potential conflicts of interest in financial markets. PFOF involves brokers receiving compensation from third-party market makers for directing orders, which may impact transaction costs and transparency. Internalization occurs when brokers execute client orders against their own inventory, affecting price improvement and market fragmentation. Awareness of these practices enables investors to make informed decisions about order routing and execution quality.

Comparison Table

| Feature | Payment for Order Flow (PFOF) | Internalization |

|---|---|---|

| Definition | Broker receives payment from market makers for routing orders. | Broker executes client orders within its own system. |

| Revenue Source | Fees paid by third-party market makers. | Spread and price improvement from internal trades. |

| Order Execution | Orders sent to external market makers. | Executed internally without external routing. |

| Potential Conflicts of Interest | High - brokers might prioritize payment over best execution. | High - broker may act as counterparty, risking client price disadvantage. |

| Regulatory Scrutiny | Intense - SEC monitors fairness and transparency. | Moderate to high - depends on disclosure and execution quality. |

| Impact on Investors | Possible price improvement or adverse selection. | Possible price improvement; risk of less competitive pricing. |

| Transparency | Requires disclosure of payment amounts. | Disclosure of internalization practices required. |

Which is better?

Payment for order flow (PFOF) offers brokers revenue by directing client orders to specific market makers, enhancing liquidity but raising potential conflicts of interest and transparency concerns. Internalization allows brokers to execute client trades within their own systems, providing faster execution and reduced market impact but possibly compromising best execution standards. Evaluating the superiority depends on factors like execution quality, cost efficiency, and regulatory scrutiny, with PFOF generally favored in retail trading and internalization preferred for institutional arrangements.

Connection

Payment for order flow (PFOF) incentivizes brokers to route customer orders to specific market makers who pay for the order flow, leading to internalization where these market makers execute trades internally instead of routing them to public exchanges. This process can reduce market transparency and potentially impact price execution quality, as trades are matched within the market maker's own system. Regulatory scrutiny focuses on ensuring that internalization resulting from PFOF does not disadvantage retail investors in terms of execution price and market fairness.

Key Terms

Order Execution

Internalization involves broker-dealers executing client orders using their own inventory, often resulting in faster executions and possible price improvement, while payment for order flow (PFOF) entails brokers receiving compensation from third-party market makers for routing orders, which may affect execution quality due to potential conflicts of interest. Both practices impact order execution by influencing speed, price transparency, and market competition, with internalization concentrating on direct order fulfillment and PFOF focusing on routing incentives. Explore detailed analyses of how these mechanisms shape execution quality and regulatory perspectives for enhanced trading strategies.

Broker-Dealer

Broker-dealers utilize internalization by executing client orders within their own systems, often enhancing execution speed and reducing market impact. Payment for order flow involves broker-dealers receiving compensation from market makers to route orders, which can affect price transparency and execution quality. Explore the effects of these practices on order execution and regulatory considerations to understand their impact on trading.

Best Execution

Internalization refers to brokers executing client orders within their own firm, often prioritizing speed and price improvement, while Payment for Order Flow (PFOF) involves brokers receiving compensation from third-party market makers for directing orders to them. Both practices impact Best Execution obligations by potentially influencing the quality and transparency of trade execution. Explore further to understand how these mechanisms affect order fulfillment and investor protection.

Source and External Links

Internalization (sociology) - Internalization in sociology and psychology refers to an individual accepting and integrating the norms, values, attitudes, and behaviors established by others, making them part of one's identity or self, often occurring through socialization and moral development processes.

Internalization: A Cognitive Process - Internalization is a psychological process where individuals subconsciously adopt and integrate external beliefs, attitudes, and norms into their own cognitive and behavioral system, shaping identity, motivations, and moral compass.

INTERNALIZATION definition | Cambridge English Dictionary - Internalization is the action of accepting or absorbing ideas, opinions, or beliefs so that they become an inherent part of one's character, crucial for social and moral development.

dowidth.com

dowidth.com