Green bond laddering involves structuring investments across multiple green bonds with staggered maturities to optimize returns and manage interest rate risk while supporting environmentally sustainable projects. Impact investing focuses on directing capital toward companies and initiatives that generate measurable social and environmental benefits alongside financial returns. Explore the key differences and advantages of these strategies to enhance your sustainable finance portfolio.

Why it is important

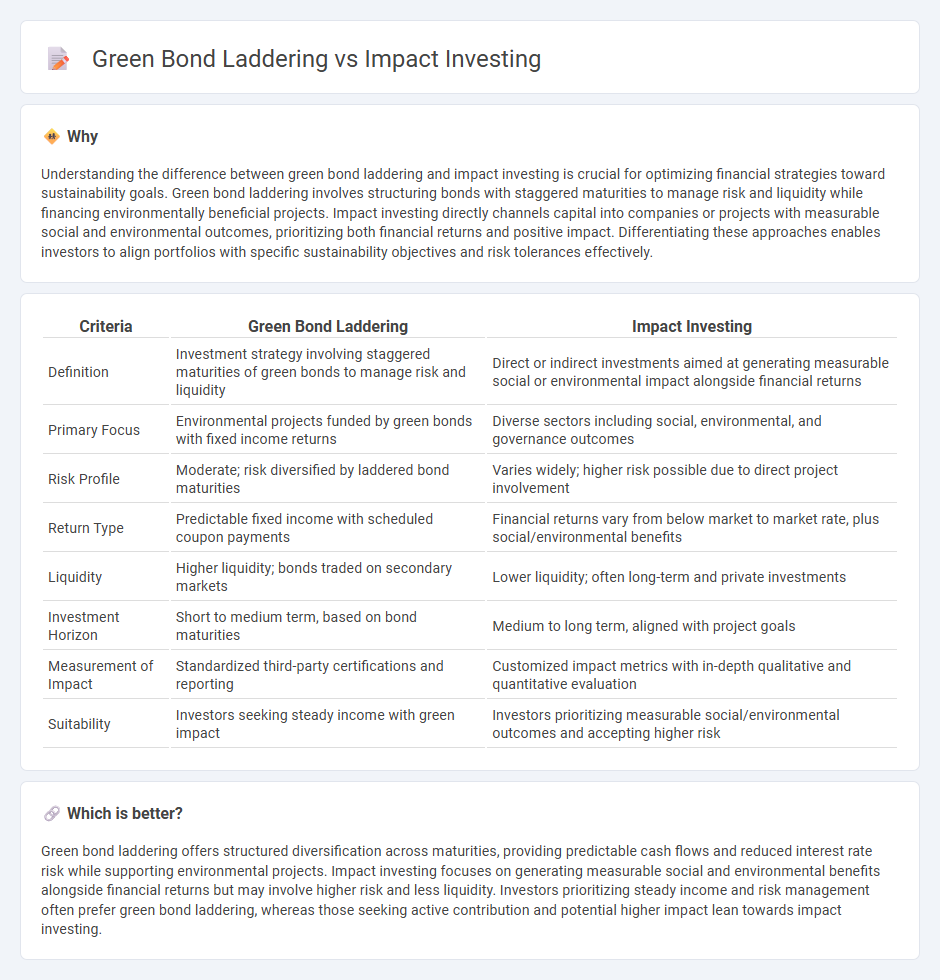

Understanding the difference between green bond laddering and impact investing is crucial for optimizing financial strategies toward sustainability goals. Green bond laddering involves structuring bonds with staggered maturities to manage risk and liquidity while financing environmentally beneficial projects. Impact investing directly channels capital into companies or projects with measurable social and environmental outcomes, prioritizing both financial returns and positive impact. Differentiating these approaches enables investors to align portfolios with specific sustainability objectives and risk tolerances effectively.

Comparison Table

| Criteria | Green Bond Laddering | Impact Investing |

|---|---|---|

| Definition | Investment strategy involving staggered maturities of green bonds to manage risk and liquidity | Direct or indirect investments aimed at generating measurable social or environmental impact alongside financial returns |

| Primary Focus | Environmental projects funded by green bonds with fixed income returns | Diverse sectors including social, environmental, and governance outcomes |

| Risk Profile | Moderate; risk diversified by laddered bond maturities | Varies widely; higher risk possible due to direct project involvement |

| Return Type | Predictable fixed income with scheduled coupon payments | Financial returns vary from below market to market rate, plus social/environmental benefits |

| Liquidity | Higher liquidity; bonds traded on secondary markets | Lower liquidity; often long-term and private investments |

| Investment Horizon | Short to medium term, based on bond maturities | Medium to long term, aligned with project goals |

| Measurement of Impact | Standardized third-party certifications and reporting | Customized impact metrics with in-depth qualitative and quantitative evaluation |

| Suitability | Investors seeking steady income with green impact | Investors prioritizing measurable social/environmental outcomes and accepting higher risk |

Which is better?

Green bond laddering offers structured diversification across maturities, providing predictable cash flows and reduced interest rate risk while supporting environmental projects. Impact investing focuses on generating measurable social and environmental benefits alongside financial returns but may involve higher risk and less liquidity. Investors prioritizing steady income and risk management often prefer green bond laddering, whereas those seeking active contribution and potential higher impact lean towards impact investing.

Connection

Green bond laddering enhances impact investing by systematically managing maturity dates to optimize returns while supporting environmental projects. Impact investing channels capital into sustainable initiatives, with green bonds providing fixed-income opportunities that align financial goals with ecological benefits. This strategic combination maximizes portfolio diversification and amplifies positive social and environmental outcomes.

Key Terms

Social Return on Investment (SROI)

Impact investing targets measurable social and environmental benefits alongside financial returns, emphasizing a high Social Return on Investment (SROI) by supporting sustainable enterprises and community projects. Green bond laddering spreads investment across bonds with staggered maturities dedicated to environmentally beneficial projects, optimizing liquidity while promoting green infrastructure and renewable energy initiatives with quantifiable social impacts. Explore the differences further to optimize your strategy for maximizing SROI in sustainable finance.

Environmental Impact Assessment

Impact investing targets measurable environmental outcomes by channeling capital into projects with quantifiable ecological benefits, whereas green bond laddering involves structured investments in successive green bonds to strategically manage environmental risk and returns over time. Environmental Impact Assessment (EIA) plays a critical role in both approaches by evaluating the potential ecological consequences of funded projects, ensuring alignment with sustainability goals and regulatory compliance. Explore the nuances of these strategies for a deeper understanding of their environmental and financial implications.

Yield Curve (for green bonds)

Impact investing targets measurable environmental and social outcomes alongside financial returns, whereas green bond laddering focuses on structuring bond maturities to optimize yield curve returns in sustainable finance. The green bond yield curve offers insights on interest rate expectations and credit risk premiums, helping investors manage duration and liquidity while supporting climate projects. Explore how aligning investment strategies with green bond market dynamics can enhance portfolio resilience and impact.

Source and External Links

What you need to know about impact investing - Impact investing is the practice of making investments intentionally designed to generate measurable positive social and environmental impacts alongside financial returns, spanning various sectors like energy, healthcare, and sustainable agriculture with a range of return expectations depending on the investor's goals.

What is Impact Investing? | Fidelity - Impact investing involves purposefully allocating capital to achieve social and environmental benefits while aiming for financial returns, attracting growing interest especially among Millennials and driven by a desire to align investments with personal values.

Impact Investing | UNDP Istanbul International Centre for Private Sector in Development - Impact investing is a strategy to mobilize private capital for sustainable development by generating measurable social or environmental benefits alongside financial return, with innovative initiatives such as the Global Islamic Finance and Impact Investing Platform to connect investors and impact enterprises.

dowidth.com

dowidth.com