Private credit offers direct lending solutions with fixed income and lower risk profiles compared to equities, catering primarily to established businesses seeking capital without equity dilution. Mezzanine financing stands as a hybrid capital form, blending debt and equity features, typically providing higher returns through subordinated debt with warrants or equity kickers, ideal for companies pursuing growth or acquisitions. Explore the nuanced differences and strategic applications of private credit and mezzanine financing to optimize your capital structure.

Why it is important

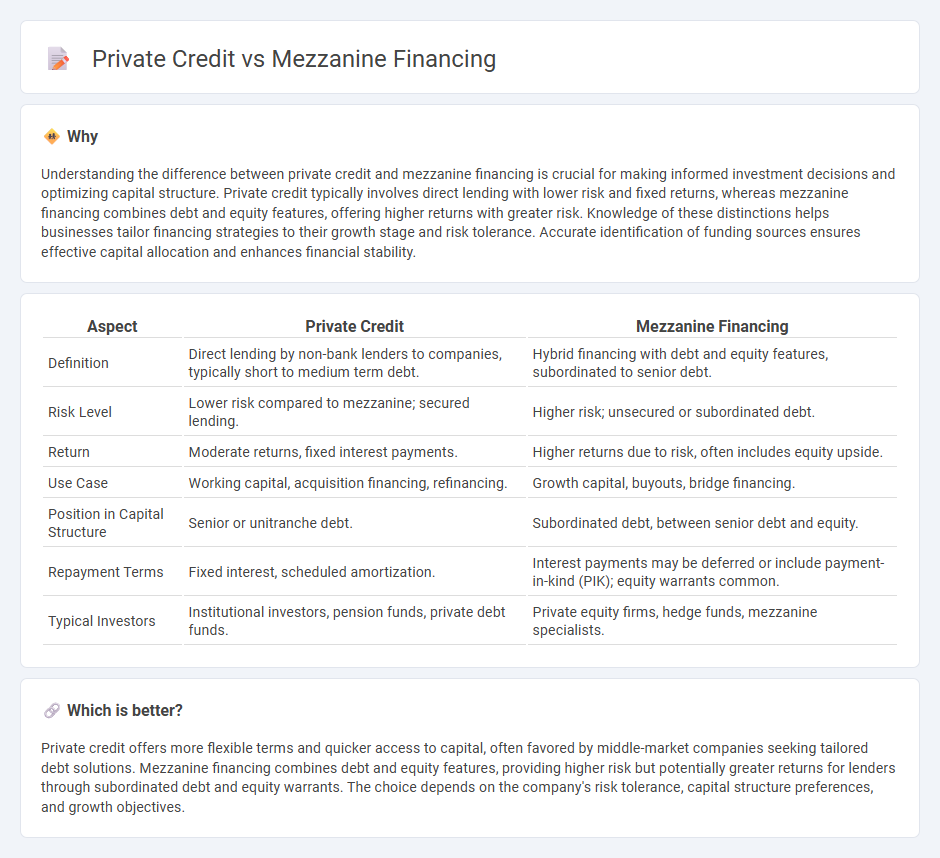

Understanding the difference between private credit and mezzanine financing is crucial for making informed investment decisions and optimizing capital structure. Private credit typically involves direct lending with lower risk and fixed returns, whereas mezzanine financing combines debt and equity features, offering higher returns with greater risk. Knowledge of these distinctions helps businesses tailor financing strategies to their growth stage and risk tolerance. Accurate identification of funding sources ensures effective capital allocation and enhances financial stability.

Comparison Table

| Aspect | Private Credit | Mezzanine Financing |

|---|---|---|

| Definition | Direct lending by non-bank lenders to companies, typically short to medium term debt. | Hybrid financing with debt and equity features, subordinated to senior debt. |

| Risk Level | Lower risk compared to mezzanine; secured lending. | Higher risk; unsecured or subordinated debt. |

| Return | Moderate returns, fixed interest payments. | Higher returns due to risk, often includes equity upside. |

| Use Case | Working capital, acquisition financing, refinancing. | Growth capital, buyouts, bridge financing. |

| Position in Capital Structure | Senior or unitranche debt. | Subordinated debt, between senior debt and equity. |

| Repayment Terms | Fixed interest, scheduled amortization. | Interest payments may be deferred or include payment-in-kind (PIK); equity warrants common. |

| Typical Investors | Institutional investors, pension funds, private debt funds. | Private equity firms, hedge funds, mezzanine specialists. |

Which is better?

Private credit offers more flexible terms and quicker access to capital, often favored by middle-market companies seeking tailored debt solutions. Mezzanine financing combines debt and equity features, providing higher risk but potentially greater returns for lenders through subordinated debt and equity warrants. The choice depends on the company's risk tolerance, capital structure preferences, and growth objectives.

Connection

Private credit and mezzanine financing are interconnected as both provide alternative funding solutions beyond traditional bank loans, typically serving middle-market companies. Mezzanine financing occupies a hybrid position between debt and equity, often structured as subordinated debt or preferred equity, which private credit funds actively invest in to capture higher returns with manageable risk. This synergy allows businesses to access flexible capital for growth, acquisitions, or recapitalizations, while investors benefit from attractive risk-adjusted yields and equity participation opportunities.

Key Terms

Subordinated Debt

Mezzanine financing and private credit often involve subordinated debt, which ranks below senior debt in repayment priority but offers higher yields due to increased risk exposure. Mezzanine financing typically includes equity kickers or warrants, enhancing returns beyond fixed interest, while private credit tends to emphasize structured loans with covenants. Explore the nuances of subordinated debt in alternative financing to optimize capital structure and investment outcomes.

Senior Secured Loan

Senior secured loans in mezzanine financing typically hold a lower claim priority compared to private credit senior secured loans, which are prioritized first in case of borrower default, providing enhanced protection for lenders. Mezzanine financing often includes subordinated debt or preferred equity with higher interest rates reflecting increased risk, while private credit senior secured loans offer more conservative risk profiles and tighter covenants. Explore how senior secured loans impact risk and return in mezzanine financing versus private credit for deeper insights.

Equity Kicker

Mezzanine financing often includes an equity kicker, granting lenders potential upside through warrants or options alongside fixed interest payments, enhancing returns beyond traditional debt structures. Private credit typically offers fixed income without equity participation, focusing on lower risk and predictable cash flow but limited upside from company growth. Explore the nuances of equity kickers in mezzanine financing to fully understand their impact on investor returns.

Source and External Links

What is Mezzanine Financing | BDC.ca - Mezzanine financing is a hybrid of debt and equity designed to fill the gap between senior debt and equity, offering flexible repayment terms and typically ranking below secured debt with higher risk and interest rates.

Mezzanine Financing - Overview, Rate of Return, Benefits - This financing type often includes an equity component like warrants or convertible features, providing companies with additional capital while being treated as equity for leverage calculations and offering tax-deductible interest.

Mezzanine capital - Wikipedia - Mezzanine capital occupies a position between senior debt and equity, usually structured as subordinated notes or preferred stock, combining cash interest, pay-in-kind interest, and equity stakes to meet lenders' expected returns.

dowidth.com

dowidth.com