Carbon credits represent quantified emission reductions verified by regulatory standards, allowing companies to meet mandatory climate targets through tradeable permits. Carbon offsets, while also reducing emissions, are typically voluntary investments in environmental projects that compensate for emissions by funding activities such as reforestation or renewable energy. Explore the key differences and applications of carbon credits versus carbon offsets to enhance your sustainability strategy.

Why it is important

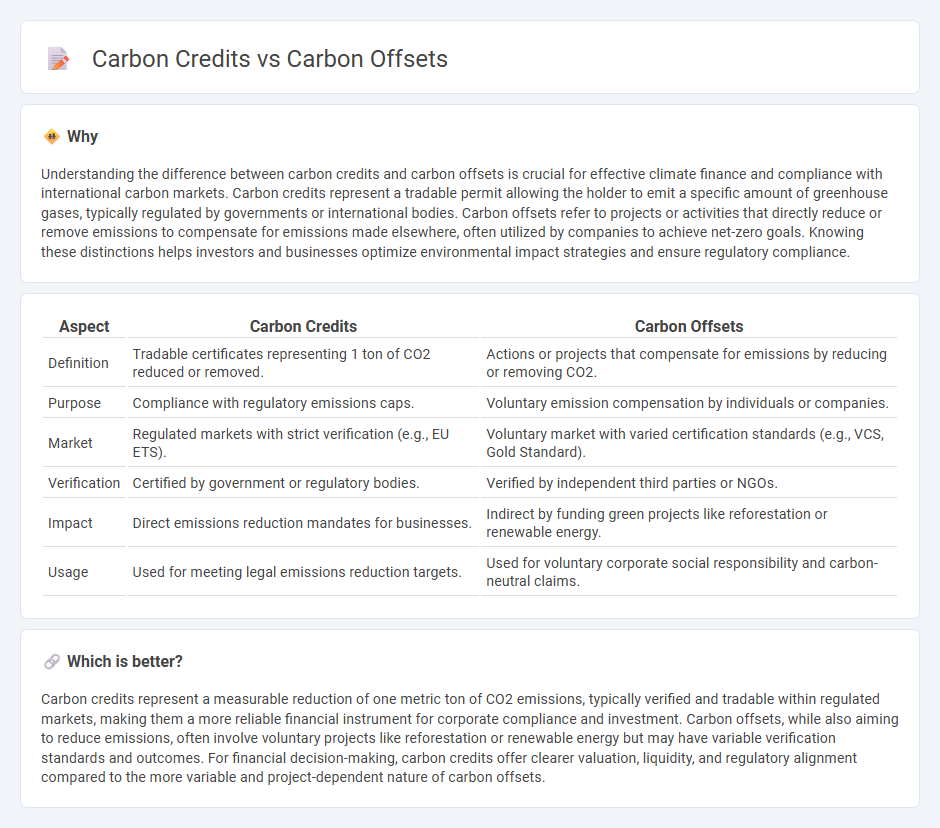

Understanding the difference between carbon credits and carbon offsets is crucial for effective climate finance and compliance with international carbon markets. Carbon credits represent a tradable permit allowing the holder to emit a specific amount of greenhouse gases, typically regulated by governments or international bodies. Carbon offsets refer to projects or activities that directly reduce or remove emissions to compensate for emissions made elsewhere, often utilized by companies to achieve net-zero goals. Knowing these distinctions helps investors and businesses optimize environmental impact strategies and ensure regulatory compliance.

Comparison Table

| Aspect | Carbon Credits | Carbon Offsets |

|---|---|---|

| Definition | Tradable certificates representing 1 ton of CO2 reduced or removed. | Actions or projects that compensate for emissions by reducing or removing CO2. |

| Purpose | Compliance with regulatory emissions caps. | Voluntary emission compensation by individuals or companies. |

| Market | Regulated markets with strict verification (e.g., EU ETS). | Voluntary market with varied certification standards (e.g., VCS, Gold Standard). |

| Verification | Certified by government or regulatory bodies. | Verified by independent third parties or NGOs. |

| Impact | Direct emissions reduction mandates for businesses. | Indirect by funding green projects like reforestation or renewable energy. |

| Usage | Used for meeting legal emissions reduction targets. | Used for voluntary corporate social responsibility and carbon-neutral claims. |

Which is better?

Carbon credits represent a measurable reduction of one metric ton of CO2 emissions, typically verified and tradable within regulated markets, making them a more reliable financial instrument for corporate compliance and investment. Carbon offsets, while also aiming to reduce emissions, often involve voluntary projects like reforestation or renewable energy but may have variable verification standards and outcomes. For financial decision-making, carbon credits offer clearer valuation, liquidity, and regulatory alignment compared to the more variable and project-dependent nature of carbon offsets.

Connection

Carbon credits represent verified emission reductions that companies can purchase to comply with regulatory limits, while carbon offsets are projects generating these credits by actively reducing or sequestering greenhouse gases. The connection lies in the fact that carbon offsets create the real-world emission reductions that are quantified and traded as carbon credits in carbon markets. This linkage drives corporate sustainability efforts by enabling businesses to balance their carbon footprint through verified environmental initiatives.

Key Terms

Emissions Reduction

Carbon offsets represent verified emission reductions achieved through projects like reforestation or renewable energy that compensate for emissions elsewhere. Carbon credits are tradable certificates derived from these emission reductions, allowing entities to meet regulatory or voluntary climate goals by purchasing the credits. Explore how these mechanisms drive sustainable emissions management and compliance strategies.

Verification

Carbon offsets represent verified emission reductions made by projects such as reforestation or renewable energy installations that compensate for emissions elsewhere, while carbon credits are tradable certificates typically issued under regulatory schemes that allow holders to emit a certain amount of CO2. Verification for carbon offsets involves third-party standards like Verified Carbon Standard (VCS) or Gold Standard to ensure real, measurable, and permanent environmental benefits. Explore the distinctions in verification processes to understand the credibility and impact of carbon mitigation strategies.

Trading Mechanism

Carbon offsets represent quantified emissions reductions from projects like reforestation or renewable energy, which can be purchased to compensate for personal or corporate carbon footprints. Carbon credits function as tradable permits issued under regulatory cap-and-trade systems, granting holders the right to emit a specific amount of CO2, thus creating a market-driven incentive to reduce emissions. Explore how trading mechanisms influence environmental impact and financial strategies by learning more about carbon offsets and credits.

Source and External Links

Carbon Offsets - MIT Climate Portal - Carbon offsets are tradable certificates linked to projects that reduce or sequester CO2 emissions, allowing buyers to compensate for their own emissions by funding reductions elsewhere, with stringent verification needed to ensure actual climate impact.

Carbon offsets and credits - Wikipedia - Carbon offsets represent one metric tonne of CO2 equivalent reduction or removal and are used as a carbon trading mechanism where credits are certified, tracked, and retired to balance emissions emitted elsewhere.

Carbon Offsets Explained | TerraPass - Carbon offsets finance projects worldwide that reduce greenhouse gases beyond individual capabilities, with each verified credit corresponding to one metric ton of CO2 equivalent reduced, enabling individuals and organizations to mitigate their inevitable emissions.

dowidth.com

dowidth.com