Regenerative finance focuses on creating sustainable economic systems that restore natural resources and promote long-term ecological health, while social finance emphasizes investments that generate positive social impact alongside financial returns. Both approaches aim to address systemic challenges but differ in their primary goals and methods of capital deployment. Discover how these innovative financial models are transforming investment landscapes and driving inclusive growth.

Why it is important

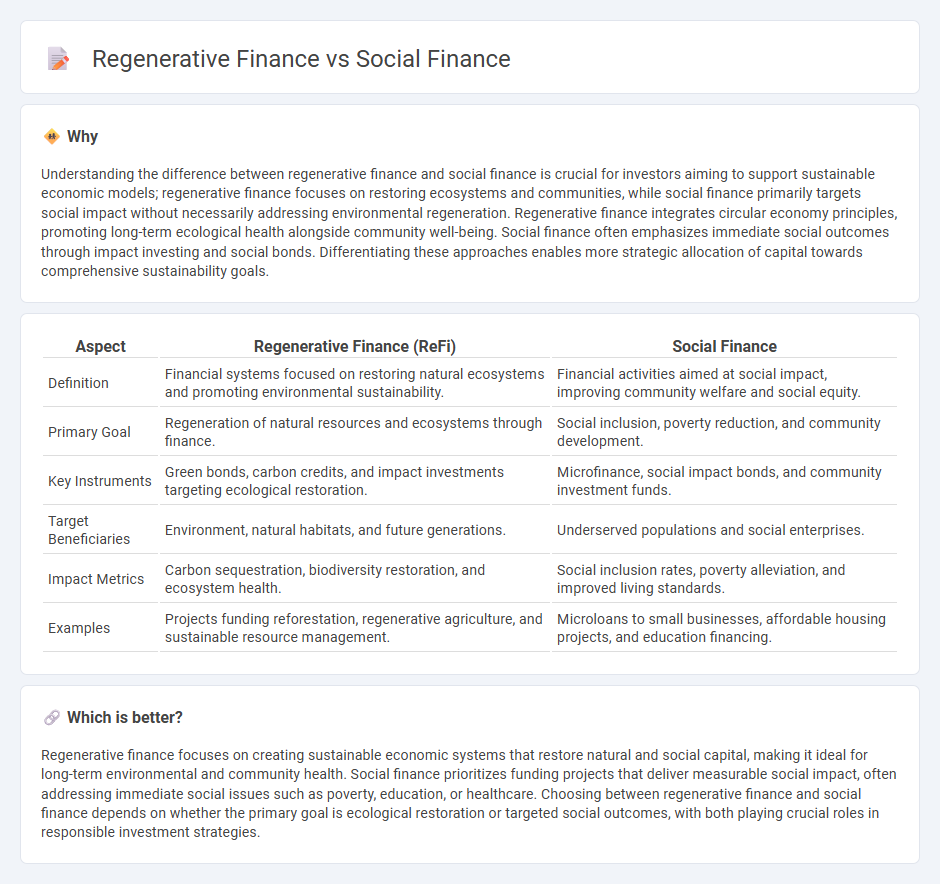

Understanding the difference between regenerative finance and social finance is crucial for investors aiming to support sustainable economic models; regenerative finance focuses on restoring ecosystems and communities, while social finance primarily targets social impact without necessarily addressing environmental regeneration. Regenerative finance integrates circular economy principles, promoting long-term ecological health alongside community well-being. Social finance often emphasizes immediate social outcomes through impact investing and social bonds. Differentiating these approaches enables more strategic allocation of capital towards comprehensive sustainability goals.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Social Finance |

|---|---|---|

| Definition | Financial systems focused on restoring natural ecosystems and promoting environmental sustainability. | Financial activities aimed at social impact, improving community welfare and social equity. |

| Primary Goal | Regeneration of natural resources and ecosystems through finance. | Social inclusion, poverty reduction, and community development. |

| Key Instruments | Green bonds, carbon credits, and impact investments targeting ecological restoration. | Microfinance, social impact bonds, and community investment funds. |

| Target Beneficiaries | Environment, natural habitats, and future generations. | Underserved populations and social enterprises. |

| Impact Metrics | Carbon sequestration, biodiversity restoration, and ecosystem health. | Social inclusion rates, poverty alleviation, and improved living standards. |

| Examples | Projects funding reforestation, regenerative agriculture, and sustainable resource management. | Microloans to small businesses, affordable housing projects, and education financing. |

Which is better?

Regenerative finance focuses on creating sustainable economic systems that restore natural and social capital, making it ideal for long-term environmental and community health. Social finance prioritizes funding projects that deliver measurable social impact, often addressing immediate social issues such as poverty, education, or healthcare. Choosing between regenerative finance and social finance depends on whether the primary goal is ecological restoration or targeted social outcomes, with both playing crucial roles in responsible investment strategies.

Connection

Regenerative finance and social finance intersect by prioritizing investments that generate both financial returns and positive social or environmental impacts. Regenerative finance focuses on restoring natural ecosystems and fostering long-term sustainability, while social finance targets solutions addressing social challenges such as poverty and inequality. Both frameworks leverage impact investing and stakeholder engagement to promote equitable and resilient economic systems.

Key Terms

Impact Investing

Social finance centers on deploying capital to generate positive social outcomes, often targeting underserved communities and addressing issues like poverty and education. Regenerative finance goes further by emphasizing investments that restore and enhance ecological systems while promoting economic resilience and community well-being. Explore how integrating impact investing strategies in both frameworks can maximize sustainable development and social equity.

Sustainable Development

Social finance directs capital toward projects that address social issues like poverty, education, and healthcare, ensuring measurable social impact alongside financial returns. Regenerative finance goes beyond sustainability by actively restoring and enhancing natural ecosystems, promoting circular economic models that replenish resources and biodiversity. Explore how these financial approaches drive the United Nations Sustainable Development Goals and reshape global investment strategies for a resilient future.

Circular Economy

Social finance channels capital to projects generating measurable social impact, often targeting poverty alleviation and community development. Regenerative finance extends beyond traditional impact investing by prioritizing systems that restore and enhance natural ecosystems, embodying Circular Economy principles such as resource efficiency, waste elimination, and continuous material reuse. Explore how integrating regenerative finance strategies can accelerate the transition to a sustainable Circular Economy model.

Source and External Links

Social Finance Wikipedia - Social finance involves leveraging private capital to address social and environmental challenges, creating economic value while generating social returns.

ILO Social Finance - The International Labour Organization engages with the financial sector to promote decent work and social justice, focusing on financial inclusion and sustainable investing.

Social Finance UK - This organization helps partners design, fund, and scale solutions to complex social issues using finance, strategy, data, and partnerships.

dowidth.com

dowidth.com