Sovereign debt restructuring involves negotiated agreements between a country and its creditors to modify the terms of debt repayments, aiming to restore fiscal stability while avoiding the severe economic consequences of a debt default. In contrast, a debt default occurs when a government fails to meet its debt obligations, often triggering legal disputes, credit rating downgrades, and restricted access to global financial markets. Explore how these financial mechanisms impact national economies and investor confidence.

Why it is important

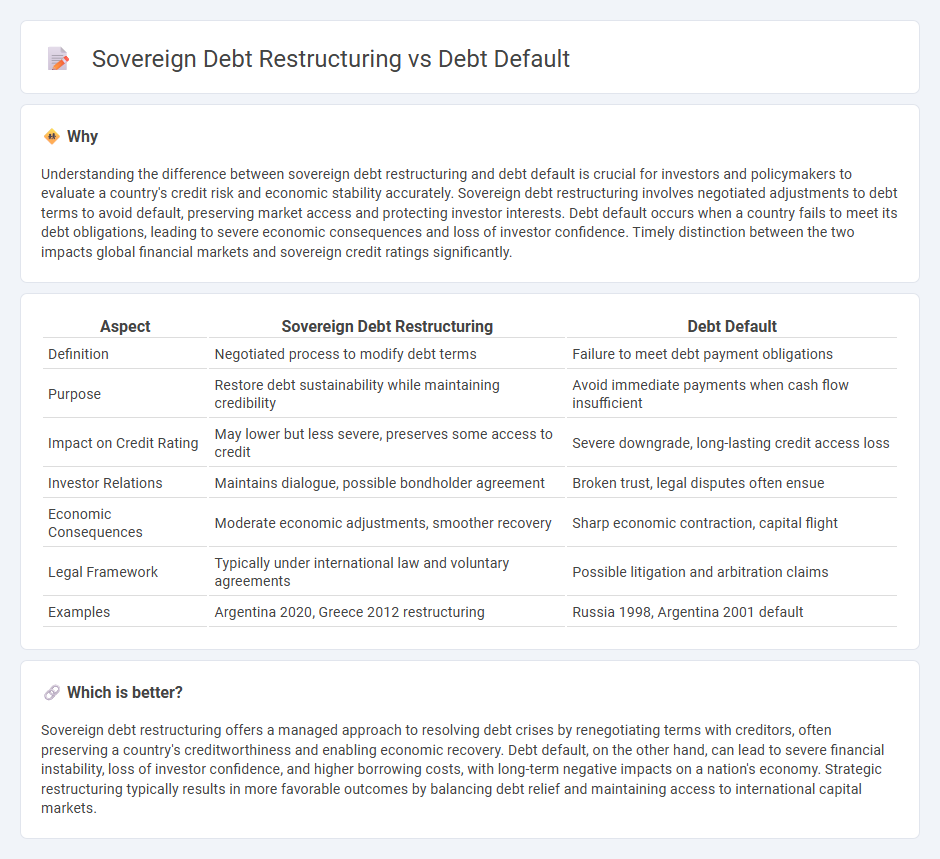

Understanding the difference between sovereign debt restructuring and debt default is crucial for investors and policymakers to evaluate a country's credit risk and economic stability accurately. Sovereign debt restructuring involves negotiated adjustments to debt terms to avoid default, preserving market access and protecting investor interests. Debt default occurs when a country fails to meet its debt obligations, leading to severe economic consequences and loss of investor confidence. Timely distinction between the two impacts global financial markets and sovereign credit ratings significantly.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Default |

|---|---|---|

| Definition | Negotiated process to modify debt terms | Failure to meet debt payment obligations |

| Purpose | Restore debt sustainability while maintaining credibility | Avoid immediate payments when cash flow insufficient |

| Impact on Credit Rating | May lower but less severe, preserves some access to credit | Severe downgrade, long-lasting credit access loss |

| Investor Relations | Maintains dialogue, possible bondholder agreement | Broken trust, legal disputes often ensue |

| Economic Consequences | Moderate economic adjustments, smoother recovery | Sharp economic contraction, capital flight |

| Legal Framework | Typically under international law and voluntary agreements | Possible litigation and arbitration claims |

| Examples | Argentina 2020, Greece 2012 restructuring | Russia 1998, Argentina 2001 default |

Which is better?

Sovereign debt restructuring offers a managed approach to resolving debt crises by renegotiating terms with creditors, often preserving a country's creditworthiness and enabling economic recovery. Debt default, on the other hand, can lead to severe financial instability, loss of investor confidence, and higher borrowing costs, with long-term negative impacts on a nation's economy. Strategic restructuring typically results in more favorable outcomes by balancing debt relief and maintaining access to international capital markets.

Connection

Sovereign debt restructuring involves renegotiating the terms of a country's existing debt to avoid default and restore fiscal stability. When a nation fails to meet its debt obligations, it triggers a debt default, which can have severe economic consequences, including loss of investor confidence and restricted access to international capital markets. By implementing debt restructuring measures, governments aim to reduce debt burdens, extend maturities, or lower interest rates, directly addressing the risks associated with potential sovereign defaults.

Key Terms

Credit Risk

Debt default occurs when a sovereign entity fails to meet its debt obligations, triggering a surge in credit risk due to increased likelihood of losses for creditors. Sovereign debt restructuring involves renegotiating debt terms to avoid default, aiming to reduce credit risk by improving debt sustainability and restoring investor confidence. Explore the nuances of credit risk management in sovereign debt scenarios to deepen your understanding.

Haircut

A debt default occurs when a borrower fails to meet its debt obligations, while sovereign debt restructuring involves renegotiating terms to avoid default, often including a "haircut"--a reduction in the principal or interest owed by creditors. Haircuts are a critical component of sovereign debt restructuring as they directly reduce the debt burden, making repayment feasible for the country while minimizing losses for creditors. Explore our detailed analysis to understand how haircuts impact sovereign debt sustainability and creditor negotiations.

Collective Action Clause

Debt default occurs when a country fails to meet its debt obligations, leading to severe economic consequences and loss of investor confidence. Sovereign debt restructuring, often facilitated through Collective Action Clauses (CACs), enables creditors to agree on revised payment terms collectively, minimizing holdout problems and ensuring smoother negotiation processes. Explore the role of CACs in stabilizing sovereign debt markets and protecting global financial stability.

Source and External Links

Debt Default - Definition, How it Affects You, Types - Debt default occurs when a borrower breaches one or more terms of a loan agreement, which can include missed payments or violations of contract clauses, and it can have various consequences depending on the terms agreed upon by lender and borrower.

Default (finance) - Wikipedia - In finance, default means failing to meet the legal obligations of a loan, such as missing scheduled payments (debt service default) or violating covenants in the loan contract (technical default), often leading to foreclosure or bankruptcy proceedings.

What Happens if I Default on a Loan? - Experian - Defaulting on a loan usually triggers negative consequences like damage to credit scores, possible foreclosure or repossession of collateral, and acceleration of the loan balance, meaning immediate repayment of the entire amount may be required.

dowidth.com

dowidth.com