Thematic ETFs focus on broad investment trends and emerging themes such as clean energy, artificial intelligence, or cybersecurity, offering targeted exposure to growth opportunities across multiple sectors. Sector ETFs, by contrast, concentrate on specific industry sectors like healthcare, technology, or financials, providing investors with a way to capitalize on the performance of a particular segment of the economy. Explore the distinct advantages of Thematic and Sector ETFs to tailor your investment strategy effectively.

Why it is important

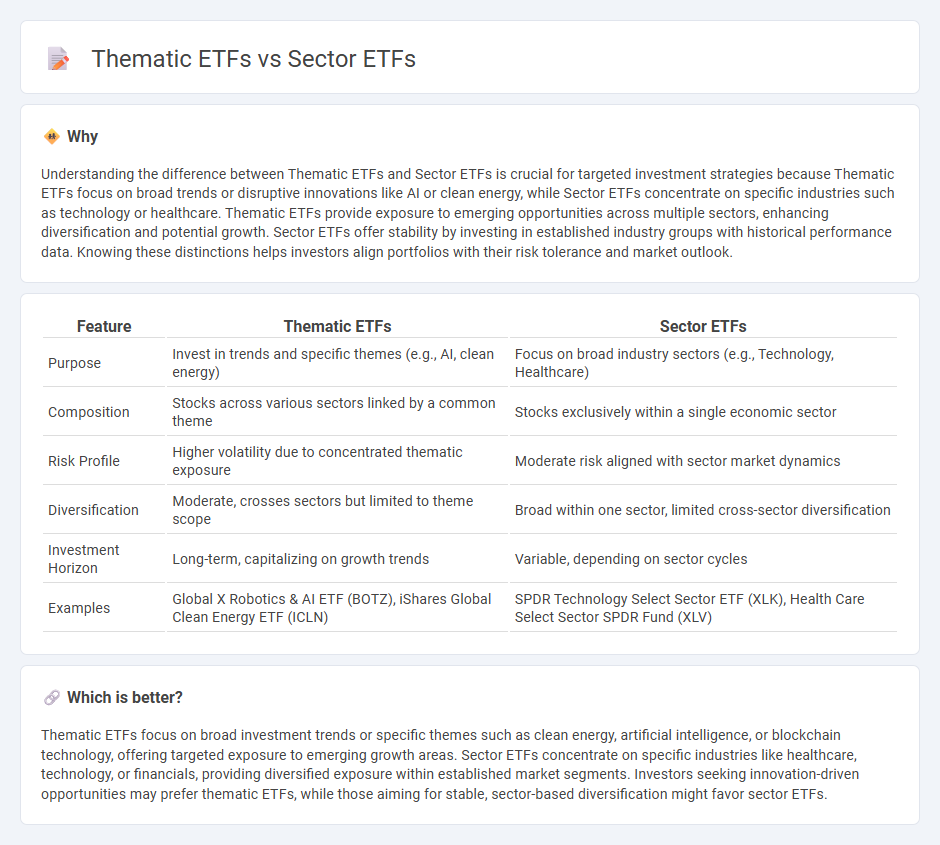

Understanding the difference between Thematic ETFs and Sector ETFs is crucial for targeted investment strategies because Thematic ETFs focus on broad trends or disruptive innovations like AI or clean energy, while Sector ETFs concentrate on specific industries such as technology or healthcare. Thematic ETFs provide exposure to emerging opportunities across multiple sectors, enhancing diversification and potential growth. Sector ETFs offer stability by investing in established industry groups with historical performance data. Knowing these distinctions helps investors align portfolios with their risk tolerance and market outlook.

Comparison Table

| Feature | Thematic ETFs | Sector ETFs |

|---|---|---|

| Purpose | Invest in trends and specific themes (e.g., AI, clean energy) | Focus on broad industry sectors (e.g., Technology, Healthcare) |

| Composition | Stocks across various sectors linked by a common theme | Stocks exclusively within a single economic sector |

| Risk Profile | Higher volatility due to concentrated thematic exposure | Moderate risk aligned with sector market dynamics |

| Diversification | Moderate, crosses sectors but limited to theme scope | Broad within one sector, limited cross-sector diversification |

| Investment Horizon | Long-term, capitalizing on growth trends | Variable, depending on sector cycles |

| Examples | Global X Robotics & AI ETF (BOTZ), iShares Global Clean Energy ETF (ICLN) | SPDR Technology Select Sector ETF (XLK), Health Care Select Sector SPDR Fund (XLV) |

Which is better?

Thematic ETFs focus on broad investment trends or specific themes such as clean energy, artificial intelligence, or blockchain technology, offering targeted exposure to emerging growth areas. Sector ETFs concentrate on specific industries like healthcare, technology, or financials, providing diversified exposure within established market segments. Investors seeking innovation-driven opportunities may prefer thematic ETFs, while those aiming for stable, sector-based diversification might favor sector ETFs.

Connection

Thematic ETFs and sector ETFs are connected through their focus on specific market segments, with thematic ETFs targeting broader trends or investment themes such as clean energy or artificial intelligence, while sector ETFs concentrate on defined industry sectors like technology or healthcare. Both types offer investors targeted exposure, allowing for strategic portfolio diversification aligned with economic or technological developments. Their performance is often interlinked since thematic ETFs typically include multiple sector ETFs representing the industries relevant to the theme.

Key Terms

Diversification

Sector ETFs provide targeted exposure to broad industry groups such as technology, healthcare, and financials, offering diversified investments within specific economic sectors. Thematic ETFs concentrate on emerging trends or niche markets like clean energy, artificial intelligence, or blockchain, which can entail higher risk but potential for significant growth. Explore how these ETF categories fit your portfolio strategy for optimal diversification and risk management.

Market Exposure

Sector ETFs provide targeted exposure to specific industries such as technology, healthcare, or financials, allowing investors to capitalize on the performance of established market segments. Thematic ETFs concentrate on broader, innovative trends like artificial intelligence, clean energy, or blockchain, capturing growth potential across multiple sectors influenced by a common theme. Explore more to understand which ETF type aligns best with your investment goals and risk tolerance.

Investment Objective

Sector ETFs target specific economic sectors such as technology, healthcare, or energy, providing diversified exposure within established industry groups. Thematic ETFs concentrate on broader investment themes like clean energy, artificial intelligence, or cybersecurity, capturing growth potential across multiple sectors aligned with the theme. Explore more to understand which ETF type aligns best with your investment objectives and risk appetite.

Source and External Links

Sector ETFs | Charles Schwab - Sector ETFs focus on groups of companies within the same business sector like energy, health care, technology, or utilities, allowing diversification within an industry to reduce single-stock risk.

Sector and Industry ETFs - Fidelity Investments - Sector ETFs invest in stocks from specific sectors such as biotechnology or chemicals, with different risk/reward profiles, where technology is often most volatile and utilities the least.

Sector & sub-industry ETFs - iShares - iShares offers sector and sub-industry ETFs for granular exposure across defensive and cyclical sectors including healthcare, technology, energy, real estate, and financials for tactical sector investing.

dowidth.com

dowidth.com