Sovereign debt restructuring involves comprehensive negotiations to modify the terms of a country's debt obligations, often including reductions in principal or interest rates to restore financial stability. Debt exchange refers to the process where existing debt securities are swapped for new ones with different terms, typically aimed at extending maturities or lowering payments without outright default. Explore deeper insights into how these mechanisms impact global financial markets and sovereign creditworthiness.

Why it is important

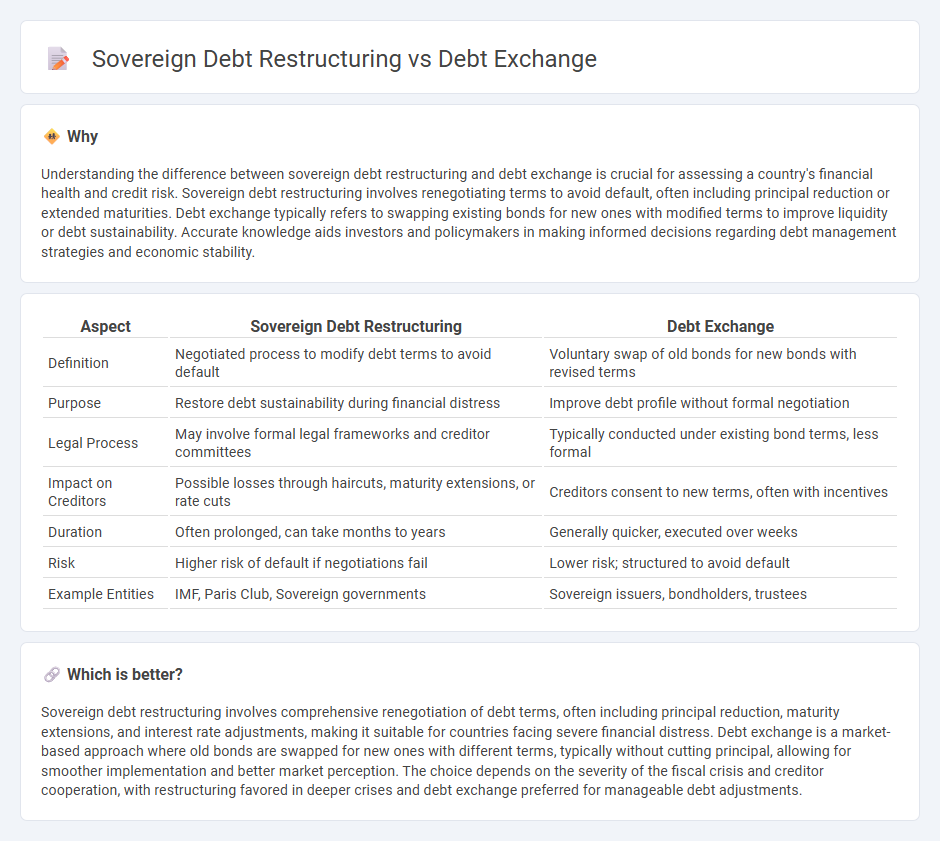

Understanding the difference between sovereign debt restructuring and debt exchange is crucial for assessing a country's financial health and credit risk. Sovereign debt restructuring involves renegotiating terms to avoid default, often including principal reduction or extended maturities. Debt exchange typically refers to swapping existing bonds for new ones with modified terms to improve liquidity or debt sustainability. Accurate knowledge aids investors and policymakers in making informed decisions regarding debt management strategies and economic stability.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Exchange |

|---|---|---|

| Definition | Negotiated process to modify debt terms to avoid default | Voluntary swap of old bonds for new bonds with revised terms |

| Purpose | Restore debt sustainability during financial distress | Improve debt profile without formal negotiation |

| Legal Process | May involve formal legal frameworks and creditor committees | Typically conducted under existing bond terms, less formal |

| Impact on Creditors | Possible losses through haircuts, maturity extensions, or rate cuts | Creditors consent to new terms, often with incentives |

| Duration | Often prolonged, can take months to years | Generally quicker, executed over weeks |

| Risk | Higher risk of default if negotiations fail | Lower risk; structured to avoid default |

| Example Entities | IMF, Paris Club, Sovereign governments | Sovereign issuers, bondholders, trustees |

Which is better?

Sovereign debt restructuring involves comprehensive renegotiation of debt terms, often including principal reduction, maturity extensions, and interest rate adjustments, making it suitable for countries facing severe financial distress. Debt exchange is a market-based approach where old bonds are swapped for new ones with different terms, typically without cutting principal, allowing for smoother implementation and better market perception. The choice depends on the severity of the fiscal crisis and creditor cooperation, with restructuring favored in deeper crises and debt exchange preferred for manageable debt adjustments.

Connection

Sovereign debt restructuring involves renegotiating a country's debt terms to restore fiscal stability and prevent default, often through debt exchange mechanisms where existing bonds are swapped for new ones with altered conditions such as extended maturities or reduced interest rates. Debt exchanges serve as a practical tool within restructuring processes to adjust the debt burden while maintaining market access and investor confidence. These strategies are interconnected components designed to manage sovereign insolvency risks and improve long-term debt sustainability.

Key Terms

Haircut

Debt exchange involves offering creditors new securities with different terms, often including a significant haircut--a reduction in the principal or interest--to manage sovereign debt burdens. Sovereign debt restructuring encompasses broader negotiations that may include haircuts, maturity extensions, or interest rate adjustments to restore fiscal sustainability. Explore the nuances of haircuts in these processes to better understand their impact on sovereign debt management.

Maturity Extension

Debt exchange involves offering creditors new debt instruments with extended maturities to replace existing bonds, aiming to ease immediate fiscal pressures without full default. Sovereign debt restructuring may include maturity extension as part of a broader strategy that can also involve principal reduction, interest rate adjustments, or partial debt forgiveness to restore debt sustainability. Learn more about the strategic differences and implications of maturity extension in sovereign debt management.

Collective Action Clauses (CACs)

Collective Action Clauses (CACs) play a crucial role in sovereign debt restructuring by facilitating agreement among diverse bondholders to modify debt terms, preventing holdouts and protracted disputes. In contrast, debt exchanges often rely less on CACs, focusing instead on voluntary swaps between issuers and creditors to restructure debt instruments efficiently. Explore how CACs impact creditor coordination and the overall success of sovereign debt negotiations.

Source and External Links

Debt exchange offers as a refinancing option - A debt exchange offer is a strategy used by companies, especially in financial distress, to exchange existing bonds or loans for new equity or debt to restructure capital, reduce interest expenses, and improve cash flow.

Debt Exchange Offers by Public Companies: Overview - Public companies use debt exchange offers to modify or reduce debt obligations by exchanging old debt for new debt with improved terms, often leveraging Section 3(a)(9) for quicker, low-cost execution without SEC registration.

Frequently Asked Questions: Distressed Debt Exchanges Scope - Debt exchange offers can be either distressed or proactive refinancing moves by issuers, where distressed exchanges help financially troubled companies manage default risks while proactive exchanges may reflect strong financial positions optimizing capital structure.

dowidth.com

dowidth.com