Decentralized finance (DeFi) utilizes blockchain technology to offer transparent, permissionless financial services without intermediaries, reducing costs and increasing accessibility. Shadow banking comprises unregulated financial entities and activities that operate outside traditional banking oversight, often leading to increased systemic risk. Explore how these contrasting systems impact the future of global finance and investment strategies.

Why it is important

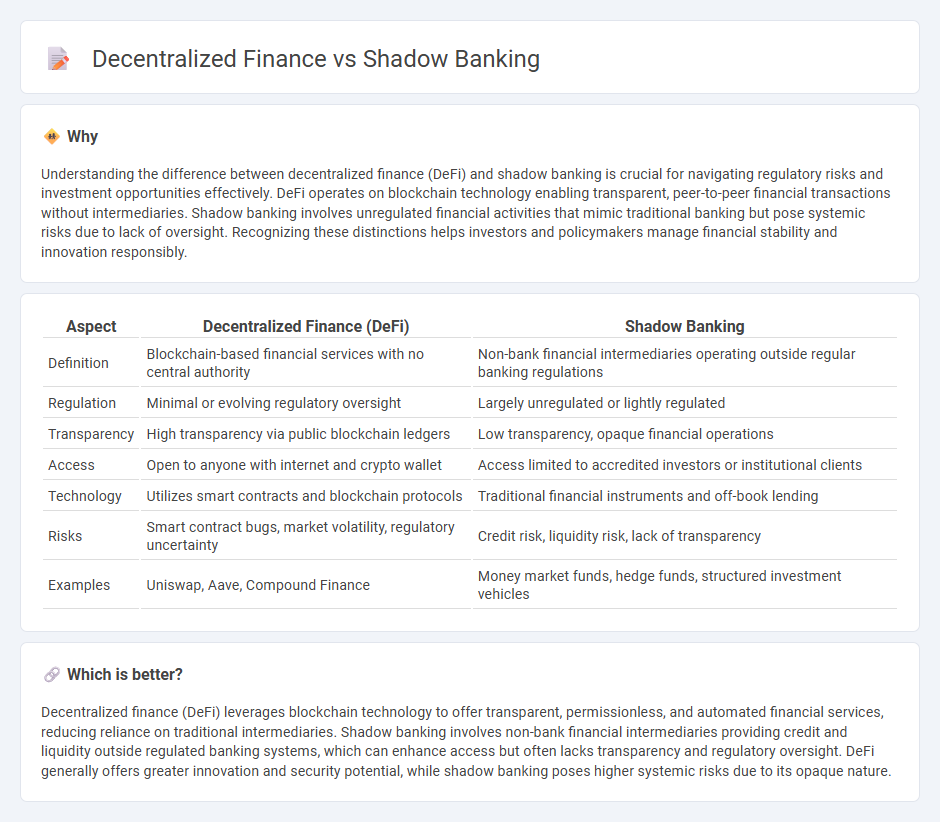

Understanding the difference between decentralized finance (DeFi) and shadow banking is crucial for navigating regulatory risks and investment opportunities effectively. DeFi operates on blockchain technology enabling transparent, peer-to-peer financial transactions without intermediaries. Shadow banking involves unregulated financial activities that mimic traditional banking but pose systemic risks due to lack of oversight. Recognizing these distinctions helps investors and policymakers manage financial stability and innovation responsibly.

Comparison Table

| Aspect | Decentralized Finance (DeFi) | Shadow Banking |

|---|---|---|

| Definition | Blockchain-based financial services with no central authority | Non-bank financial intermediaries operating outside regular banking regulations |

| Regulation | Minimal or evolving regulatory oversight | Largely unregulated or lightly regulated |

| Transparency | High transparency via public blockchain ledgers | Low transparency, opaque financial operations |

| Access | Open to anyone with internet and crypto wallet | Access limited to accredited investors or institutional clients |

| Technology | Utilizes smart contracts and blockchain protocols | Traditional financial instruments and off-book lending |

| Risks | Smart contract bugs, market volatility, regulatory uncertainty | Credit risk, liquidity risk, lack of transparency |

| Examples | Uniswap, Aave, Compound Finance | Money market funds, hedge funds, structured investment vehicles |

Which is better?

Decentralized finance (DeFi) leverages blockchain technology to offer transparent, permissionless, and automated financial services, reducing reliance on traditional intermediaries. Shadow banking involves non-bank financial intermediaries providing credit and liquidity outside regulated banking systems, which can enhance access but often lacks transparency and regulatory oversight. DeFi generally offers greater innovation and security potential, while shadow banking poses higher systemic risks due to its opaque nature.

Connection

Decentralized finance (DeFi) and shadow banking are connected through their roles in providing alternative financial services outside traditional banking systems. DeFi leverages blockchain technology to enable peer-to-peer lending, borrowing, and asset trading without intermediaries, while shadow banking encompasses non-bank entities engaging in credit intermediation and liquidity transformation. Both systems increase financial innovation and access but pose risks related to regulation, transparency, and systemic stability.

Key Terms

Intermediation

Shadow banking operates through non-bank financial intermediaries that facilitate credit creation outside the traditional banking system, often relying on complex, opaque structures and regulatory arbitrage. Decentralized finance (DeFi) eliminates centralized intermediaries by leveraging blockchain technology and smart contracts to provide peer-to-peer financial services with increased transparency and accessibility. Explore the key differences in intermediation mechanisms to understand the evolving landscape of financial innovation.

Transparency

Shadow banking operates within traditional financial systems and often lacks transparency due to complex intermediaries and opaque regulatory oversight. In contrast, decentralized finance (DeFi) leverages blockchain technology to provide transparent, real-time transaction visibility and immutable records accessible to all participants. Explore more about how transparency shapes the future of financial trust and innovation in these paradigms.

Regulation

Shadow banking operates within a regulatory gray area, often involving non-bank financial intermediaries such as hedge funds, private equity, and money market funds that provide credit outside traditional banking systems. Decentralized finance (DeFi) leverages blockchain technology to enable peer-to-peer financial services without centralized control, posing unique regulatory challenges around transparency, fraud prevention, and consumer protection. Explore further to understand how evolving regulations aim to balance innovation with stability in both shadow banking and DeFi sectors.

Source and External Links

Shadow Banking - The shadow banking system consists of non-bank financial intermediaries that perform credit, maturity, and liquidity transformation outside the regulated banking sector, typically using securitization and secured funding techniques such as asset-backed securities and repurchase agreements.

Explainer - What is shadow banking? - Shadow banking describes bank-like lending activities conducted by entities like bond funds, money market funds, and finance companies outside the traditional banking sector, without the same regulatory oversight or access to central bank support.

What Is Shadow Banking? - Back to Basics - Shadow banking refers to financial institutions that engage in maturity transformation--borrowing short-term to invest in longer-term assets--but operate without the regulations, deposit insurance, or lender-of-last-resort access available to traditional banks.

dowidth.com

dowidth.com