Bucket investing involves segmenting assets into distinct categories based on time horizons and risk tolerance, aiming to meet specific financial goals through tailored strategies. Passive index investing focuses on replicating the performance of a market index by holding a diversified portfolio of securities, minimizing management costs and market timing risks. Explore the differences and benefits of bucket investing versus passive index investing to optimize your financial planning.

Why it is important

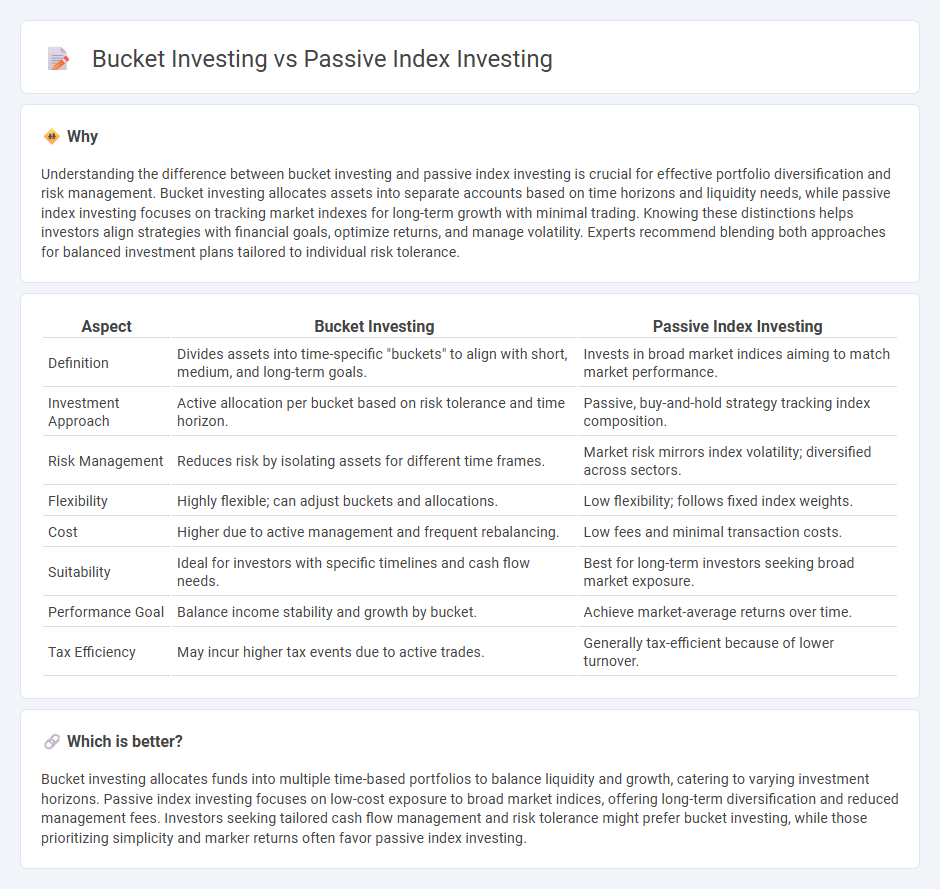

Understanding the difference between bucket investing and passive index investing is crucial for effective portfolio diversification and risk management. Bucket investing allocates assets into separate accounts based on time horizons and liquidity needs, while passive index investing focuses on tracking market indexes for long-term growth with minimal trading. Knowing these distinctions helps investors align strategies with financial goals, optimize returns, and manage volatility. Experts recommend blending both approaches for balanced investment plans tailored to individual risk tolerance.

Comparison Table

| Aspect | Bucket Investing | Passive Index Investing |

|---|---|---|

| Definition | Divides assets into time-specific "buckets" to align with short, medium, and long-term goals. | Invests in broad market indices aiming to match market performance. |

| Investment Approach | Active allocation per bucket based on risk tolerance and time horizon. | Passive, buy-and-hold strategy tracking index composition. |

| Risk Management | Reduces risk by isolating assets for different time frames. | Market risk mirrors index volatility; diversified across sectors. |

| Flexibility | Highly flexible; can adjust buckets and allocations. | Low flexibility; follows fixed index weights. |

| Cost | Higher due to active management and frequent rebalancing. | Low fees and minimal transaction costs. |

| Suitability | Ideal for investors with specific timelines and cash flow needs. | Best for long-term investors seeking broad market exposure. |

| Performance Goal | Balance income stability and growth by bucket. | Achieve market-average returns over time. |

| Tax Efficiency | May incur higher tax events due to active trades. | Generally tax-efficient because of lower turnover. |

Which is better?

Bucket investing allocates funds into multiple time-based portfolios to balance liquidity and growth, catering to varying investment horizons. Passive index investing focuses on low-cost exposure to broad market indices, offering long-term diversification and reduced management fees. Investors seeking tailored cash flow management and risk tolerance might prefer bucket investing, while those prioritizing simplicity and marker returns often favor passive index investing.

Connection

Bucket investing and passive index investing both prioritize risk management and long-term growth by segmenting assets based on investment horizons and using low-cost, diversified index funds. Bucket investing divides portfolios into short-, medium-, and long-term buckets, aligning with specific financial goals, while passive index investing provides broad market exposure within those buckets to minimize costs and improve returns. This approach enhances portfolio stability and simplifies rebalancing through consistent, data-driven asset allocation.

Key Terms

Index Fund

Passive index investing concentrates on replicating the performance of a market index through low-cost index funds, providing broad market exposure and minimizing fees. Bucket investing segments assets into different categories or time horizons, often combining safety, income, and growth buckets for systematic withdrawal strategies. Discover how choosing between passive index funds and bucket investing can optimize your portfolio strategy.

Asset Allocation

Passive index investing relies on maintaining a fixed asset allocation through diversified ETFs or mutual funds that track market indexes, aiming for long-term market returns with minimal management. Bucket investing segments assets into different time horizons or goals, typically allocating funds across cash, bonds, and equities to manage risk and liquidity according to short-, medium-, and long-term needs. Explore detailed strategies to optimize your asset allocation for enhanced portfolio stability and growth.

Time Horizon

Passive index investing leverages broad market exposure through low-cost ETFs or mutual funds, favoring long-term growth over multiple decades due to its compounding benefits and minimized risk from market timing. Bucket investing segments assets into short-, medium-, and long-term "buckets," aligning withdrawals with specific time horizons to manage liquidity and reduce sequence of returns risk during retirement. Explore how these strategies tailor portfolio construction and risk management for different investor timelines to optimize financial outcomes.

Source and External Links

Passive management - Wikipedia - Passive index investing is an investment strategy that replicates a market-weighted index or portfolio, focusing on choosing a rules-based, transparent, and investable index aligned with desired market exposure, and implementing funds that track this index without active stock picking or timing the market.

Passive Equity Investing | CFA Institute - Passive index investing seeks to track benchmark indexes that are rules-based, transparent, and investable, relying on index weighting schemes like market-cap weighting and disciplined rebalancing to reflect the benchmark's performance and risk characteristics.

Passive Investing: What It Is and How It Works - NerdWallet - Passive index investing typically involves buying index funds or ETFs that mirror stock market indexes and holding them long term, offering diversification and generally lower costs compared to active management.

dowidth.com

dowidth.com