Digital asset custody involves entrusting third-party providers, such as financial institutions or specialized custodians, with the secure storage and management of cryptocurrencies and tokens. Self-custody, on the other hand, requires individuals to maintain full control over their private keys and digital wallets, offering enhanced autonomy but increased personal responsibility. Explore the key differences and benefits of digital asset custody versus self-custody to make informed financial decisions.

Why it is important

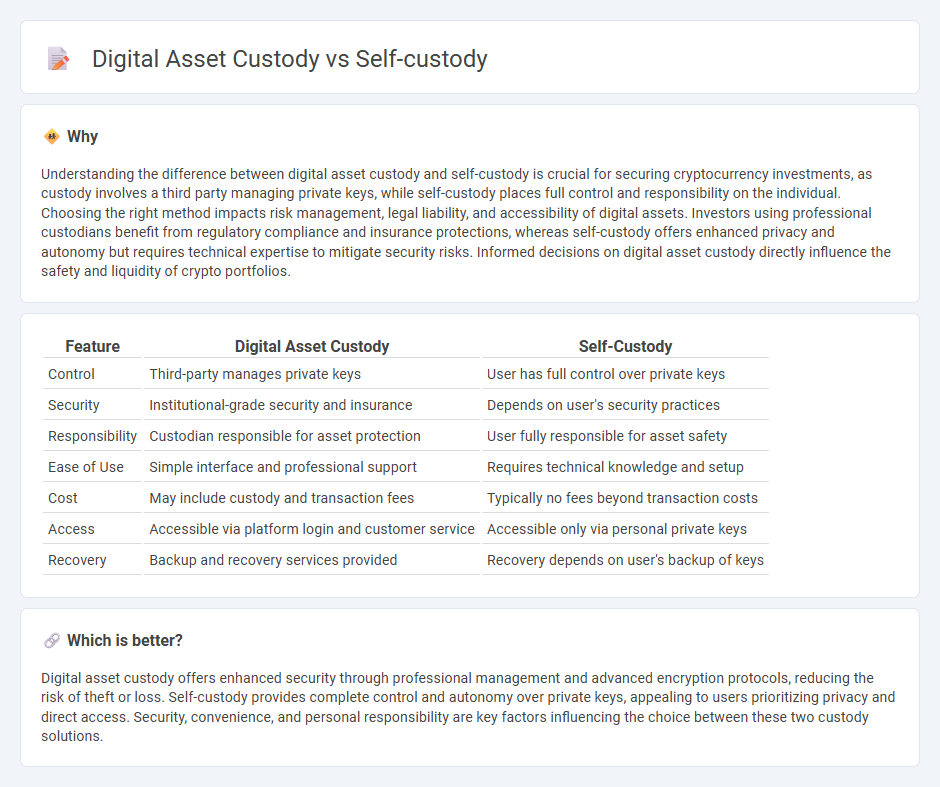

Understanding the difference between digital asset custody and self-custody is crucial for securing cryptocurrency investments, as custody involves a third party managing private keys, while self-custody places full control and responsibility on the individual. Choosing the right method impacts risk management, legal liability, and accessibility of digital assets. Investors using professional custodians benefit from regulatory compliance and insurance protections, whereas self-custody offers enhanced privacy and autonomy but requires technical expertise to mitigate security risks. Informed decisions on digital asset custody directly influence the safety and liquidity of crypto portfolios.

Comparison Table

| Feature | Digital Asset Custody | Self-Custody |

|---|---|---|

| Control | Third-party manages private keys | User has full control over private keys |

| Security | Institutional-grade security and insurance | Depends on user's security practices |

| Responsibility | Custodian responsible for asset protection | User fully responsible for asset safety |

| Ease of Use | Simple interface and professional support | Requires technical knowledge and setup |

| Cost | May include custody and transaction fees | Typically no fees beyond transaction costs |

| Access | Accessible via platform login and customer service | Accessible only via personal private keys |

| Recovery | Backup and recovery services provided | Recovery depends on user's backup of keys |

Which is better?

Digital asset custody offers enhanced security through professional management and advanced encryption protocols, reducing the risk of theft or loss. Self-custody provides complete control and autonomy over private keys, appealing to users prioritizing privacy and direct access. Security, convenience, and personal responsibility are key factors influencing the choice between these two custody solutions.

Connection

Digital asset custody and self-custody are interconnected concepts in finance where digital asset custody involves third-party services managing private keys and secure storage of cryptocurrencies, enhancing institutional security and regulatory compliance. Self-custody empowers individuals to hold and control their digital assets independently through private keys, reducing reliance on intermediaries but requiring strong security practices. Both methods address the critical need for safeguarding digital assets, balancing control, risk, and accessibility in the evolving digital financial ecosystem.

Key Terms

Private Key

Self-custody of digital assets involves individuals securely managing their private keys, ensuring full control and ownership without relying on third parties. Digital asset custody services store private keys on behalf of users, often employing advanced security measures but introducing potential centralized risks. Explore the distinct advantages and security implications of each approach to determine the best solution for your digital asset protection needs.

Custodian

A custodian in digital asset custody provides secure storage and regulatory compliance, minimizing risks associated with self-custody such as lost keys or unauthorized access. Institutional custodians deploy advanced multi-signature wallets and cold storage solutions to safeguard assets, ensuring enhanced protection and liquidity management. Explore the benefits and differences between self-custody and custodian services to optimize your digital asset security strategy.

Wallet Security

Self-custody wallets provide users with full control over private keys, minimizing reliance on third parties but requiring robust personal security measures to guard against loss or theft. Digital asset custody solutions, often managed by institutional custodians, offer advanced security features such as multi-signature protocols, insurance coverage, and regulatory compliance to protect assets at scale. Explore in-depth insights to determine which wallet security approach best suits your digital asset management needs.

Source and External Links

What Is a Self-Custody Wallet? How Do I Take Control of My Crypto ... - Self-custody wallets allow users to fully control their crypto assets by holding their own private keys, but they are solely responsible for the security and management of those keys and their funds.

What is Bitcoin self-custody? - Trezor - Bitcoin self-custody means personally managing and securing your bitcoin private keys, often using hardware wallets, giving you full control and privacy without relying on third parties.

What is self-custody? - Strike - Self-custody means controlling the private keys that authorize spending your bitcoin, and managing them securely with backups like seed phrases, reflecting true ownership of your crypto assets.

dowidth.com

dowidth.com