Carbon trading facilitates the buying and selling of emission allowances to incentivize reductions in greenhouse gases, creating a market-driven approach to combating climate change. Impact investing directs capital toward companies and projects that generate measurable environmental or social benefits alongside financial returns. Explore the distinctions between these innovative finance mechanisms and their roles in sustainable development.

Why it is important

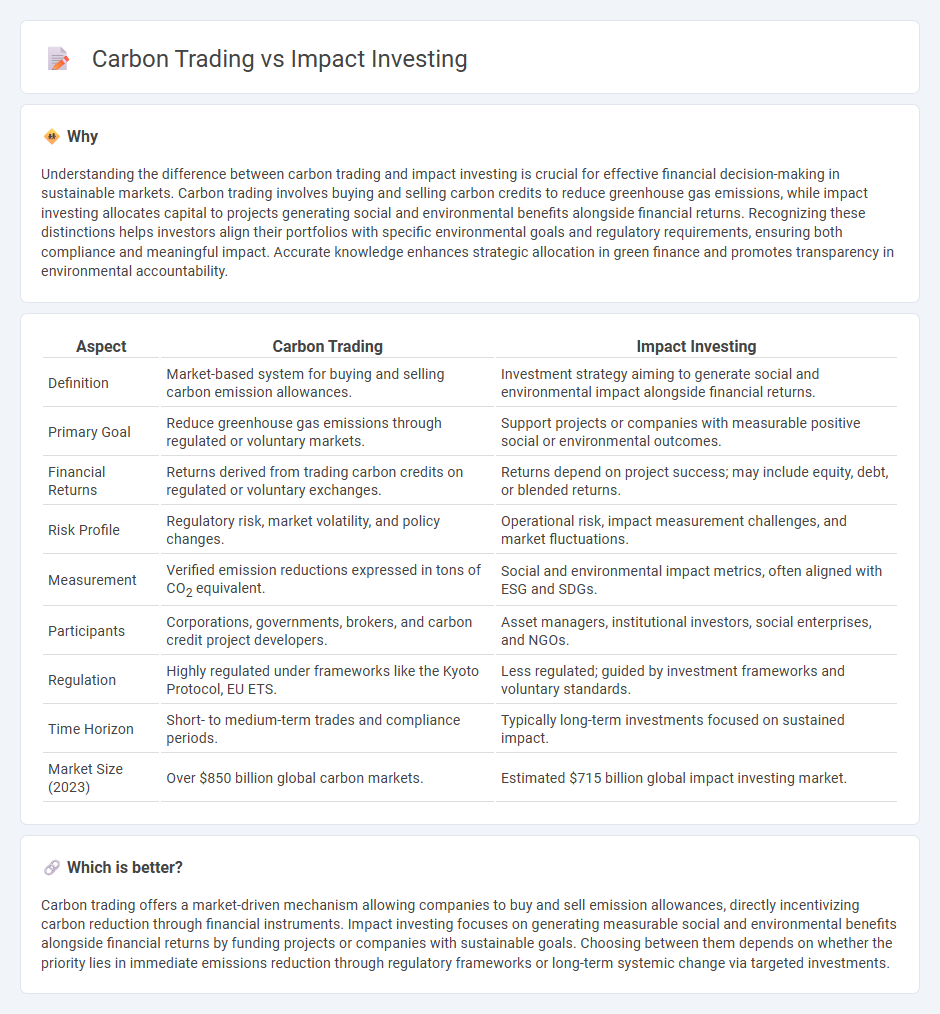

Understanding the difference between carbon trading and impact investing is crucial for effective financial decision-making in sustainable markets. Carbon trading involves buying and selling carbon credits to reduce greenhouse gas emissions, while impact investing allocates capital to projects generating social and environmental benefits alongside financial returns. Recognizing these distinctions helps investors align their portfolios with specific environmental goals and regulatory requirements, ensuring both compliance and meaningful impact. Accurate knowledge enhances strategic allocation in green finance and promotes transparency in environmental accountability.

Comparison Table

| Aspect | Carbon Trading | Impact Investing |

|---|---|---|

| Definition | Market-based system for buying and selling carbon emission allowances. | Investment strategy aiming to generate social and environmental impact alongside financial returns. |

| Primary Goal | Reduce greenhouse gas emissions through regulated or voluntary markets. | Support projects or companies with measurable positive social or environmental outcomes. |

| Financial Returns | Returns derived from trading carbon credits on regulated or voluntary exchanges. | Returns depend on project success; may include equity, debt, or blended returns. |

| Risk Profile | Regulatory risk, market volatility, and policy changes. | Operational risk, impact measurement challenges, and market fluctuations. |

| Measurement | Verified emission reductions expressed in tons of CO2 equivalent. | Social and environmental impact metrics, often aligned with ESG and SDGs. |

| Participants | Corporations, governments, brokers, and carbon credit project developers. | Asset managers, institutional investors, social enterprises, and NGOs. |

| Regulation | Highly regulated under frameworks like the Kyoto Protocol, EU ETS. | Less regulated; guided by investment frameworks and voluntary standards. |

| Time Horizon | Short- to medium-term trades and compliance periods. | Typically long-term investments focused on sustained impact. |

| Market Size (2023) | Over $850 billion global carbon markets. | Estimated $715 billion global impact investing market. |

Which is better?

Carbon trading offers a market-driven mechanism allowing companies to buy and sell emission allowances, directly incentivizing carbon reduction through financial instruments. Impact investing focuses on generating measurable social and environmental benefits alongside financial returns by funding projects or companies with sustainable goals. Choosing between them depends on whether the priority lies in immediate emissions reduction through regulatory frameworks or long-term systemic change via targeted investments.

Connection

Carbon trading markets enable companies to buy and sell emission allowances, promoting reductions in greenhouse gases, while impact investing channels capital into projects with measurable environmental outcomes. Both mechanisms drive sustainable finance by aligning economic incentives with environmental goals, fostering innovation in clean technologies and renewable energy. This synergy enhances corporate social responsibility and supports global commitments to carbon neutrality and climate resilience.

Key Terms

**Impact Investing:**

Impact investing directs capital towards companies and projects generating measurable social and environmental benefits alongside financial returns, emphasizing long-term sustainability and positive change. It targets sectors like renewable energy, affordable housing, and social enterprises, aligning investor values with tangible impact metrics such as carbon reduction, community development, and social equity. Explore the growing opportunities and key strategies shaping impact investing to maximize both profit and purpose.

Social Return on Investment (SROI)

Impact investing directs capital toward projects generating measurable social and environmental benefits alongside financial returns, emphasizing Social Return on Investment (SROI) to quantify positive community impact. Carbon trading involves buying and selling emission allowances to reduce greenhouse gases but often struggles to capture broader social outcomes in its valuation. Explore how these approaches differ in integrating SROI for comprehensive sustainability strategies.

Environmental, Social, and Governance (ESG)

Impact investing prioritizes deploying capital to generate measurable environmental and social benefits alongside financial returns, aligning with rigorous Environmental, Social, and Governance (ESG) criteria to support sustainable development. Carbon trading operates within regulatory or voluntary markets, allowing companies to buy and sell emission allowances or credits as a market-based approach to reducing greenhouse gas emissions, directly influencing environmental performance but with less emphasis on broader social governance factors. Explore how integrating impact investing and carbon trading strategies can enhance ESG outcomes for a comprehensive sustainable investment approach.

Source and External Links

What you need to know about impact investing - The GIIN - Impact investing involves making investments with the intention to generate positive, measurable social or environmental impact alongside a financial return, and it spans various sectors like energy, healthcare, and sustainable agriculture while accommodating a range of financial return expectations.

What is Impact Investing? | Fidelity Charitable - Impact investing is the purposeful act of making investments that achieve social and environmental benefits while generating financial returns, allowing investors to align investments with personal and philanthropic values, with growing participation among the wealthy and Millennials.

Impact Investing | United Nations Development Programme - Defined as deploying funds into investments that generate measurable social or environmental impact alongside financial returns, impact investing boosts private sector contributions to sustainable development and is supported by initiatives like the Global Islamic Finance and Impact Investing Platform.

dowidth.com

dowidth.com