Sovereign debt restructuring involves renegotiating a country's debt obligations to restore financial stability, often through debt rescheduling, reduction, or swaps. IMF intervention typically includes financial assistance programs and policy adjustments aimed at stabilizing the economy and restoring creditor confidence. Explore the differences and impacts of these approaches on national economies and global markets.

Why it is important

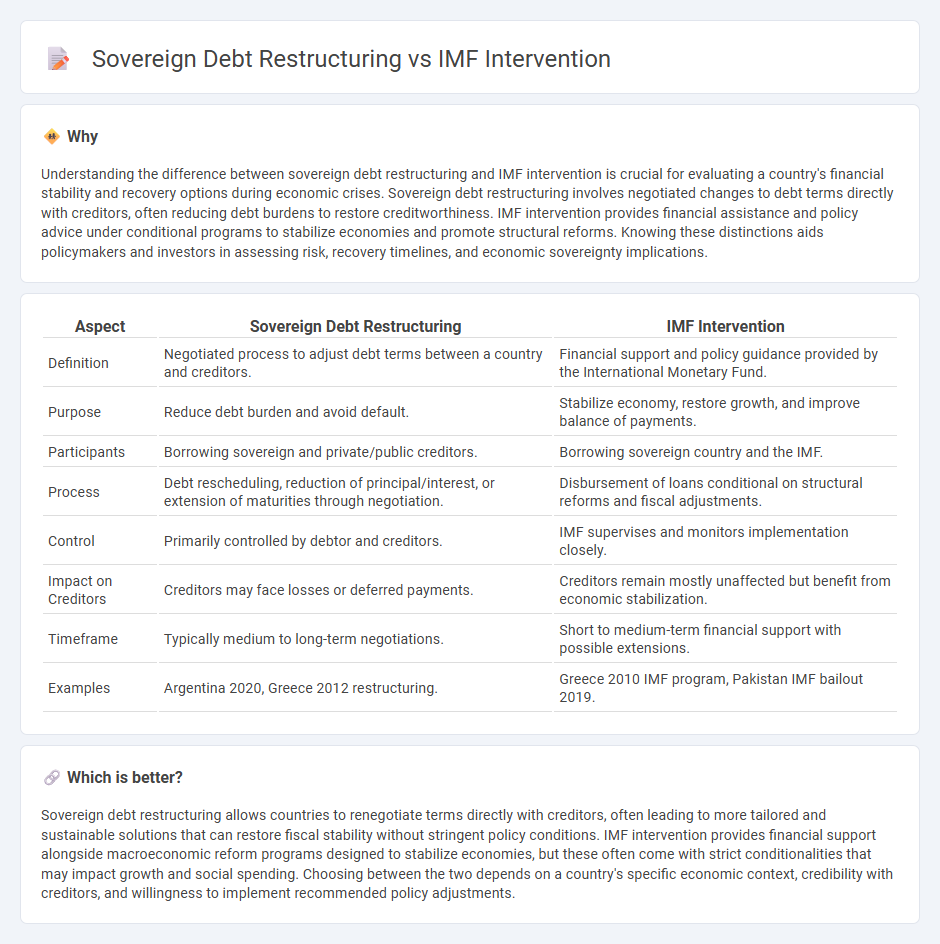

Understanding the difference between sovereign debt restructuring and IMF intervention is crucial for evaluating a country's financial stability and recovery options during economic crises. Sovereign debt restructuring involves negotiated changes to debt terms directly with creditors, often reducing debt burdens to restore creditworthiness. IMF intervention provides financial assistance and policy advice under conditional programs to stabilize economies and promote structural reforms. Knowing these distinctions aids policymakers and investors in assessing risk, recovery timelines, and economic sovereignty implications.

Comparison Table

| Aspect | Sovereign Debt Restructuring | IMF Intervention |

|---|---|---|

| Definition | Negotiated process to adjust debt terms between a country and creditors. | Financial support and policy guidance provided by the International Monetary Fund. |

| Purpose | Reduce debt burden and avoid default. | Stabilize economy, restore growth, and improve balance of payments. |

| Participants | Borrowing sovereign and private/public creditors. | Borrowing sovereign country and the IMF. |

| Process | Debt rescheduling, reduction of principal/interest, or extension of maturities through negotiation. | Disbursement of loans conditional on structural reforms and fiscal adjustments. |

| Control | Primarily controlled by debtor and creditors. | IMF supervises and monitors implementation closely. |

| Impact on Creditors | Creditors may face losses or deferred payments. | Creditors remain mostly unaffected but benefit from economic stabilization. |

| Timeframe | Typically medium to long-term negotiations. | Short to medium-term financial support with possible extensions. |

| Examples | Argentina 2020, Greece 2012 restructuring. | Greece 2010 IMF program, Pakistan IMF bailout 2019. |

Which is better?

Sovereign debt restructuring allows countries to renegotiate terms directly with creditors, often leading to more tailored and sustainable solutions that can restore fiscal stability without stringent policy conditions. IMF intervention provides financial support alongside macroeconomic reform programs designed to stabilize economies, but these often come with strict conditionalities that may impact growth and social spending. Choosing between the two depends on a country's specific economic context, credibility with creditors, and willingness to implement recommended policy adjustments.

Connection

Sovereign debt restructuring often occurs when countries face unsustainable debt levels, prompting negotiations to modify repayment terms with creditors. The International Monetary Fund (IMF) plays a critical role by providing financial assistance and policy guidance to stabilize economies during restructuring processes. IMF intervention aims to restore fiscal health and economic growth, facilitating successful debt relief and preventing default crises.

Key Terms

Conditionality

IMF intervention often comes with stringent conditionality, requiring countries to implement specific economic reforms to stabilize their economies and ensure loan repayment. Sovereign debt restructuring typically involves negotiations with creditors to modify the terms of debt without necessarily imposing standardized reform conditions. Explore deeper insights into how conditionality shapes the effectiveness of IMF programs versus debt restructuring strategies.

Haircut

IMF intervention in sovereign debt crises often involves financial assistance programs requiring policy reforms, while sovereign debt restructuring primarily focuses on negotiating a "haircut," which means creditors accept a reduction in the principal or interest payments to restore debt sustainability. The size of the haircut varies depending on the debtor country's economic conditions, creditworthiness, and the negotiation power of creditors, with typical haircuts ranging from 20% to over 50%. Explore the nuances of haircuts and debt strategies to understand their impact on global financial stability.

Stand-By Arrangement

IMF intervention through a Stand-By Arrangement (SBA) provides temporary financial assistance to countries facing balance of payments problems while implementing policy adjustments to restore economic stability. Unlike sovereign debt restructuring, which involves renegotiating debt terms with creditors to alleviate repayment burdens, SBAs emphasize conditional program support without altering existing debt contracts. Explore the mechanisms and impacts of Stand-By Arrangements to understand their role in global financial stability.

Source and External Links

What Is the IMF? - The IMF acts as a financial crisis firefighter for member countries facing debt crises, providing loans tied to economic reforms to restore financial stability and prevent contagion, with notable interventions in countries like Argentina, Brazil, Indonesia, and Greece.

IMF Lending Programs - The IMF provides emergency financing to absorb shocks, catalyze private investment, and promote macroeconomic stability, with a history of supporting countries through various global crises including post-WWII recovery, oil shocks, and the COVID-19 pandemic.

International Monetary Fund - As a loan condition, the IMF requires borrowing countries to implement structural adjustment reforms, which has led to criticism that such policies can impose harsh economic changes and perpetuate dependency on debt, sometimes described as a modern form of economic colonization.

dowidth.com

dowidth.com