AI-driven portfolios leverage advanced machine learning algorithms to analyze vast datasets and identify optimal investment opportunities tailored to an individual's risk profile. Robo-advisors automate portfolio management using predefined rules and algorithms but may lack the nuanced insights of AI systems that continuously learn and adapt. Explore the differences to understand which technology best fits your investment strategy.

Why it is important

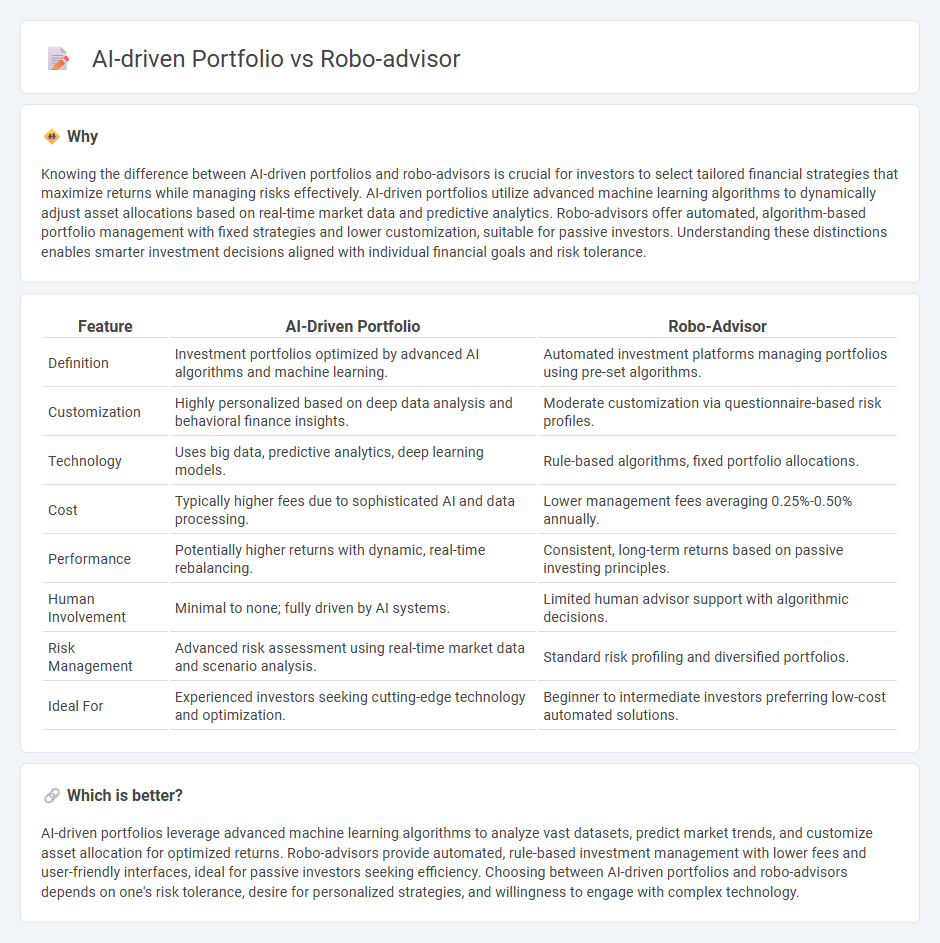

Knowing the difference between AI-driven portfolios and robo-advisors is crucial for investors to select tailored financial strategies that maximize returns while managing risks effectively. AI-driven portfolios utilize advanced machine learning algorithms to dynamically adjust asset allocations based on real-time market data and predictive analytics. Robo-advisors offer automated, algorithm-based portfolio management with fixed strategies and lower customization, suitable for passive investors. Understanding these distinctions enables smarter investment decisions aligned with individual financial goals and risk tolerance.

Comparison Table

| Feature | AI-Driven Portfolio | Robo-Advisor |

|---|---|---|

| Definition | Investment portfolios optimized by advanced AI algorithms and machine learning. | Automated investment platforms managing portfolios using pre-set algorithms. |

| Customization | Highly personalized based on deep data analysis and behavioral finance insights. | Moderate customization via questionnaire-based risk profiles. |

| Technology | Uses big data, predictive analytics, deep learning models. | Rule-based algorithms, fixed portfolio allocations. |

| Cost | Typically higher fees due to sophisticated AI and data processing. | Lower management fees averaging 0.25%-0.50% annually. |

| Performance | Potentially higher returns with dynamic, real-time rebalancing. | Consistent, long-term returns based on passive investing principles. |

| Human Involvement | Minimal to none; fully driven by AI systems. | Limited human advisor support with algorithmic decisions. |

| Risk Management | Advanced risk assessment using real-time market data and scenario analysis. | Standard risk profiling and diversified portfolios. |

| Ideal For | Experienced investors seeking cutting-edge technology and optimization. | Beginner to intermediate investors preferring low-cost automated solutions. |

Which is better?

AI-driven portfolios leverage advanced machine learning algorithms to analyze vast datasets, predict market trends, and customize asset allocation for optimized returns. Robo-advisors provide automated, rule-based investment management with lower fees and user-friendly interfaces, ideal for passive investors seeking efficiency. Choosing between AI-driven portfolios and robo-advisors depends on one's risk tolerance, desire for personalized strategies, and willingness to engage with complex technology.

Connection

AI-driven portfolios utilize advanced machine learning algorithms to analyze vast financial data, optimize asset allocation, and predict market trends, enhancing investment strategies. Robo-advisors integrate these AI capabilities to offer automated, personalized portfolio management services with minimal human intervention. This synergy allows investors to access cost-effective, data-driven financial advice, improving portfolio performance and risk management.

Key Terms

Algorithmic Trading

Robo-advisors utilize predefined algorithms to offer automated, low-cost portfolio management primarily based on client risk profiles and goals, while AI-driven portfolios leverage machine learning to adapt dynamically to market conditions through sophisticated algorithmic trading strategies. Algorithmic trading powered by AI enables real-time analysis of vast datasets, improving trade execution and identifying emerging market trends with higher precision compared to traditional robo-advisors. Explore the advantages and nuances of both approaches to optimize your investment strategy.

Risk Assessment

Robo-advisors utilize algorithm-driven models to automate investment decisions primarily based on user-defined risk tolerance and financial goals, ensuring tailored portfolio management. AI-driven portfolios incorporate advanced machine learning techniques and real-time data analysis to dynamically assess risk factors, market conditions, and individual asset volatility, enabling more adaptive and predictive risk management. Explore further to understand how each approach optimizes risk assessment for enhanced investment outcomes.

Portfolio Optimization

Robo-advisors utilize algorithm-based strategies to automate portfolio management, optimizing asset allocation according to individual risk tolerance and financial goals. AI-driven portfolios leverage machine learning and big data analytics to continuously adapt and enhance investment strategies, identifying market trends and minimizing risk dynamically. Explore deeper insights into how these technologies revolutionize portfolio optimization.

Source and External Links

Robo-advisor - Robo-advisors are automated financial advisers that provide personalized investment management online with minimal human intervention, using algorithms to allocate and optimize client assets based on risk tolerance and goals.

What is a robo advisor? | Robo advisory services - A robo advisor is a cost-effective digital platform that automates investing by using client-provided data such as risk tolerance and financial goals to create, manage, and rebalance portfolios.

Best Robo-Advisors: Top Picks for 2025 - Robo-advisors use algorithms to automate portfolio management, offering low fees, automatic rebalancing, tax optimization, and occasionally access to human advisors for investors preferring a mostly hands-off approach.

dowidth.com

dowidth.com