Web scraping for stock data enables investors to extract real-time market information from publicly accessible websites, providing cost-effective access to diverse financial metrics without subscription fees. Proprietary trading terminals offer advanced analytics, direct market access, and low-latency execution tailored for institutional traders, supported by exclusive datasets and integrated trading algorithms. Explore the advantages and limitations of each approach to optimize your trading strategy.

Why it is important

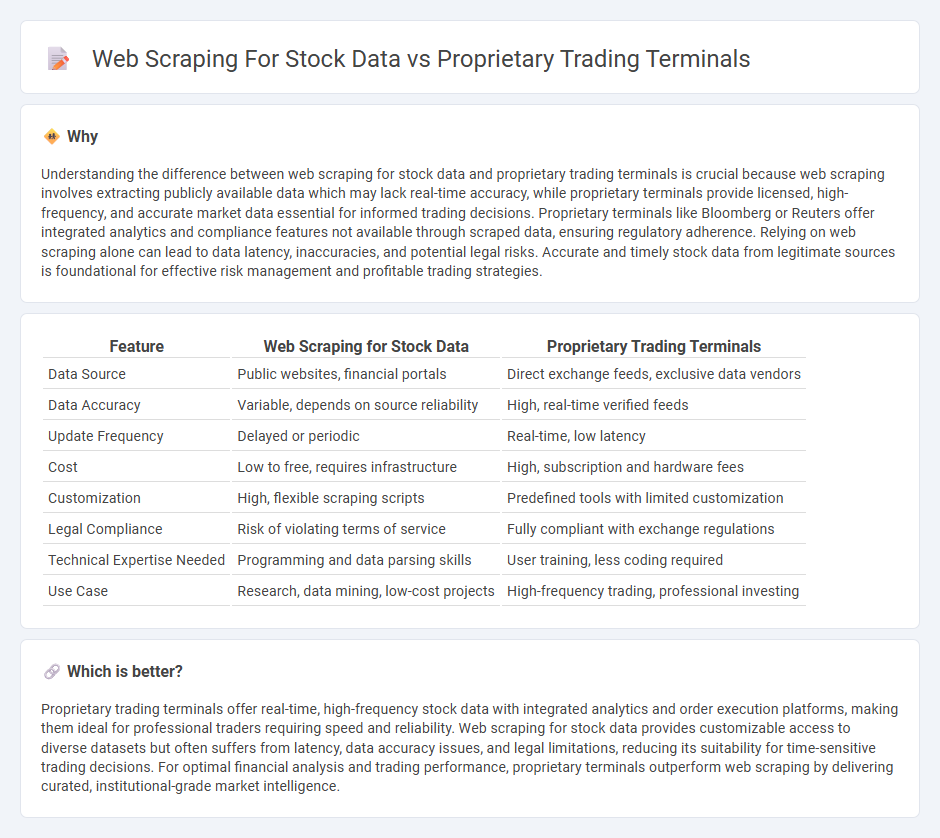

Understanding the difference between web scraping for stock data and proprietary trading terminals is crucial because web scraping involves extracting publicly available data which may lack real-time accuracy, while proprietary terminals provide licensed, high-frequency, and accurate market data essential for informed trading decisions. Proprietary terminals like Bloomberg or Reuters offer integrated analytics and compliance features not available through scraped data, ensuring regulatory adherence. Relying on web scraping alone can lead to data latency, inaccuracies, and potential legal risks. Accurate and timely stock data from legitimate sources is foundational for effective risk management and profitable trading strategies.

Comparison Table

| Feature | Web Scraping for Stock Data | Proprietary Trading Terminals |

|---|---|---|

| Data Source | Public websites, financial portals | Direct exchange feeds, exclusive data vendors |

| Data Accuracy | Variable, depends on source reliability | High, real-time verified feeds |

| Update Frequency | Delayed or periodic | Real-time, low latency |

| Cost | Low to free, requires infrastructure | High, subscription and hardware fees |

| Customization | High, flexible scraping scripts | Predefined tools with limited customization |

| Legal Compliance | Risk of violating terms of service | Fully compliant with exchange regulations |

| Technical Expertise Needed | Programming and data parsing skills | User training, less coding required |

| Use Case | Research, data mining, low-cost projects | High-frequency trading, professional investing |

Which is better?

Proprietary trading terminals offer real-time, high-frequency stock data with integrated analytics and order execution platforms, making them ideal for professional traders requiring speed and reliability. Web scraping for stock data provides customizable access to diverse datasets but often suffers from latency, data accuracy issues, and legal limitations, reducing its suitability for time-sensitive trading decisions. For optimal financial analysis and trading performance, proprietary terminals outperform web scraping by delivering curated, institutional-grade market intelligence.

Connection

Web scraping for stock data enables real-time extraction of market prices, trading volumes, and financial news essential for proprietary trading terminals to execute high-frequency and algorithmic trades effectively. Proprietary trading terminals leverage this scraped data to perform advanced analytics, risk assessment, and strategy optimization, ensuring faster decision-making in volatile markets. This integration enhances competitive advantage by providing proprietary traders with timely and comprehensive market insights beyond standard data providers.

Key Terms

Market Data Access

Proprietary trading terminals provide direct, real-time access to high-quality market data with minimal latency, supporting advanced analytics and seamless integration within trading platforms. Web scraping stock data often involves delays, limited depth, and potential accuracy issues due to reliance on publicly available sources and website structures. Explore the nuances of market data access and determine the best solution for your trading needs.

Latency

Proprietary trading terminals offer ultra-low latency data transmission, often in microseconds, essential for high-frequency trading strategies. Web scraping generally involves greater latency due to HTTP request-response cycles and data parsing delays, making it less suitable for real-time trading decisions. Explore deeper insights into latency differences and their impact on trading performance.

Data Reliability

Proprietary trading terminals such as Bloomberg Terminal and Thomson Reuters Eikon provide highly reliable, real-time stock data with comprehensive market analytics and regulatory compliance, ensuring data accuracy and consistency for professional traders. Web scraping stock data from websites may lead to inconsistencies, delayed updates, and potential legal risks due to unverified sources and data extraction limitations. Explore detailed comparisons and best practices to determine the optimal solution for secure and dependable stock data acquisition.

Source and External Links

Proprietary Trading Desk Setup: A Step by Step Guide - This guide explains setting up a proprietary trading desk including the importance of market access, arranging capital, and necessary infrastructure such as trading platforms and data terminals.

Proprietary trading - Wikipedia - Proprietary trading terminals enable traders to use the firm's own capital to trade various financial instruments and employ strategies like arbitrage and volatility trading within well-known trading firms.

Proprietary Trading: Top 10 Platforms - UpTrader CRM - Lists popular proprietary trading platforms and terminals including Bloomberg Terminal, UpTrader, cTrader, and NinjaTrader used for executing and managing proprietary trades.

dowidth.com

dowidth.com