Copy trading platforms enable investors to mimic the trades of experienced traders in real time, offering a hands-on approach to portfolio management. Robo-advisors use algorithms to provide automated, personalized investment strategies based on individual risk tolerance and financial goals. Explore the benefits and differences of these innovative financial tools to optimize your investment strategy.

Why it is important

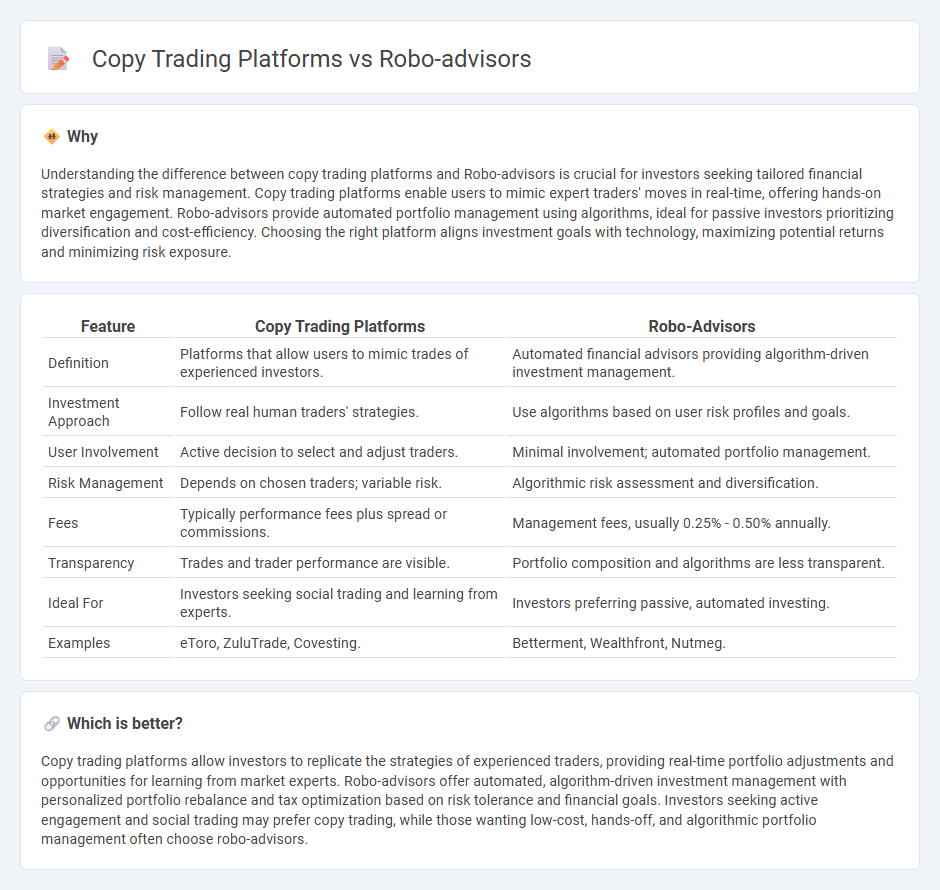

Understanding the difference between copy trading platforms and Robo-advisors is crucial for investors seeking tailored financial strategies and risk management. Copy trading platforms enable users to mimic expert traders' moves in real-time, offering hands-on market engagement. Robo-advisors provide automated portfolio management using algorithms, ideal for passive investors prioritizing diversification and cost-efficiency. Choosing the right platform aligns investment goals with technology, maximizing potential returns and minimizing risk exposure.

Comparison Table

| Feature | Copy Trading Platforms | Robo-Advisors |

|---|---|---|

| Definition | Platforms that allow users to mimic trades of experienced investors. | Automated financial advisors providing algorithm-driven investment management. |

| Investment Approach | Follow real human traders' strategies. | Use algorithms based on user risk profiles and goals. |

| User Involvement | Active decision to select and adjust traders. | Minimal involvement; automated portfolio management. |

| Risk Management | Depends on chosen traders; variable risk. | Algorithmic risk assessment and diversification. |

| Fees | Typically performance fees plus spread or commissions. | Management fees, usually 0.25% - 0.50% annually. |

| Transparency | Trades and trader performance are visible. | Portfolio composition and algorithms are less transparent. |

| Ideal For | Investors seeking social trading and learning from experts. | Investors preferring passive, automated investing. |

| Examples | eToro, ZuluTrade, Covesting. | Betterment, Wealthfront, Nutmeg. |

Which is better?

Copy trading platforms allow investors to replicate the strategies of experienced traders, providing real-time portfolio adjustments and opportunities for learning from market experts. Robo-advisors offer automated, algorithm-driven investment management with personalized portfolio rebalance and tax optimization based on risk tolerance and financial goals. Investors seeking active engagement and social trading may prefer copy trading, while those wanting low-cost, hands-off, and algorithmic portfolio management often choose robo-advisors.

Connection

Copy trading platforms and robo-advisors are connected through their use of algorithm-driven strategies to automate investment decisions and optimize portfolio management. Both leverage advanced data analytics and machine learning to replicate successful trades or provide personalized financial advice efficiently. This integration enhances accessibility for retail investors by simplifying complex trading processes and reducing the need for active management.

Key Terms

Algorithmic Portfolio Management

Algorithmic portfolio management in robo-advisors utilizes advanced AI algorithms to automatically create and rebalance diversified investment portfolios tailored to user risk profiles and financial goals. Copy trading platforms enable investors to replicate trades of experienced traders in real-time, offering a more hands-on approach but with higher dependency on individual trader performance. Explore how these technologies differ in risk management and personalization to optimize your investment strategy.

Social Trading

Social trading platforms enable investors to replicate strategies of successful traders in real time, merging community insights with automated execution. Robo-advisors use algorithms and AI to provide personalized portfolio management based on individual risk tolerance and goals without direct human intervention. Explore detailed comparisons to understand which option aligns best with your investment strategy and preferences.

Risk Profiling

Robo-advisors leverage advanced algorithms and user-provided financial data to generate personalized risk profiles, ensuring investment strategies align with individual risk tolerance and financial goals. Copy trading platforms typically offer limited risk profiling, relying on traders' historical performance and follower discretion rather than tailored risk assessments. Explore the intricacies of risk profiling in robo-advisors versus copy trading to optimize your investment decisions effectively.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial advisors that use algorithms to provide personalized investment management online with minimal human intervention, automatically allocating and optimizing client assets mainly through ETFs based on risk tolerance and target returns.

What is a robo advisor? | Robo advisory services - Fidelity Investments - Robo advisors are affordable digital services that automate investing by collecting investor information such as risk tolerance and financial goals to create and maintain portfolios, often charging lower fees than traditional advisors.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors offer automated, semi-custom asset allocation portfolios with lower costs than wealth managers and include financial planning tools and access to human advisors as needed, serving retail investors interested in tailored but automated investing.

dowidth.com

dowidth.com