Greenium represents the premium investors pay for environmentally sustainable investments, reflecting growing demand for green assets. Risk premium denotes the additional return required by investors to compensate for the uncertainty and potential losses associated with a financial asset. Explore the distinctions and implications of greenium versus risk premium to better understand sustainable finance strategies.

Why it is important

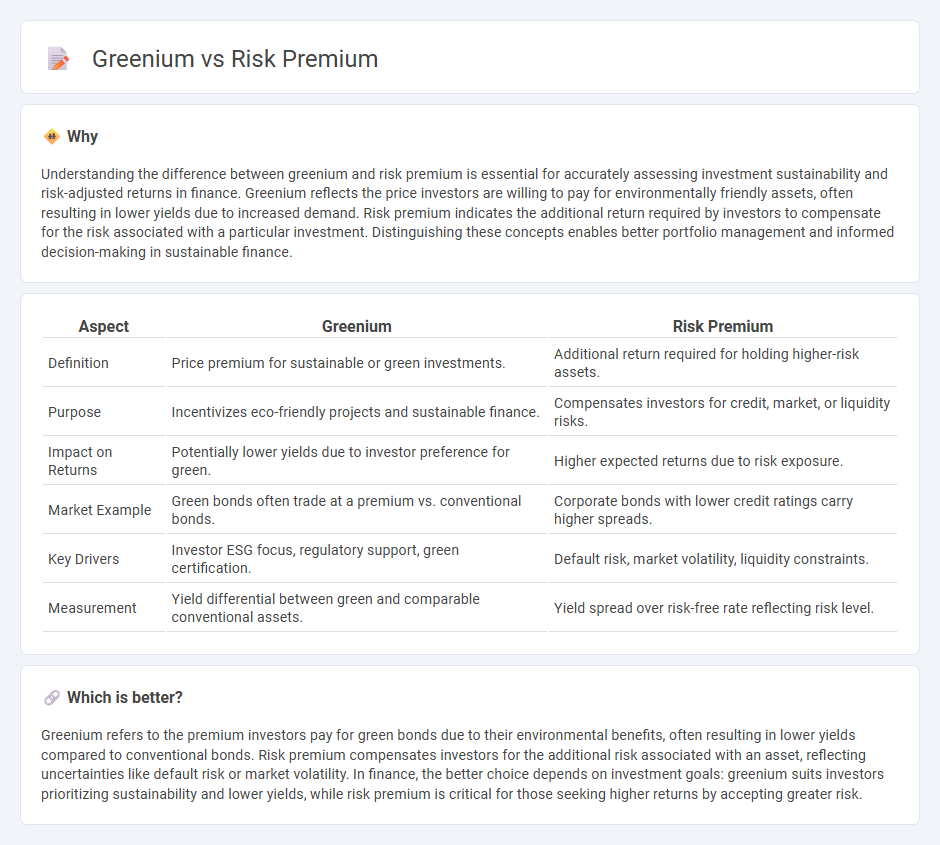

Understanding the difference between greenium and risk premium is essential for accurately assessing investment sustainability and risk-adjusted returns in finance. Greenium reflects the price investors are willing to pay for environmentally friendly assets, often resulting in lower yields due to increased demand. Risk premium indicates the additional return required by investors to compensate for the risk associated with a particular investment. Distinguishing these concepts enables better portfolio management and informed decision-making in sustainable finance.

Comparison Table

| Aspect | Greenium | Risk Premium |

|---|---|---|

| Definition | Price premium for sustainable or green investments. | Additional return required for holding higher-risk assets. |

| Purpose | Incentivizes eco-friendly projects and sustainable finance. | Compensates investors for credit, market, or liquidity risks. |

| Impact on Returns | Potentially lower yields due to investor preference for green. | Higher expected returns due to risk exposure. |

| Market Example | Green bonds often trade at a premium vs. conventional bonds. | Corporate bonds with lower credit ratings carry higher spreads. |

| Key Drivers | Investor ESG focus, regulatory support, green certification. | Default risk, market volatility, liquidity constraints. |

| Measurement | Yield differential between green and comparable conventional assets. | Yield spread over risk-free rate reflecting risk level. |

Which is better?

Greenium refers to the premium investors pay for green bonds due to their environmental benefits, often resulting in lower yields compared to conventional bonds. Risk premium compensates investors for the additional risk associated with an asset, reflecting uncertainties like default risk or market volatility. In finance, the better choice depends on investment goals: greenium suits investors prioritizing sustainability and lower yields, while risk premium is critical for those seeking higher returns by accepting greater risk.

Connection

The greenium represents the pricing premium investors are willing to pay for green bonds compared to conventional bonds, reflecting the demand for environmentally sustainable investments. This premium directly influences the risk premium, as green bonds often carry a lower risk premium due to perceived lower environmental and regulatory risks. Consequently, the interplay between greenium and risk premium shapes the cost of capital for firms engaging in green initiatives.

Key Terms

Expected Return

Risk premium refers to the additional expected return investors demand for holding riskier assets compared to risk-free securities, quantifying compensation for market volatility or credit risk. Greenium represents the price premium, often resulting in a lower expected return, that investors accept for sustainable or green bonds due to increasing ESG preferences and regulatory support. Explore the dynamics between risk premium and greenium to optimize investment strategies and balance sustainable finance goals with expected returns.

Sustainability

Risk premium represents the extra return investors demand for taking on additional risk, while greenium refers to the pricing premium investors are willing to pay for sustainable or green assets, reflecting growing environmental, social, and governance (ESG) considerations. In sustainable finance, greenium often results in lower yields for green bonds compared to conventional bonds due to high demand for eco-friendly investments. Explore how integrating risk premium and greenium dynamics can enhance sustainable investment strategies.

Credit Spread

The risk premium reflects the extra yield investors demand to compensate for credit risk, while the greenium represents the typically lower credit spread investors accept for green bonds due to their environmental benefits and strong demand. Credit spreads on green bonds tend to be narrower compared to traditional bonds, signaling investor willingness to pay a premium for sustainable debt despite similar credit quality. Explore the nuances of credit spreads further to understand the dynamics between risk premium and greenium in sustainable finance.

Source and External Links

Risk premium - Wikipedia - A risk premium is the excess return required by an individual to compensate for increased risk, calculated as the expected risky return minus the risk-free return, and it varies with economic conditions and types of risk involved.

Equity Risk Premium (ERP) | Formula + Calculator - Wall Street Prep - The equity risk premium is the difference between the expected market return and the risk-free rate, representing the additional return investors require for market risk, typically calculated using market returns like the S&P 500 minus treasury yields.

Market Risk Premium - Definition, Formula, Template - Corporate Finance Institute - The market risk premium is the additional return expected by investors for holding a risky market portfolio instead of risk-free assets, central to CAPM, and calculated as the expected rate of return minus the risk-free rate (e.g., S&P 500 return minus Treasury bill rate).

dowidth.com

dowidth.com