Catastrophe bonds are risk-linked securities that transfer catastrophe risk from insurers to investors, providing capital relief in the event of natural disasters, while credit default swaps (CDS) are financial derivatives that allow parties to hedge or speculate on the credit risk of corporate or sovereign debt. Both instruments play crucial roles in risk management and capital markets but target fundamentally different types of risks--natural catastrophe versus credit default risk. Explore detailed comparisons and applications to better understand their impact on financial strategies and market stability.

Why it is important

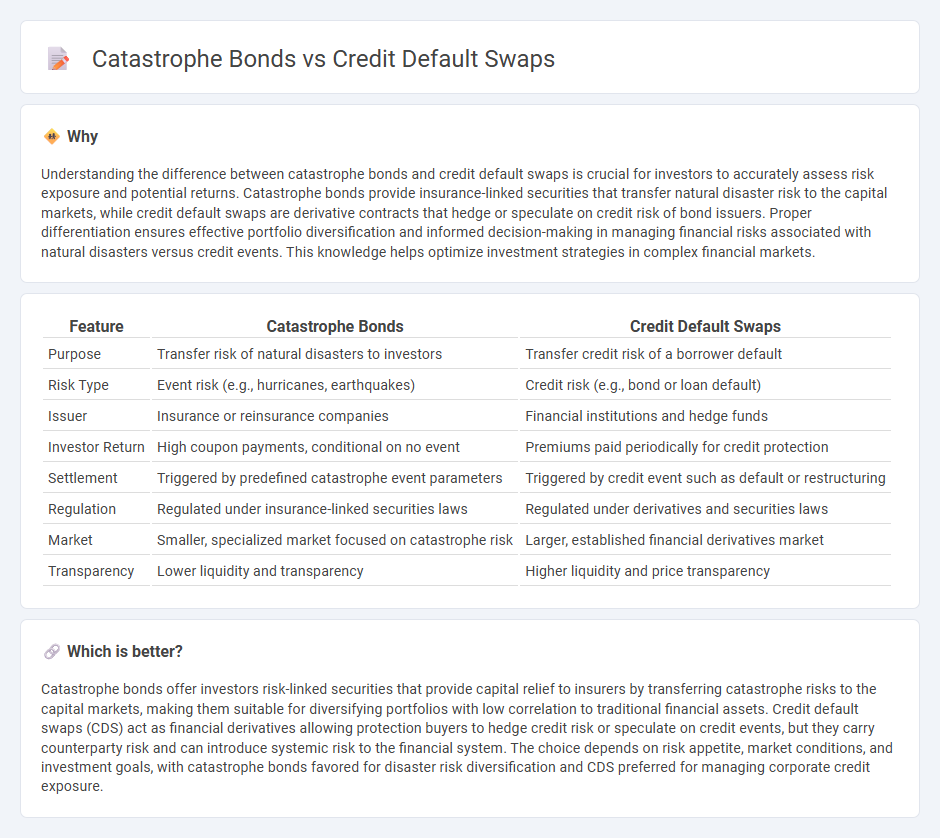

Understanding the difference between catastrophe bonds and credit default swaps is crucial for investors to accurately assess risk exposure and potential returns. Catastrophe bonds provide insurance-linked securities that transfer natural disaster risk to the capital markets, while credit default swaps are derivative contracts that hedge or speculate on credit risk of bond issuers. Proper differentiation ensures effective portfolio diversification and informed decision-making in managing financial risks associated with natural disasters versus credit events. This knowledge helps optimize investment strategies in complex financial markets.

Comparison Table

| Feature | Catastrophe Bonds | Credit Default Swaps |

|---|---|---|

| Purpose | Transfer risk of natural disasters to investors | Transfer credit risk of a borrower default |

| Risk Type | Event risk (e.g., hurricanes, earthquakes) | Credit risk (e.g., bond or loan default) |

| Issuer | Insurance or reinsurance companies | Financial institutions and hedge funds |

| Investor Return | High coupon payments, conditional on no event | Premiums paid periodically for credit protection |

| Settlement | Triggered by predefined catastrophe event parameters | Triggered by credit event such as default or restructuring |

| Regulation | Regulated under insurance-linked securities laws | Regulated under derivatives and securities laws |

| Market | Smaller, specialized market focused on catastrophe risk | Larger, established financial derivatives market |

| Transparency | Lower liquidity and transparency | Higher liquidity and price transparency |

Which is better?

Catastrophe bonds offer investors risk-linked securities that provide capital relief to insurers by transferring catastrophe risks to the capital markets, making them suitable for diversifying portfolios with low correlation to traditional financial assets. Credit default swaps (CDS) act as financial derivatives allowing protection buyers to hedge credit risk or speculate on credit events, but they carry counterparty risk and can introduce systemic risk to the financial system. The choice depends on risk appetite, market conditions, and investment goals, with catastrophe bonds favored for disaster risk diversification and CDS preferred for managing corporate credit exposure.

Connection

Catastrophe bonds and credit default swaps both serve as financial instruments designed to manage and transfer risk. Catastrophe bonds provide insurance companies with capital relief by transferring the risk of disaster events to investors, while credit default swaps offer protection against the default risk of debt issuers. The connection lies in their role in risk mitigation, with CDS focusing on credit risk and catastrophe bonds emphasizing insurance-linked securities for natural disasters.

Key Terms

Counterparty Risk

Credit default swaps (CDS) involve significant counterparty risk since the protection buyer depends on the seller's ability to pay in the event of a credit event, making the financial stability of the counterparty crucial. Catastrophe bonds (cat bonds) transfer risk to investors without direct counterparty exposure, as the bond issuer's obligation to pay is contingent on predefined catastrophe events rather than default risk. Explore the nuances of counterparty risk in financial instruments to understand their implications better.

Trigger Event

Credit default swaps (CDS) are triggered by a credit event such as a bond default or restructuring, providing protection against the failure of a borrower to meet obligations. Catastrophe bonds (cat bonds) activate upon specific natural disaster occurrences like hurricanes or earthquakes, transferring the risk of catastrophic events from insurers to investors. Explore deeper to understand how these trigger events affect risk management strategies in finance and insurance.

Risk Transfer

Credit default swaps (CDS) transfer credit risk by allowing investors to hedge against the default of debt issuers, while catastrophe bonds (cat bonds) transfer insurance risk related to natural disasters to capital markets. CDS primarily address financial risk stemming from borrower insolvency, whereas cat bonds provide a mechanism for insurers to offload catastrophe risk, thereby converting potential large-scale losses into investment opportunities. Explore the unique risk transfer features and applications of CDS and catastrophe bonds to understand their impact on financial and insurance sectors.

Source and External Links

Credit default swap - A credit default swap (CDS) is a financial contract where the seller compensates the buyer if a debtor defaults, effectively insuring against credit risk; the buyer pays periodic fees and receives a payoff if the asset defaults, with the market growing significantly by the 2000s and gaining regulatory attention after the 2008 financial crisis.

Credit Default Swaps - A CDS is a contract where one party buys protection from another against losses from a borrower's default, often covering bonds of a reference entity, with settlement occurring via cash payment or physical delivery upon a credit event such as bankruptcy or failure to pay.

Credit Default Swap - Defintion, How it Works, Risk - A CDS is a credit derivative providing protection against default, involving premium payments by the buyer to the seller, where the seller faces significant risk if a default occurs; by 2008, CDSs held a notional value exceeding even the stock market.

dowidth.com

dowidth.com