Buy Now Pay Later (BNPL) offers short-term, interest-free installments for immediate purchases, making it appealing for budget-conscious consumers seeking flexibility without upfront costs. Revolving credit, such as credit cards, provides a continuous credit line with variable interest rates, allowing users to borrow, repay, and reuse funds while managing cash flow over time. Discover how these financing options can impact your financial strategy and spending habits.

Why it is important

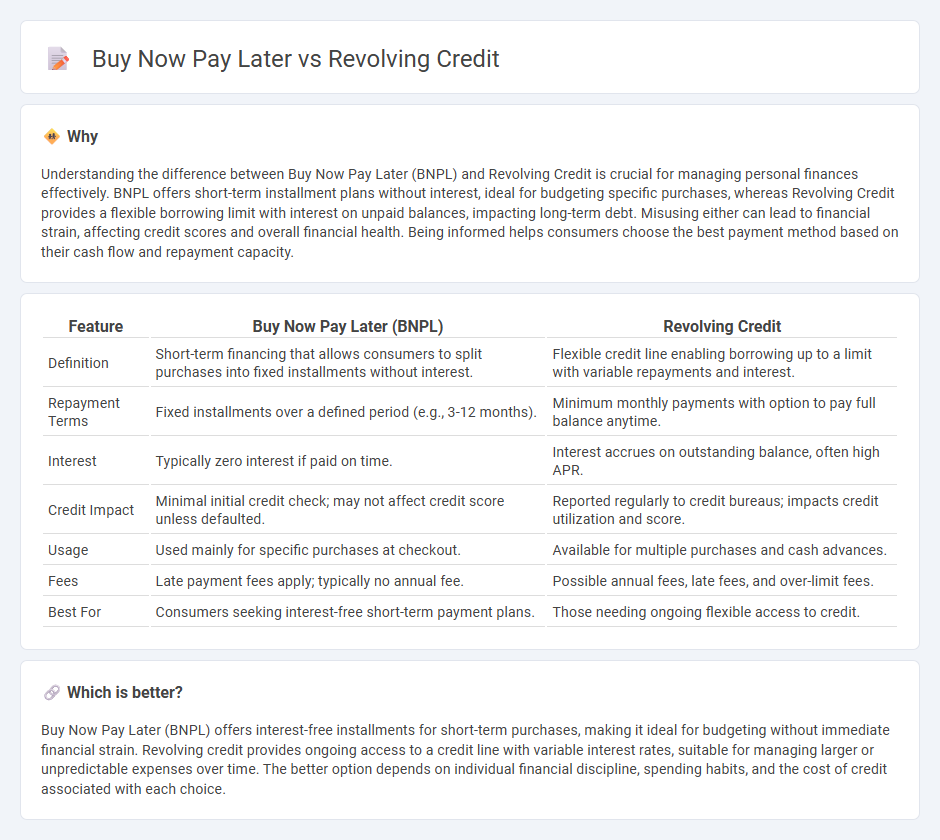

Understanding the difference between Buy Now Pay Later (BNPL) and Revolving Credit is crucial for managing personal finances effectively. BNPL offers short-term installment plans without interest, ideal for budgeting specific purchases, whereas Revolving Credit provides a flexible borrowing limit with interest on unpaid balances, impacting long-term debt. Misusing either can lead to financial strain, affecting credit scores and overall financial health. Being informed helps consumers choose the best payment method based on their cash flow and repayment capacity.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Revolving Credit |

|---|---|---|

| Definition | Short-term financing that allows consumers to split purchases into fixed installments without interest. | Flexible credit line enabling borrowing up to a limit with variable repayments and interest. |

| Repayment Terms | Fixed installments over a defined period (e.g., 3-12 months). | Minimum monthly payments with option to pay full balance anytime. |

| Interest | Typically zero interest if paid on time. | Interest accrues on outstanding balance, often high APR. |

| Credit Impact | Minimal initial credit check; may not affect credit score unless defaulted. | Reported regularly to credit bureaus; impacts credit utilization and score. |

| Usage | Used mainly for specific purchases at checkout. | Available for multiple purchases and cash advances. |

| Fees | Late payment fees apply; typically no annual fee. | Possible annual fees, late fees, and over-limit fees. |

| Best For | Consumers seeking interest-free short-term payment plans. | Those needing ongoing flexible access to credit. |

Which is better?

Buy Now Pay Later (BNPL) offers interest-free installments for short-term purchases, making it ideal for budgeting without immediate financial strain. Revolving credit provides ongoing access to a credit line with variable interest rates, suitable for managing larger or unpredictable expenses over time. The better option depends on individual financial discipline, spending habits, and the cost of credit associated with each choice.

Connection

Buy Now Pay Later (BNPL) and revolving credit both provide consumers with flexible payment options, allowing purchases to be made upfront with payments spread over time. BNPL often operates through short-term, interest-free installment plans, whereas revolving credit allows continuous borrowing up to a credit limit with varying interest rates. Both financial tools impact consumer spending behavior and credit risk assessment by extending access to credit beyond immediate funds.

Key Terms

Credit Limit

Revolving credit typically offers a flexible credit limit that resets as you repay your balance, allowing continuous access to funds up to a predetermined maximum. Buy Now Pay Later (BNPL) options often have lower credit limits tied to individual purchase amounts rather than an ongoing reusable limit. Discover the key differences in credit limits and how they impact your financial flexibility by exploring more details.

Interest Rate

Revolving credit typically charges variable interest rates ranging from 15% to 25%, which can accumulate quickly if balances are not paid in full each month. Buy Now Pay Later (BNPL) services often offer interest-free periods but impose high fees or interest rates exceeding 20% if payments are missed or extended beyond the grace period. Explore detailed comparisons of interest structures and repayment terms to choose the best financing option for your needs.

Repayment Schedule

Revolving credit offers flexible repayment schedules that allow borrowers to carry a balance and make minimum payments each month, with interest accruing on outstanding amounts. Buy now pay later (BNPL) typically involves fixed, short-term installments without ongoing interest, designed for quick repayment within weeks or months. Explore the nuances of each repayment schedule to determine the best fit for your financial needs.

Source and External Links

What Is Revolving Credit? - Revolving credit lets you borrow money up to a maximum credit limit, pay it back over time, and borrow again as needed, with the option to carry over a balance that accrues interest or pay in full to avoid interest.

What Is Revolving Credit and How Does It Work? - Revolving credit is a line of credit allowing you to borrow up to a set limit, repay it, and borrow again, commonly through credit cards, personal lines of credit, and home equity lines of credit (HELOCs).

Revolving credit: what is it and how does it work? - Revolving credit is a type of loan automatically renewed as debt is paid, giving access to a preset credit limit, where you can either pay off balances in full or carry over a balance with interest accruing.

dowidth.com

dowidth.com