Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to enable transparent, community-governed management of digital assets, offering agility and real-time adaptability compared to traditional public sector reserves. Public sector reserves typically involve centralized control with regulatory oversight, focusing on macroeconomic stability and long-term fiscal policy implementation. Explore further to understand the distinct financial mechanisms and governance models shaping these treasury systems.

Why it is important

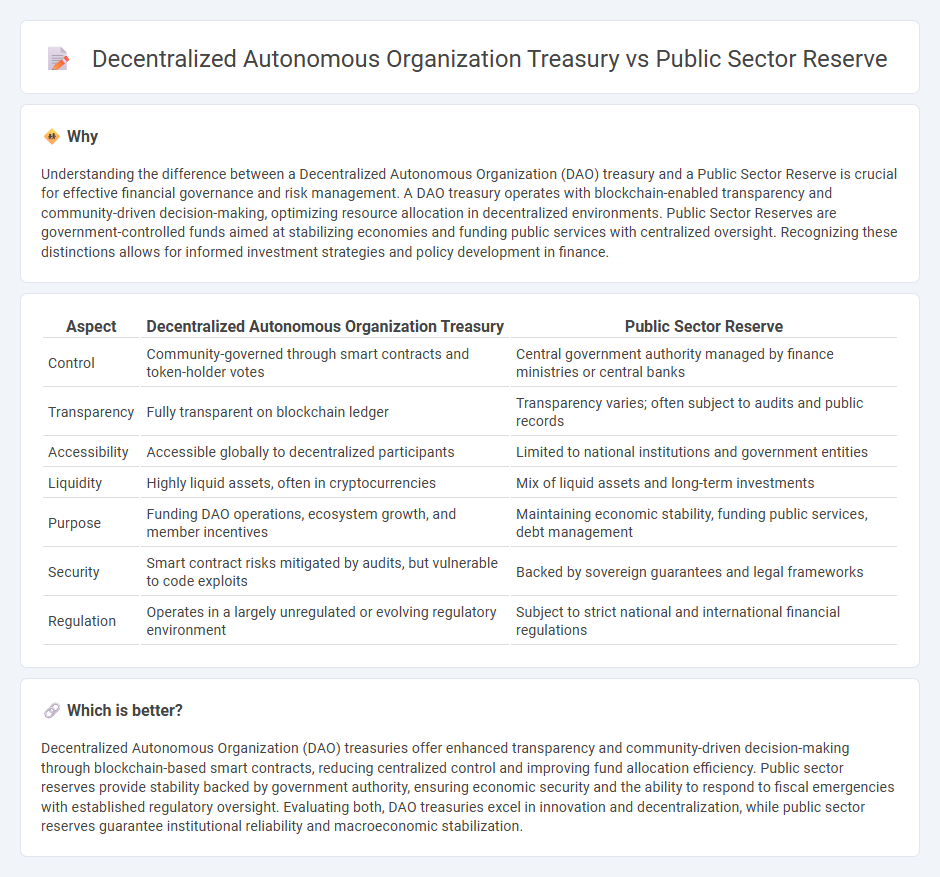

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a Public Sector Reserve is crucial for effective financial governance and risk management. A DAO treasury operates with blockchain-enabled transparency and community-driven decision-making, optimizing resource allocation in decentralized environments. Public Sector Reserves are government-controlled funds aimed at stabilizing economies and funding public services with centralized oversight. Recognizing these distinctions allows for informed investment strategies and policy development in finance.

Comparison Table

| Aspect | Decentralized Autonomous Organization Treasury | Public Sector Reserve |

|---|---|---|

| Control | Community-governed through smart contracts and token-holder votes | Central government authority managed by finance ministries or central banks |

| Transparency | Fully transparent on blockchain ledger | Transparency varies; often subject to audits and public records |

| Accessibility | Accessible globally to decentralized participants | Limited to national institutions and government entities |

| Liquidity | Highly liquid assets, often in cryptocurrencies | Mix of liquid assets and long-term investments |

| Purpose | Funding DAO operations, ecosystem growth, and member incentives | Maintaining economic stability, funding public services, debt management |

| Security | Smart contract risks mitigated by audits, but vulnerable to code exploits | Backed by sovereign guarantees and legal frameworks |

| Regulation | Operates in a largely unregulated or evolving regulatory environment | Subject to strict national and international financial regulations |

Which is better?

Decentralized Autonomous Organization (DAO) treasuries offer enhanced transparency and community-driven decision-making through blockchain-based smart contracts, reducing centralized control and improving fund allocation efficiency. Public sector reserves provide stability backed by government authority, ensuring economic security and the ability to respond to fiscal emergencies with established regulatory oversight. Evaluating both, DAO treasuries excel in innovation and decentralization, while public sector reserves guarantee institutional reliability and macroeconomic stabilization.

Connection

Decentralized Autonomous Organization (DAO) treasuries and public sector reserves both function as centralized pools of funds managed with distinct governance models to support fiscal stability and strategic investments. DAO treasuries leverage blockchain technology and smart contracts to enable transparent, automated financial management, while public sector reserves utilize government frameworks to safeguard economic stability and fund public initiatives. Their connection lies in their shared objective of managing assets to ensure long-term financial resilience and efficient resource allocation.

Key Terms

Centralization vs. Decentralization

Public sector reserves are managed centrally by government institutions, ensuring controlled distribution of funds and adherence to regulatory frameworks for economic stability. Decentralized autonomous organization (DAO) treasuries operate through blockchain technology, enabling transparent, community-driven financial governance without centralized authority. Explore the dynamics of centralized control versus decentralized financial autonomy to understand their impact on fiscal management.

Governance Mechanism

Public sector reserves are managed through hierarchical governance structures with regulatory oversight, ensuring accountability and compliance with public policies. Decentralized Autonomous Organization (DAO) treasuries employ blockchain-based smart contracts and community voting mechanisms to enable transparent, autonomous fund management without centralized control. Explore the intricacies of governance mechanisms to understand their impact on financial accountability and decision-making.

Asset Custody

Public sector reserves typically involve centralized asset custody managed by government entities, ensuring regulatory oversight and risk mitigation through established financial institutions. Decentralized Autonomous Organization (DAO) treasuries rely on blockchain technology for asset custody, emphasizing transparency, security, and decentralized control via multi-signature wallets or smart contracts. Explore how these contrasting custody mechanisms impact governance and asset security in evolving financial ecosystems.

Source and External Links

What are 'reserves' and 'balances' in local government? - Public sector reserves are funds held by councils or governments not allocated for short-term spending, used to manage finances as they cannot borrow to balance budgets, and include general, earmarked, ring-fenced, and unusable reserves depending on their intended purpose.

GFOA Recommends Governments Rethink Their Reserve ... - Public sector reserves refer to liquid resources like cash and investments outside the budget, intended for contingencies or emergencies, with policies often specifying minimum and maximum reserve levels based on financial risk management practices.

Guideline PSG 4 - Funds and reserves - Governmental funds and reserves reflect intentions to undertake future activities or comply with regulations, are disclosed in notes and schedules of financial reports, and their creation or use does not impact revenue or expense recognition.

dowidth.com

dowidth.com