Greenium refers to the premium investors pay for green bonds compared to conventional bonds, reflecting higher demand for environmentally friendly investments. Climate bonds are debt securities specifically issued to fund projects with positive climate benefits, often certified to ensure environmental impact. Explore the nuances between greenium and climate bonds to better understand sustainable finance dynamics.

Why it is important

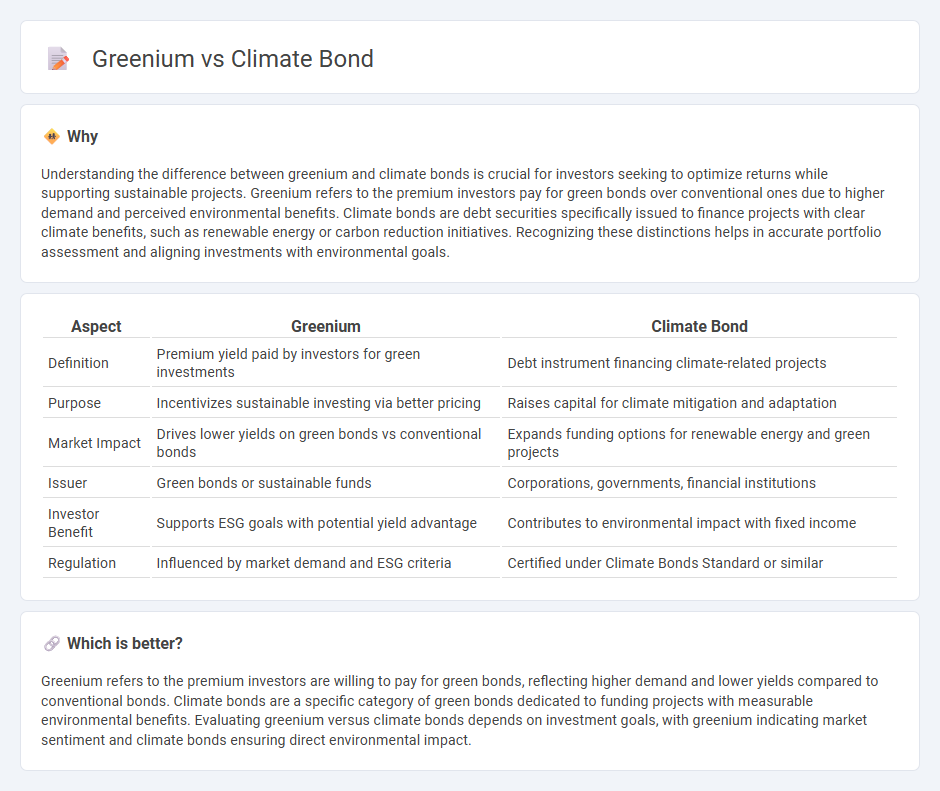

Understanding the difference between greenium and climate bonds is crucial for investors seeking to optimize returns while supporting sustainable projects. Greenium refers to the premium investors pay for green bonds over conventional ones due to higher demand and perceived environmental benefits. Climate bonds are debt securities specifically issued to finance projects with clear climate benefits, such as renewable energy or carbon reduction initiatives. Recognizing these distinctions helps in accurate portfolio assessment and aligning investments with environmental goals.

Comparison Table

| Aspect | Greenium | Climate Bond |

|---|---|---|

| Definition | Premium yield paid by investors for green investments | Debt instrument financing climate-related projects |

| Purpose | Incentivizes sustainable investing via better pricing | Raises capital for climate mitigation and adaptation |

| Market Impact | Drives lower yields on green bonds vs conventional bonds | Expands funding options for renewable energy and green projects |

| Issuer | Green bonds or sustainable funds | Corporations, governments, financial institutions |

| Investor Benefit | Supports ESG goals with potential yield advantage | Contributes to environmental impact with fixed income |

| Regulation | Influenced by market demand and ESG criteria | Certified under Climate Bonds Standard or similar |

Which is better?

Greenium refers to the premium investors are willing to pay for green bonds, reflecting higher demand and lower yields compared to conventional bonds. Climate bonds are a specific category of green bonds dedicated to funding projects with measurable environmental benefits. Evaluating greenium versus climate bonds depends on investment goals, with greenium indicating market sentiment and climate bonds ensuring direct environmental impact.

Connection

Greenium refers to the premium investors are willing to pay for green bonds, reflecting heightened demand for sustainable assets, while climate bonds are fixed-income securities specifically designed to fund projects with positive environmental impacts. The existence of greenium in climate bonds demonstrates the market's growing preference for environmentally responsible investments, incentivizing issuers to focus on climate-related projects. This connection fosters increased capital flow toward renewable energy, energy efficiency, and other climate solutions, accelerating the transition to a low-carbon economy.

Key Terms

Climate Bond

Climate bonds are fixed-income securities issued to finance projects with clear environmental benefits, serving as a key instrument in sustainable finance markets. They often feature a lower yield compared to conventional bonds due to the "greenium," a premium investors accept for supporting climate-friendly initiatives. Discover how climate bonds drive the transition to a low-carbon economy and explore their impact on investment strategies.

Greenium

Greenium refers to the premium investors are willing to pay for green bonds compared to conventional bonds, reflecting growing demand for sustainable finance products. This pricing advantage arises from heightened investor preference for environmental projects and supports issuers in lowering borrowing costs. Explore how greenium impacts bond markets and accelerates green investments to understand its significance.

Yield Spread

Climate bonds often exhibit a greenium, which means their yield spreads are typically lower compared to conventional bonds due to increased investor demand for sustainable assets. This yield spread difference reflects the premium investors are willing to pay for environmentally friendly projects financed by climate bonds. Explore how yield spread dynamics between climate bonds and greenium impact investment strategies and portfolio diversification.

Source and External Links

Climate Bonds Initiative - The Climate Bonds Initiative is an international, investor-focused non-profit working to mobilize the $100 trillion bond market to finance climate change solutions and develop a large liquid green and climate bonds market worldwide.

Climate Bonds | Homepage - Climate Bonds is dedicated to mobilizing global capital for climate action by setting science-based standards for green bonds to ensure their alignment with climate goals, with the aligned sustainable debt market now exceeding USD 6 trillion.

Green bond - A green bond is a fixed-income financial instrument used specifically to fund projects with positive environmental benefits, including climate change mitigation, renewable energy, and pollution control.

dowidth.com

dowidth.com