Revenue-based financing offers businesses flexible capital repayment tied directly to their revenue streams, avoiding equity dilution and preserving ownership control. Equity financing involves selling company shares to investors, providing substantial capital influx while sharing future profits and decision-making authority. Explore how these funding methods impact your financial strategy and growth potential.

Why it is important

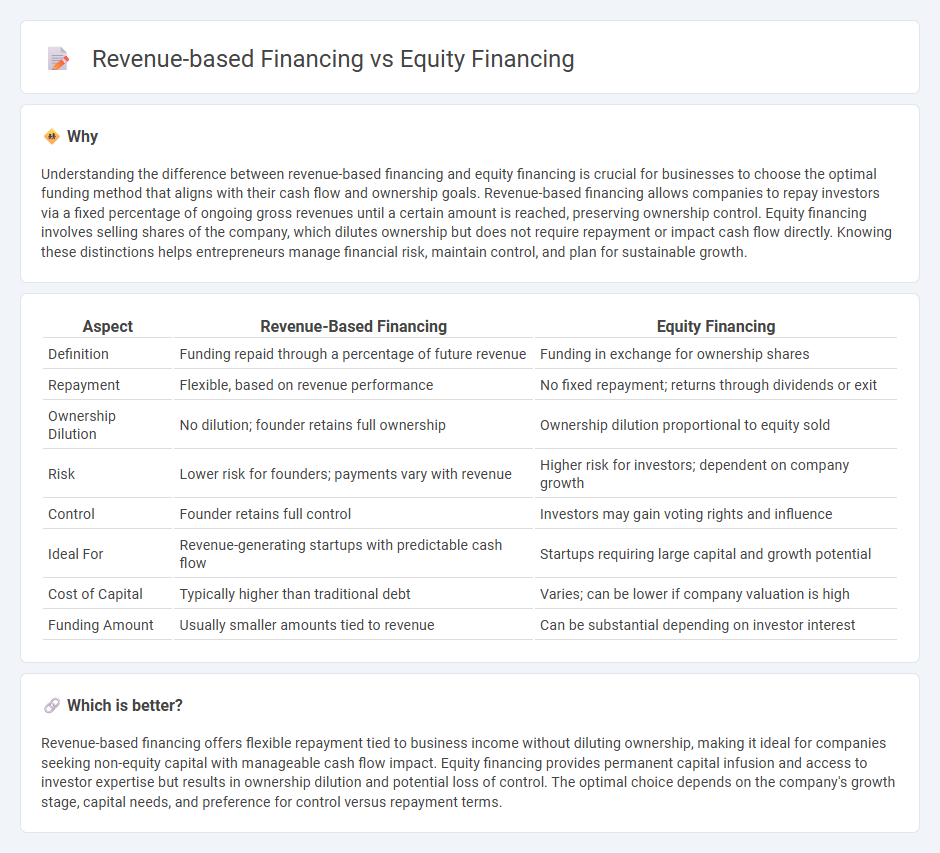

Understanding the difference between revenue-based financing and equity financing is crucial for businesses to choose the optimal funding method that aligns with their cash flow and ownership goals. Revenue-based financing allows companies to repay investors via a fixed percentage of ongoing gross revenues until a certain amount is reached, preserving ownership control. Equity financing involves selling shares of the company, which dilutes ownership but does not require repayment or impact cash flow directly. Knowing these distinctions helps entrepreneurs manage financial risk, maintain control, and plan for sustainable growth.

Comparison Table

| Aspect | Revenue-Based Financing | Equity Financing |

|---|---|---|

| Definition | Funding repaid through a percentage of future revenue | Funding in exchange for ownership shares |

| Repayment | Flexible, based on revenue performance | No fixed repayment; returns through dividends or exit |

| Ownership Dilution | No dilution; founder retains full ownership | Ownership dilution proportional to equity sold |

| Risk | Lower risk for founders; payments vary with revenue | Higher risk for investors; dependent on company growth |

| Control | Founder retains full control | Investors may gain voting rights and influence |

| Ideal For | Revenue-generating startups with predictable cash flow | Startups requiring large capital and growth potential |

| Cost of Capital | Typically higher than traditional debt | Varies; can be lower if company valuation is high |

| Funding Amount | Usually smaller amounts tied to revenue | Can be substantial depending on investor interest |

Which is better?

Revenue-based financing offers flexible repayment tied to business income without diluting ownership, making it ideal for companies seeking non-equity capital with manageable cash flow impact. Equity financing provides permanent capital infusion and access to investor expertise but results in ownership dilution and potential loss of control. The optimal choice depends on the company's growth stage, capital needs, and preference for control versus repayment terms.

Connection

Revenue-based financing and equity financing both serve as alternative funding methods for startups and growing businesses seeking capital without traditional debt. Revenue-based financing ties repayments directly to a percentage of future revenues, aligning investor returns with company performance, while equity financing involves selling ownership stakes to investors, sharing both risks and rewards. Both financing options influence company valuation, capital structure, and investor relations, making strategic selection crucial for long-term financial planning.

Key Terms

Ownership Dilution

Equity financing involves raising capital by selling ownership stakes, which results in ownership dilution as investors gain partial control over the company's decisions and profits. Revenue-based financing offers capital in exchange for a percentage of future revenues without diluting ownership, allowing founders to retain full control. Explore more about how these financing options impact ownership structure and business growth strategies.

Repayment Structure

Equity financing involves raising capital by selling shares of ownership in a company, with repayment occurring through dividends or eventual share buybacks tied to company performance. Revenue-based financing entails regular repayments as a fixed percentage of gross revenue until a predetermined amount is repaid, offering flexible payment schedules aligned with business income. Discover more about how each repayment structure impacts your funding strategy and business growth.

Capital Flexibility

Equity financing provides capital by selling ownership stakes, offering long-term financial support without immediate repayment but reducing control for founders. Revenue-based financing delivers funds in exchange for a fixed percentage of future revenue, maintaining ownership while aligning repayment with business performance. Discover how each method affects your capital flexibility and business growth potential.

Source and External Links

How equity financing works for startups - J.P. Morgan - Equity financing involves raising capital by selling ownership stakes in a company to investors, who become long-term partners sharing the company's success instead of receiving fixed repayments like in debt financing.

Equity Financing - Definition, How it Works, Pros, Cons - Equity financing is the sale of company shares to raise capital, typically used at the startup stage, with investors gaining ownership rights and potential returns through dividends or share price appreciation.

Advantages and Disadvantages of Equity Financing - Equity financing allows companies to raise funds without repayment obligations but requires giving up partial ownership and may involve consulting investors for decisions, often costing more than debt financing due to higher investor risk.

dowidth.com

dowidth.com