Tokenized treasury bills offer a digital alternative to traditional bank savings accounts, providing enhanced liquidity and transparency through blockchain technology. These digital assets represent government debt certificates that can be traded 24/7, often yielding higher returns compared to conventional savings accounts with fixed interest rates. Explore the benefits and risks associated with tokenized treasury bills versus bank savings accounts to make an informed financial decision.

Why it is important

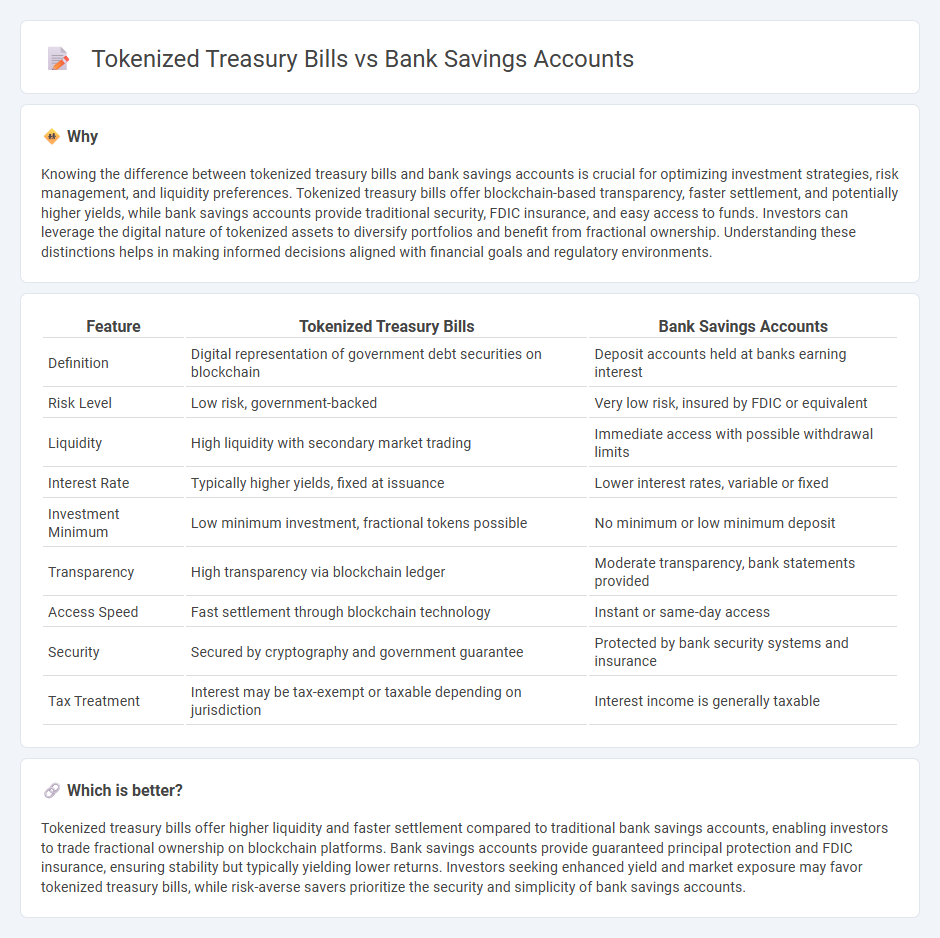

Knowing the difference between tokenized treasury bills and bank savings accounts is crucial for optimizing investment strategies, risk management, and liquidity preferences. Tokenized treasury bills offer blockchain-based transparency, faster settlement, and potentially higher yields, while bank savings accounts provide traditional security, FDIC insurance, and easy access to funds. Investors can leverage the digital nature of tokenized assets to diversify portfolios and benefit from fractional ownership. Understanding these distinctions helps in making informed decisions aligned with financial goals and regulatory environments.

Comparison Table

| Feature | Tokenized Treasury Bills | Bank Savings Accounts |

|---|---|---|

| Definition | Digital representation of government debt securities on blockchain | Deposit accounts held at banks earning interest |

| Risk Level | Low risk, government-backed | Very low risk, insured by FDIC or equivalent |

| Liquidity | High liquidity with secondary market trading | Immediate access with possible withdrawal limits |

| Interest Rate | Typically higher yields, fixed at issuance | Lower interest rates, variable or fixed |

| Investment Minimum | Low minimum investment, fractional tokens possible | No minimum or low minimum deposit |

| Transparency | High transparency via blockchain ledger | Moderate transparency, bank statements provided |

| Access Speed | Fast settlement through blockchain technology | Instant or same-day access |

| Security | Secured by cryptography and government guarantee | Protected by bank security systems and insurance |

| Tax Treatment | Interest may be tax-exempt or taxable depending on jurisdiction | Interest income is generally taxable |

Which is better?

Tokenized treasury bills offer higher liquidity and faster settlement compared to traditional bank savings accounts, enabling investors to trade fractional ownership on blockchain platforms. Bank savings accounts provide guaranteed principal protection and FDIC insurance, ensuring stability but typically yielding lower returns. Investors seeking enhanced yield and market exposure may favor tokenized treasury bills, while risk-averse savers prioritize the security and simplicity of bank savings accounts.

Connection

Tokenized treasury bills are digital representations of traditional government securities, enabling fractional ownership and increased liquidity through blockchain technology. Bank savings accounts typically serve as a secure place for holding cash, which can be used to purchase tokenized treasury bills, integrating traditional banking with digital asset investment. This connection enhances accessibility to government debt instruments while maintaining the stability and security linked to conventional banking systems.

Key Terms

Liquidity

Bank savings accounts offer high liquidity with immediate access to funds and minimal transaction restrictions, making them ideal for everyday financial needs. Tokenized treasury bills provide liquidity through blockchain technology, enabling faster settlement and secondary market trading but may have variable access times depending on platform regulations. Explore how liquidity compares in these options to optimize your investment strategy.

Yield

Bank savings accounts typically offer annual interest rates between 0.01% and 1.5%, reflecting low-risk liquidity with minimal returns. Tokenized treasury bills, often yielding around 2% to 4% annually, provide higher returns by representing fractional ownership of government debt with enhanced transparency and faster settlement through blockchain technology. Discover more about maximizing your investments by exploring the comparative yields of these financial instruments.

Custody

Bank savings accounts offer custodial services where institutions safeguard customer deposits, providing government-backed insurance up to a certain limit, ensuring liquidity and security. Tokenized treasury bills use blockchain technology to represent debt securities digitally, requiring secure digital wallets for custody, enabling faster settlement and reduced counterparty risks. Explore the evolving custody mechanisms for both to understand their impact on investment safety and accessibility.

Source and External Links

Savings Accounts - View our best rates | Open online - U.S. Bank offers various savings accounts including relationship savings, money market accounts, and CDs with interest rates up to 3.50% APY, requiring minimum deposits and monthly fees depending on the account type.

Open a Savings Account Online - Wells Fargo provides interest-bearing savings and CD accounts with features like automatic savings and requires applicants to be 18 or older with valid ID and U.S. address to open an account online or at branches.

Best High-Yield Savings Accounts Of July 2025 - Up to 4.44% - Bankrate lists high-yield savings accounts such as EverBank offering up to 4.30% APY with no minimum deposit, suitable for those wanting competitive interest without minimum balance requirements.

dowidth.com

dowidth.com