Decentralized over-the-counter (OTC) trading facilitates direct transactions between parties without relying on centralized exchanges, enhancing privacy and customizability. Auction markets, in contrast, centralize buyers and sellers, matching orders through competitive bidding to determine asset prices transparently and efficiently. Explore these distinct market structures to understand their impact on trading strategies and market liquidity.

Why it is important

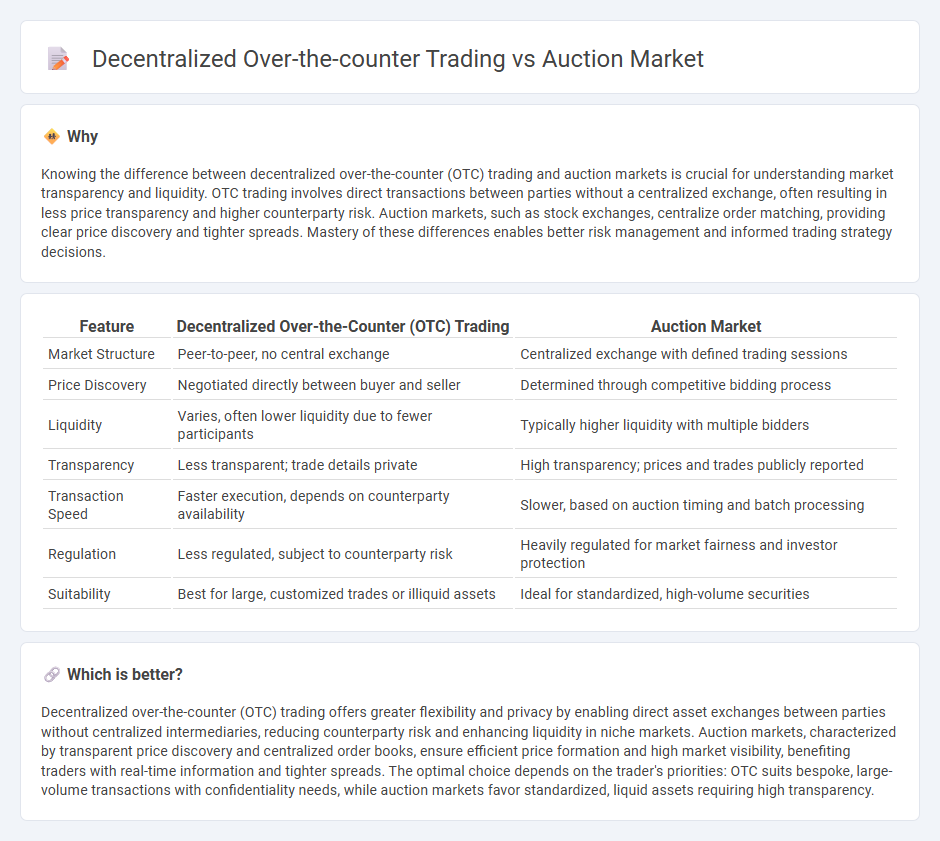

Knowing the difference between decentralized over-the-counter (OTC) trading and auction markets is crucial for understanding market transparency and liquidity. OTC trading involves direct transactions between parties without a centralized exchange, often resulting in less price transparency and higher counterparty risk. Auction markets, such as stock exchanges, centralize order matching, providing clear price discovery and tighter spreads. Mastery of these differences enables better risk management and informed trading strategy decisions.

Comparison Table

| Feature | Decentralized Over-the-Counter (OTC) Trading | Auction Market |

|---|---|---|

| Market Structure | Peer-to-peer, no central exchange | Centralized exchange with defined trading sessions |

| Price Discovery | Negotiated directly between buyer and seller | Determined through competitive bidding process |

| Liquidity | Varies, often lower liquidity due to fewer participants | Typically higher liquidity with multiple bidders |

| Transparency | Less transparent; trade details private | High transparency; prices and trades publicly reported |

| Transaction Speed | Faster execution, depends on counterparty availability | Slower, based on auction timing and batch processing |

| Regulation | Less regulated, subject to counterparty risk | Heavily regulated for market fairness and investor protection |

| Suitability | Best for large, customized trades or illiquid assets | Ideal for standardized, high-volume securities |

Which is better?

Decentralized over-the-counter (OTC) trading offers greater flexibility and privacy by enabling direct asset exchanges between parties without centralized intermediaries, reducing counterparty risk and enhancing liquidity in niche markets. Auction markets, characterized by transparent price discovery and centralized order books, ensure efficient price formation and high market visibility, benefiting traders with real-time information and tighter spreads. The optimal choice depends on the trader's priorities: OTC suits bespoke, large-volume transactions with confidentiality needs, while auction markets favor standardized, liquid assets requiring high transparency.

Connection

Decentralized over-the-counter (OTC) trading and auction markets are connected through their roles in providing liquidity and price discovery outside traditional centralized exchanges. OTC trading facilitates direct, peer-to-peer transactions, enhancing market accessibility and flexibility, while auction markets aggregate bids and offers to establish efficient pricing in a transparent manner. Both mechanisms complement each other by enabling diverse trading strategies and optimizing capital allocation in financial markets.

Key Terms

Centralized Exchange

Centralized exchanges (CEX) differ significantly from decentralized over-the-counter (OTC) trading by offering structured auction markets with higher liquidity and price discovery efficiency. CEX platforms facilitate real-time matching of buy and sell orders within an order book, ensuring transparency and regulatory compliance, whereas decentralized OTC trades occur directly between parties without a central intermediary, often leading to less price visibility. Explore how these dynamics influence trading strategies and market access on centralized exchanges.

Order Book

The auction market utilizes a centralized order book where buy and sell orders are matched at predetermined intervals, enhancing price discovery and liquidity aggregation. Decentralized over-the-counter (OTC) trading operates without a centralized order book, relying on peer-to-peer negotiation and direct matching, which increases privacy but may reduce transparency and immediate liquidity. Explore the intricacies of order book functionalities and their impact on market efficiency for deeper insight.

Counterparty Risk

Auction markets reduce counterparty risk by centralizing transactions through a clearinghouse that guarantees trade settlement, minimizing the chances of default. Decentralized over-the-counter (OTC) trading increases counterparty risk as trades occur directly between parties without a clearing intermediary, exposing participants to potential credit risk. Explore detailed comparisons and risk mitigation strategies for auction markets and decentralized OTC trading.

Source and External Links

Auction markets: What is it, types, Importance, Example, FAQ | POEMS - An auction market is where buyers and sellers compete by entering bids and offers to trade assets, with prices determined by these bids rather than set in advance, ensuring transparency and efficient price discovery for financial instruments like stocks and bonds.

Auction markets - Ch2sec5 - Auction markets often have a physical location such as the New York Stock Exchange where buyers and sellers transact shares through an organized bidding process, making it distinct from dealer markets.

What is Auction Market? Definition of Auction ... - The Economic Times - An auction market is characterized by buyers and sellers entering competitive bids and offers simultaneously, with transactions executed at prices where bid and offer prices meet, reflecting real-time market value.

dowidth.com

dowidth.com