Finfluencers leverage social media platforms to provide accessible financial advice, focusing on trends like investing, budgeting, and wealth-building strategies for various audiences. Retirement planners specialize in creating personalized, long-term strategies to ensure clients achieve financial security and comfortable living in their retirement years. Explore the distinct benefits and choose the approach that best suits your financial goals.

Why it is important

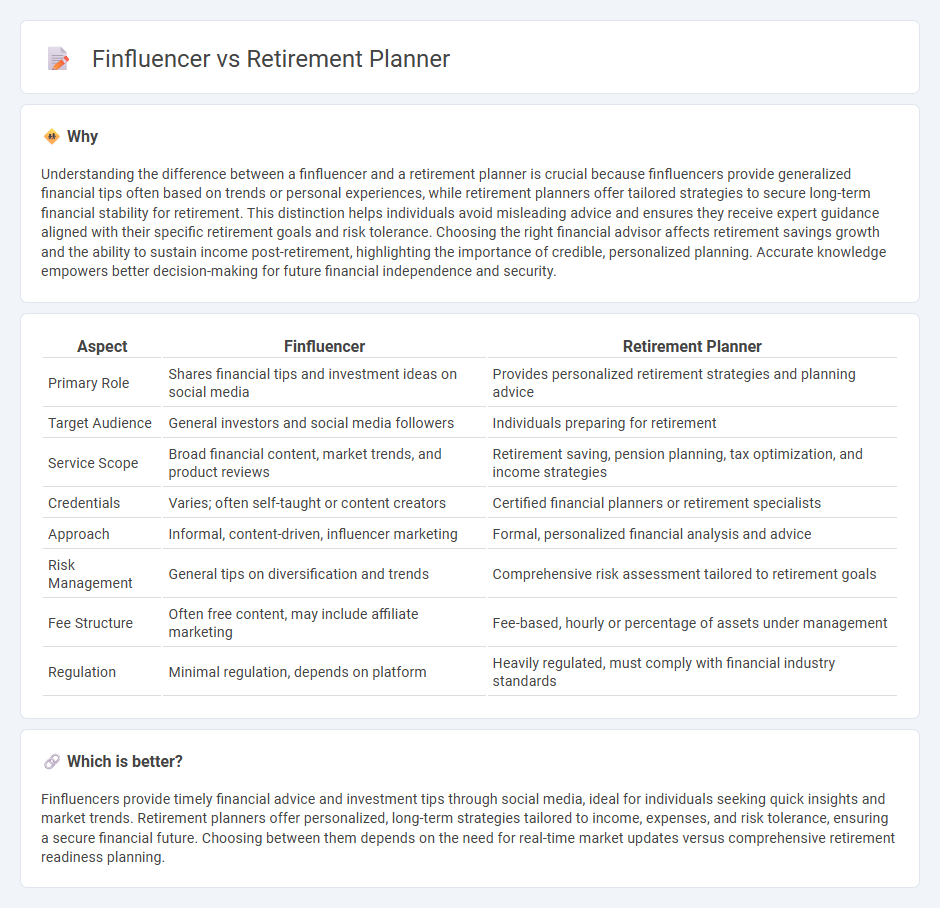

Understanding the difference between a finfluencer and a retirement planner is crucial because finfluencers provide generalized financial tips often based on trends or personal experiences, while retirement planners offer tailored strategies to secure long-term financial stability for retirement. This distinction helps individuals avoid misleading advice and ensures they receive expert guidance aligned with their specific retirement goals and risk tolerance. Choosing the right financial advisor affects retirement savings growth and the ability to sustain income post-retirement, highlighting the importance of credible, personalized planning. Accurate knowledge empowers better decision-making for future financial independence and security.

Comparison Table

| Aspect | Finfluencer | Retirement Planner |

|---|---|---|

| Primary Role | Shares financial tips and investment ideas on social media | Provides personalized retirement strategies and planning advice |

| Target Audience | General investors and social media followers | Individuals preparing for retirement |

| Service Scope | Broad financial content, market trends, and product reviews | Retirement saving, pension planning, tax optimization, and income strategies |

| Credentials | Varies; often self-taught or content creators | Certified financial planners or retirement specialists |

| Approach | Informal, content-driven, influencer marketing | Formal, personalized financial analysis and advice |

| Risk Management | General tips on diversification and trends | Comprehensive risk assessment tailored to retirement goals |

| Fee Structure | Often free content, may include affiliate marketing | Fee-based, hourly or percentage of assets under management |

| Regulation | Minimal regulation, depends on platform | Heavily regulated, must comply with financial industry standards |

Which is better?

Finfluencers provide timely financial advice and investment tips through social media, ideal for individuals seeking quick insights and market trends. Retirement planners offer personalized, long-term strategies tailored to income, expenses, and risk tolerance, ensuring a secure financial future. Choosing between them depends on the need for real-time market updates versus comprehensive retirement readiness planning.

Connection

Finfluencers leverage social media platforms to educate audiences on retirement planning strategies, promoting financial literacy and investment options tailored for long-term wealth accumulation. Retirement planners often collaborate with finfluencers to reach a broader demographic, integrating personalized retirement solutions with accessible digital content. This synergy enhances informed decision-making, encouraging disciplined saving and diversified portfolios essential for a secure retirement.

Key Terms

**Retirement Planner:**

Retirement planners specialize in creating personalized financial strategies to help individuals achieve a secure and comfortable retirement by assessing income sources, budgeting needs, and investment options. They provide expert advice on Social Security, pensions, tax implications, and estate planning, ensuring clients maximize their retirement savings and minimize risks. Discover how a professional retirement planner can tailor solutions specifically for your long-term financial freedom by exploring detailed comparisons with finfluencers.

Pension

Retirement planners specialize in personalized strategies to maximize pension benefits through tailored savings plans and risk management, ensuring long-term financial security. Finfluencers provide accessible, general advice on pension options and trends via social media, often emphasizing emerging investment opportunities and government pension incentives. Explore how expert retirement planners and finfluencers differ in enhancing your pension strategy.

Annuity

Retirement planners offer personalized strategies to maximize annuity benefits, ensuring stable income throughout retirement by assessing individual financial goals and risk tolerance. Finfluencers provide accessible, real-time insights on annuity products, market trends, and investment options through social media platforms, making complex financial information easier to understand. Explore detailed comparisons to determine which approach best aligns with your retirement income needs and financial literacy preferences.

Source and External Links

Retirement planning tools | USAGov - Offers interactive worksheets and calculators to help you manage finances, plan Social Security benefits, and estimate retirement living costs, with personalized government benefit finders and resources for federal employees.

Retirement Planner - Empower - Provides a comprehensive retirement planning tool where you can input events and financial data to model your retirement lifestyle, income needs, and savings strategy, with access to financial professionals for personalized advice.

Retirement Calculator - NerdWallet - A calculator that estimates your retirement savings longevity by inputting your income, current savings, monthly contributions, and expected retirement budget to help plan for both accumulation and withdrawal phases.

dowidth.com

dowidth.com