Sovereign debt restructuring involves renegotiating terms on existing national debt to ensure repayment sustainability and avoid default, often including debt relief, maturity extensions, or interest rate adjustments. Liability management focuses on optimizing a country's debt profile through strategies like debt buybacks, swaps, or refinancing to reduce costs and improve fiscal stability. Discover more about how these financial strategies impact global economic resilience and sovereign creditworthiness.

Why it is important

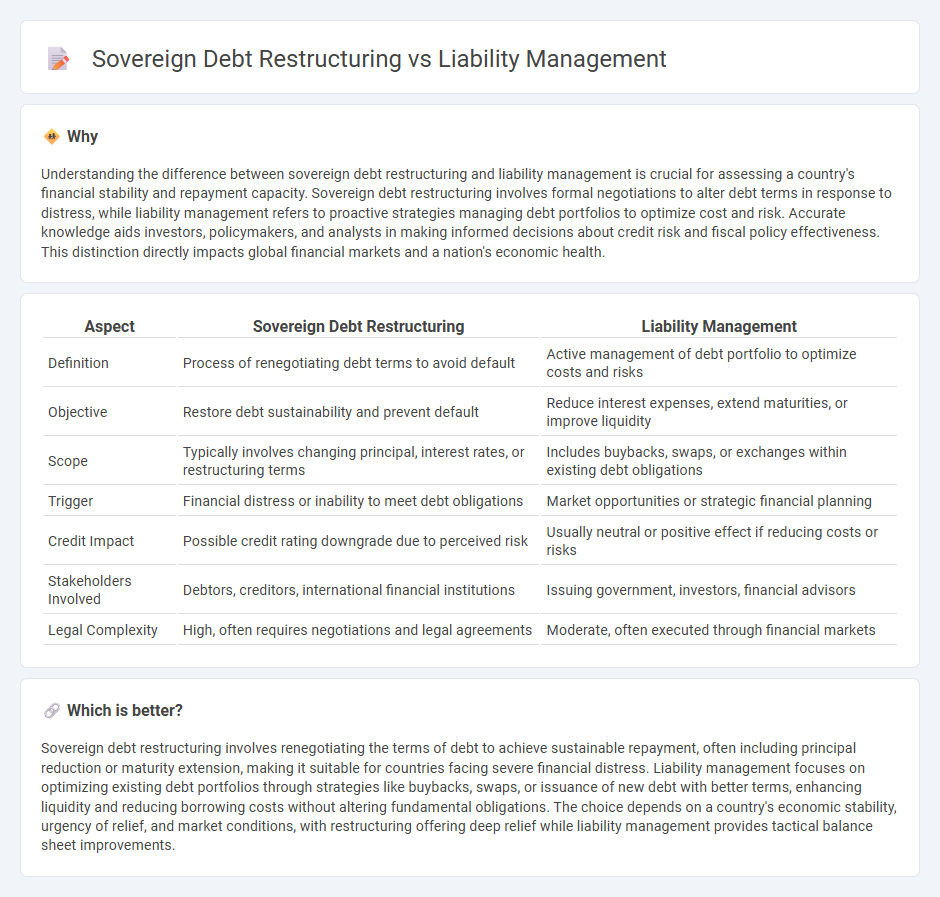

Understanding the difference between sovereign debt restructuring and liability management is crucial for assessing a country's financial stability and repayment capacity. Sovereign debt restructuring involves formal negotiations to alter debt terms in response to distress, while liability management refers to proactive strategies managing debt portfolios to optimize cost and risk. Accurate knowledge aids investors, policymakers, and analysts in making informed decisions about credit risk and fiscal policy effectiveness. This distinction directly impacts global financial markets and a nation's economic health.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Liability Management |

|---|---|---|

| Definition | Process of renegotiating debt terms to avoid default | Active management of debt portfolio to optimize costs and risks |

| Objective | Restore debt sustainability and prevent default | Reduce interest expenses, extend maturities, or improve liquidity |

| Scope | Typically involves changing principal, interest rates, or restructuring terms | Includes buybacks, swaps, or exchanges within existing debt obligations |

| Trigger | Financial distress or inability to meet debt obligations | Market opportunities or strategic financial planning |

| Credit Impact | Possible credit rating downgrade due to perceived risk | Usually neutral or positive effect if reducing costs or risks |

| Stakeholders Involved | Debtors, creditors, international financial institutions | Issuing government, investors, financial advisors |

| Legal Complexity | High, often requires negotiations and legal agreements | Moderate, often executed through financial markets |

Which is better?

Sovereign debt restructuring involves renegotiating the terms of debt to achieve sustainable repayment, often including principal reduction or maturity extension, making it suitable for countries facing severe financial distress. Liability management focuses on optimizing existing debt portfolios through strategies like buybacks, swaps, or issuance of new debt with better terms, enhancing liquidity and reducing borrowing costs without altering fundamental obligations. The choice depends on a country's economic stability, urgency of relief, and market conditions, with restructuring offering deep relief while liability management provides tactical balance sheet improvements.

Connection

Sovereign debt restructuring involves renegotiating a country's debt terms to enhance repayment sustainability, while liability management includes strategic operations such as debt buybacks, swaps, or rescheduling to optimize debt profiles. Both practices aim to improve a nation's fiscal stability by reducing debt burdens and managing cash flow effectively. Their interconnected role ensures sovereign entities maintain creditworthiness and access to international capital markets.

Key Terms

**Liability Management:**

Liability management involves strategic actions by governments or corporations to optimize their debt portfolio, including debt buybacks, exchanges, or refinancing to reduce costs and extend maturities. Unlike sovereign debt restructuring, which often occurs during financial distress to negotiate terms with creditors, liability management proactively enhances debt sustainability while minimizing disruptions to credit ratings. Explore more about how liability management strengthens fiscal stability and mitigates repayment risks.

Debt Refinancing

Liability management involves strategies such as debt buybacks and swaps to optimize a country's debt profile and reduce interest expenses, while sovereign debt restructuring typically entails renegotiating terms with creditors to avoid default. Debt refinancing, a key component of liability management, enhances liquidity by replacing existing debt with new obligations under more favorable terms, improving sovereign credit metrics. Explore further to understand how these approaches impact fiscal sustainability and international financial stability.

Interest Rate Risk

Liability management strategies actively address interest rate risk by refinancing or modifying existing debt to reduce exposure and optimize borrowing costs. Sovereign debt restructuring involves renegotiating terms under financial distress but may increase uncertainty related to interest rate fluctuations. Explore in-depth how these approaches differently impact interest rate risk and sovereign financial stability.

Source and External Links

What is Liability Management? - Vintti - Liability management refers to strategies and techniques financial institutions use to optimize their balance sheets by managing obligations to align with strategic goals, focusing on minimizing interest rate risk, maintaining liquidity, optimizing capital structure, and adhering to regulations.

Liability Management | Services & Industries - Ropes & Gray LLP - Liability management transactions (LMTs) involve complex, innovative balance sheet optimization methods such as maturity extension, discount captures, and unique loan structures used by companies to improve debt profiles and liquidity efficiently.

Liability Management - Clifford Chance - Liability management encompasses a variety of procedures like bond buybacks, consent solicitations, and exchange offers, requiring careful legal and regulatory analysis to ensure compliance with bond terms and applicable laws in the issuer's jurisdiction.

dowidth.com

dowidth.com