Flash loan attacks exploit instant, uncollateralized loans to manipulate DeFi protocols, often causing rapid price fluctuations and protocol vulnerabilities. Liquidity pool draining involves malicious actors removing significant funds from decentralized pools, leading to severe liquidity shortages and financial losses for participants. Discover how these threats impact decentralized finance security and strategies to safeguard assets.

Why it is important

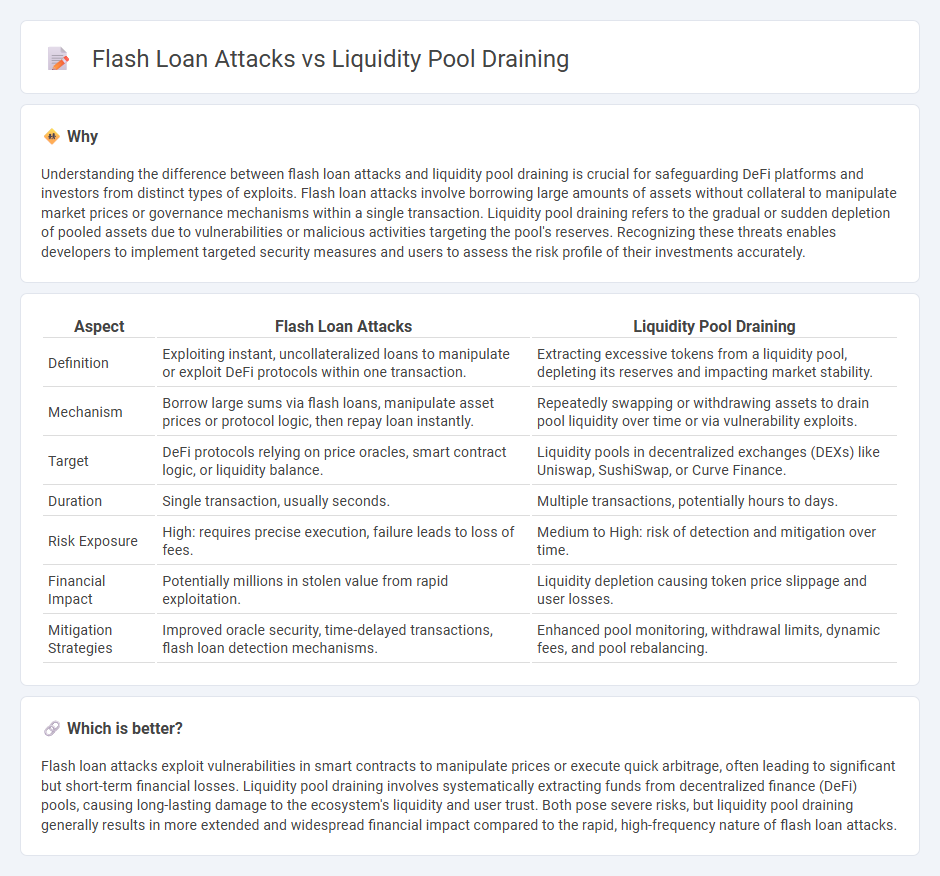

Understanding the difference between flash loan attacks and liquidity pool draining is crucial for safeguarding DeFi platforms and investors from distinct types of exploits. Flash loan attacks involve borrowing large amounts of assets without collateral to manipulate market prices or governance mechanisms within a single transaction. Liquidity pool draining refers to the gradual or sudden depletion of pooled assets due to vulnerabilities or malicious activities targeting the pool's reserves. Recognizing these threats enables developers to implement targeted security measures and users to assess the risk profile of their investments accurately.

Comparison Table

| Aspect | Flash Loan Attacks | Liquidity Pool Draining |

|---|---|---|

| Definition | Exploiting instant, uncollateralized loans to manipulate or exploit DeFi protocols within one transaction. | Extracting excessive tokens from a liquidity pool, depleting its reserves and impacting market stability. |

| Mechanism | Borrow large sums via flash loans, manipulate asset prices or protocol logic, then repay loan instantly. | Repeatedly swapping or withdrawing assets to drain pool liquidity over time or via vulnerability exploits. |

| Target | DeFi protocols relying on price oracles, smart contract logic, or liquidity balance. | Liquidity pools in decentralized exchanges (DEXs) like Uniswap, SushiSwap, or Curve Finance. |

| Duration | Single transaction, usually seconds. | Multiple transactions, potentially hours to days. |

| Risk Exposure | High: requires precise execution, failure leads to loss of fees. | Medium to High: risk of detection and mitigation over time. |

| Financial Impact | Potentially millions in stolen value from rapid exploitation. | Liquidity depletion causing token price slippage and user losses. |

| Mitigation Strategies | Improved oracle security, time-delayed transactions, flash loan detection mechanisms. | Enhanced pool monitoring, withdrawal limits, dynamic fees, and pool rebalancing. |

Which is better?

Flash loan attacks exploit vulnerabilities in smart contracts to manipulate prices or execute quick arbitrage, often leading to significant but short-term financial losses. Liquidity pool draining involves systematically extracting funds from decentralized finance (DeFi) pools, causing long-lasting damage to the ecosystem's liquidity and user trust. Both pose severe risks, but liquidity pool draining generally results in more extended and widespread financial impact compared to the rapid, high-frequency nature of flash loan attacks.

Connection

Flash loan attacks exploit vulnerabilities in DeFi protocols by borrowing large amounts of capital without collateral and manipulating market prices or governance mechanisms. These manipulations often target liquidity pools, draining their reserves through rapid, atomic transactions before the system can react. The connection lies in using flash loans to orchestrate swift, capital-intensive exploits that deplete liquidity pool funds and destabilize decentralized finance ecosystems.

Key Terms

Smart Contract Vulnerabilities

Smart contract vulnerabilities often serve as the root cause for both liquidity pool draining and flash loan attacks, exposing decentralized finance (DeFi) platforms to significant financial risks. Liquidity pool draining exploits improper access controls or logic errors within smart contracts to siphon funds, whereas flash loan attacks leverage large, uncollateralized loans to manipulate market conditions and exploit arbitrage or price oracle flaws. Explore detailed analyses of these exploits and effective mitigation strategies to enhance smart contract security.

Arbitrage Exploitation

Arbitrage exploitation in liquidity pool draining involves attackers manipulating price disparities across decentralized exchanges to extract disproportionate gains, often by exploiting imbalances in token reserves. Flash loan attacks leverage uncollateralized loans to perform rapid, large-scale arbitrage trades that can cause significant liquidity shifts, enabling attackers to drain pools before markets can adjust. Explore more about how these sophisticated exploits disrupt DeFi ecosystems and the strategies to mitigate associated risks.

Instant Borrowing

Liquidity pool draining involves malicious actors exploiting vulnerabilities to siphon assets from DeFi protocols, often by manipulating token prices or exploiting flawed smart contracts. Flash loan attacks leverage Instant Borrowing, allowing attackers to borrow large amounts without collateral within a single transaction, execute complex sequences to manipulate markets, and repay the loan before the transaction ends, leaving protocols financially harmed. Explore detailed case studies and mitigation strategies to better understand and protect against these sophisticated DeFi threats.

Source and External Links

Slow is Fast Dissecting Ethereum's Slow Liquidity Drain ... - Liquidity pool draining scams involve withdrawing liquidity and selling inflated tokens to extract profit, with scam pools often remaining active longer than typical rug pulls which drain liquidity quickly, sometimes losing over $103 million cumulatively in targeted pools.

Liquidity in Crypto: How to Use Liquidity Pools - Liquidity pool draining often happens through rug pulls, where malicious actors create pools with fraudulent tokens and then drain liquidity before disappearing, representing a major risk along with impermanent loss and smart contract vulnerabilities.

Predy Finance Attack - How a Liquidity Pool Can Be Drained - Specific attacks on liquidity pools can occur by exploiting contract vulnerabilities, as happened in the Predy Finance case where attackers transferred liquidity to new pairs and drained existing pools.

dowidth.com

dowidth.com