Tokenization transforms traditional assets into digital tokens on a blockchain, enabling enhanced liquidity and fractional ownership, while registered shares represent conventional equity recorded in a company's shareholder register, providing legal ownership with regulatory oversight. Tokenized assets offer increased accessibility and faster transactions compared to the more established but less flexible registered shares. Explore how these two methods revolutionize asset management and investment opportunities in the evolving financial landscape.

Why it is important

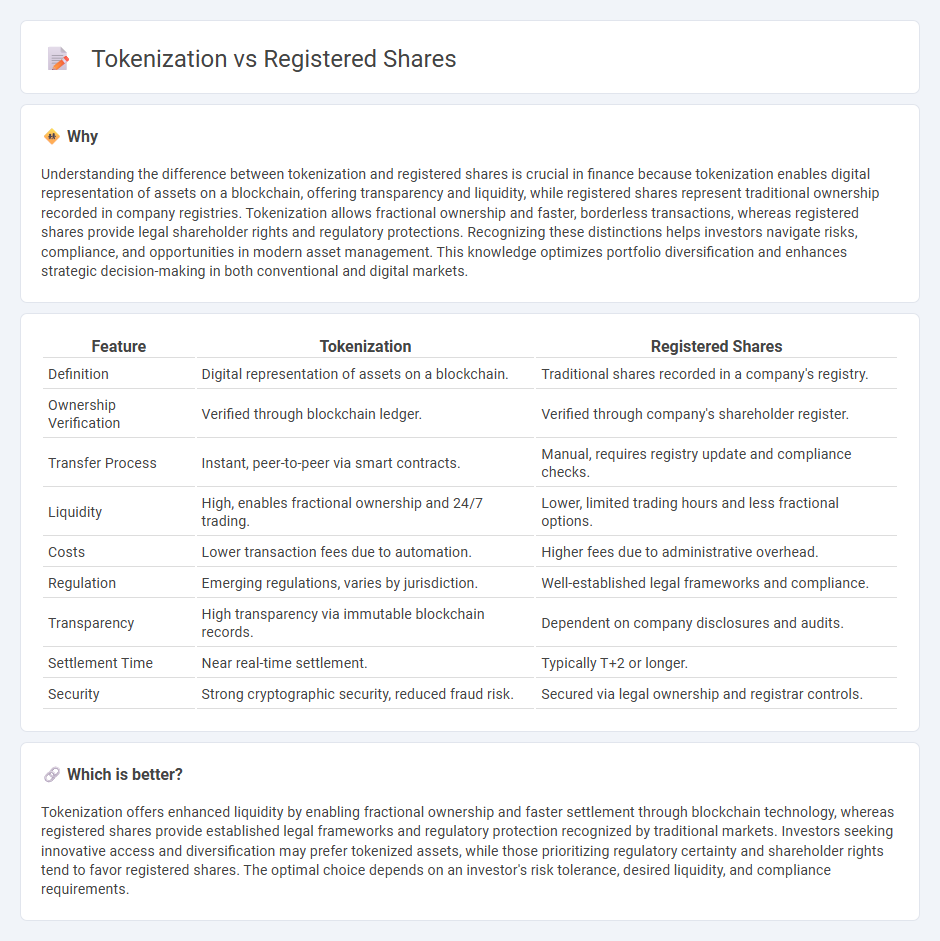

Understanding the difference between tokenization and registered shares is crucial in finance because tokenization enables digital representation of assets on a blockchain, offering transparency and liquidity, while registered shares represent traditional ownership recorded in company registries. Tokenization allows fractional ownership and faster, borderless transactions, whereas registered shares provide legal shareholder rights and regulatory protections. Recognizing these distinctions helps investors navigate risks, compliance, and opportunities in modern asset management. This knowledge optimizes portfolio diversification and enhances strategic decision-making in both conventional and digital markets.

Comparison Table

| Feature | Tokenization | Registered Shares |

|---|---|---|

| Definition | Digital representation of assets on a blockchain. | Traditional shares recorded in a company's registry. |

| Ownership Verification | Verified through blockchain ledger. | Verified through company's shareholder register. |

| Transfer Process | Instant, peer-to-peer via smart contracts. | Manual, requires registry update and compliance checks. |

| Liquidity | High, enables fractional ownership and 24/7 trading. | Lower, limited trading hours and less fractional options. |

| Costs | Lower transaction fees due to automation. | Higher fees due to administrative overhead. |

| Regulation | Emerging regulations, varies by jurisdiction. | Well-established legal frameworks and compliance. |

| Transparency | High transparency via immutable blockchain records. | Dependent on company disclosures and audits. |

| Settlement Time | Near real-time settlement. | Typically T+2 or longer. |

| Security | Strong cryptographic security, reduced fraud risk. | Secured via legal ownership and registrar controls. |

Which is better?

Tokenization offers enhanced liquidity by enabling fractional ownership and faster settlement through blockchain technology, whereas registered shares provide established legal frameworks and regulatory protection recognized by traditional markets. Investors seeking innovative access and diversification may prefer tokenized assets, while those prioritizing regulatory certainty and shareholder rights tend to favor registered shares. The optimal choice depends on an investor's risk tolerance, desired liquidity, and compliance requirements.

Connection

Tokenization transforms traditional registered shares into digital assets on blockchain platforms, enhancing liquidity and enabling fractional ownership. Registered shares maintain clear ownership records essential for compliance and corporate governance, which tokenization preserves through immutable ledger technology. This connection fosters more efficient trading, transparency, and broader market access within the financial ecosystem.

Key Terms

Ownership Structure

Registered shares provide straightforward ownership with the shareholder's identity recorded in the company's register, ensuring legal clarity and voting rights. Tokenization transforms ownership into digital tokens on a blockchain, enabling fractional ownership, enhanced liquidity, and programmable rights while maintaining transparency and security. Explore how tokenization is revolutionizing ownership structure and investor accessibility.

Transferability

Registered shares are traditional equity instruments recorded in a company's register, requiring formal procedures and regulatory compliance for transfer, which can limit liquidity and speed. Tokenization leverages blockchain technology to digitize shares, enabling instant, peer-to-peer transfers while maintaining transparency and security. Explore how tokenization transforms transferability and unlocks new opportunities for shareholders.

Transparency

Registered shares provide transparency through official shareholder registries maintained by companies, ensuring clear ownership records and regulatory compliance. Tokenization enhances transparency by recording share ownership on immutable blockchain ledgers, enabling real-time tracking and reducing risks of fraud. Explore how these transparency mechanisms transform shareholder engagement and corporate governance.

Source and External Links

What is a registered share? | SumUp Invoices - A registered share is a share issued in the owner's name, and ownership must be registered when the share is sold, allowing the company to track its shareholders and granting registered shareholders voting rights and dividend payments directly from the company.

Capital Markets Glossary | Registered Shares - Registered shares are stocks registered in the exact owner's name, requiring new owners to register upon sale, which enables issuers to always know their shareholders and subjects them to ongoing reporting requirements under securities laws.

Becoming a registered shareholder in US-listed companies ... - Registered shareholders hold shares directly in their name on the company register with legal recognition, direct receipt of dividends and voting rights, while beneficial shareholders hold shares through intermediaries with limited issuer visibility.

dowidth.com

dowidth.com