Zero day options are financial derivatives that expire on the same day they are traded, offering traders the chance for rapid gains or losses within a very short timeframe. Covered warrants, issued by financial institutions, give investors the right to buy or sell an underlying asset at a predetermined price before expiration, typically with longer durations and less immediate time decay compared to zero day options. Explore the distinctive features and strategic uses of zero day options versus covered warrants to enhance your investment decisions.

Why it is important

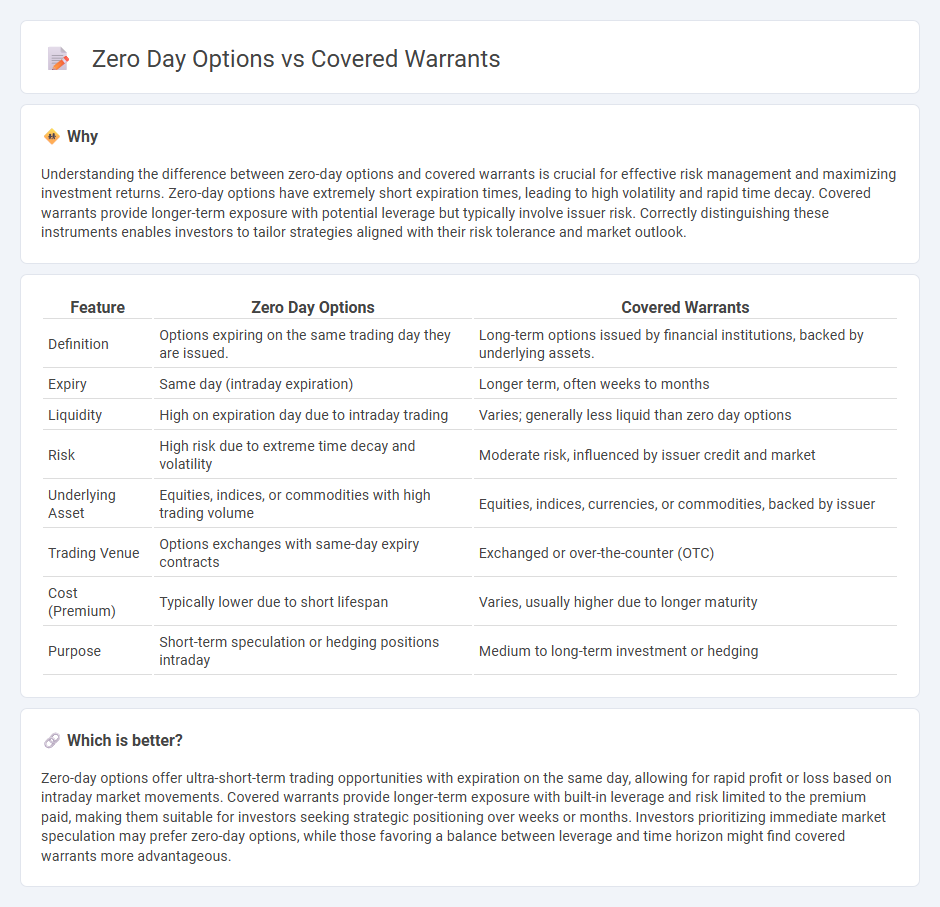

Understanding the difference between zero-day options and covered warrants is crucial for effective risk management and maximizing investment returns. Zero-day options have extremely short expiration times, leading to high volatility and rapid time decay. Covered warrants provide longer-term exposure with potential leverage but typically involve issuer risk. Correctly distinguishing these instruments enables investors to tailor strategies aligned with their risk tolerance and market outlook.

Comparison Table

| Feature | Zero Day Options | Covered Warrants |

|---|---|---|

| Definition | Options expiring on the same trading day they are issued. | Long-term options issued by financial institutions, backed by underlying assets. |

| Expiry | Same day (intraday expiration) | Longer term, often weeks to months |

| Liquidity | High on expiration day due to intraday trading | Varies; generally less liquid than zero day options |

| Risk | High risk due to extreme time decay and volatility | Moderate risk, influenced by issuer credit and market |

| Underlying Asset | Equities, indices, or commodities with high trading volume | Equities, indices, currencies, or commodities, backed by issuer |

| Trading Venue | Options exchanges with same-day expiry contracts | Exchanged or over-the-counter (OTC) |

| Cost (Premium) | Typically lower due to short lifespan | Varies, usually higher due to longer maturity |

| Purpose | Short-term speculation or hedging positions intraday | Medium to long-term investment or hedging |

Which is better?

Zero-day options offer ultra-short-term trading opportunities with expiration on the same day, allowing for rapid profit or loss based on intraday market movements. Covered warrants provide longer-term exposure with built-in leverage and risk limited to the premium paid, making them suitable for investors seeking strategic positioning over weeks or months. Investors prioritizing immediate market speculation may prefer zero-day options, while those favoring a balance between leverage and time horizon might find covered warrants more advantageous.

Connection

Zero day options and covered warrants both serve as derivative instruments offering opportunities for speculation and hedging in financial markets, with zero day options expiring on the same trading day, thus providing high leverage and quick exposure to price movements. Covered warrants are issued by financial institutions and grant the right, but not the obligation, to buy or sell an underlying asset at a fixed price before expiry, often spanning longer durations than zero day options. Both instruments attract traders seeking leveraged exposure to equities, indices, or other assets, enabling strategic portfolio management with varying liquidity and risk profiles.

Key Terms

Leverage

Covered warrants provide investors with leveraged exposure to an underlying asset, allowing for significant gains with a relatively small capital outlay, while limiting risk to the premium paid. Zero day options offer extremely high leverage but come with increased risk due to their ultra-short expiry, amplifying potential gains and losses within a single trading day. Explore the nuances of leverage, risk profiles, and trading strategies for both instruments to enhance your investment approach.

Expiry

Covered warrants and zero-day options significantly differ in expiry characteristics, with covered warrants typically having longer durations ranging from several months to years, while zero-day options expire on the same trading day they are issued. This variance impacts trading strategies, as covered warrants allow for extended speculation or hedging, whereas zero-day options cater to high-risk, short-term trades exploiting immediate market movements. Explore how expiry timelines influence risk management and profit potential in both instruments to make informed investment decisions.

Underlying asset

Covered warrants are issued by financial institutions and provide investors with the right to buy or sell a specified underlying asset, such as stocks or indices, at a predetermined price before expiration. Zero day options refer to options contracts with the same expiration date as the trading day, offering extremely short-term exposure to underlying assets, commonly used in high-frequency trading of equities and ETFs. Explore further to understand how the stability of underlying assets influences risk and strategy in covered warrants versus zero day options.

Source and External Links

Definition for : Covered warrant - Glossary - Vernimmen - Covered warrants are warrants on existing securities issued independently of the company that issued the underlying shares and are "covered" because the issuer hedges exposure by buying the underlying securities in the market.

Covered Warrant - Definition, Types, How It Works, Example - Upstox - Covered warrants give the holder the right, but not the obligation, to buy or sell an underlying asset before or at a predetermined date, are issued by financial institutions who cover their risk by purchasing the underlying asset, and differ from options in maturity, flexibility, and the absence of margin calls.

Covered warrants - an introduction | London Stock Exchange - Covered warrants are financial securities issued by institutions that grant rights to buy or sell an underlying asset at a set price by a set date, typically have longer maturities than options, are traded on exchanges, and limit loss to the initial investment since there are no margin calls.

dowidth.com

dowidth.com