Insurtech leverages innovative technologies to transform insurance processes, enhancing customer experience, risk assessment, and claims management. Regtech focuses on streamlining regulatory compliance through automation, advanced data analytics, and real-time monitoring to reduce risk and ensure adherence to financial laws. Explore how insurtech and regtech are redefining the financial industry's future.

Why it is important

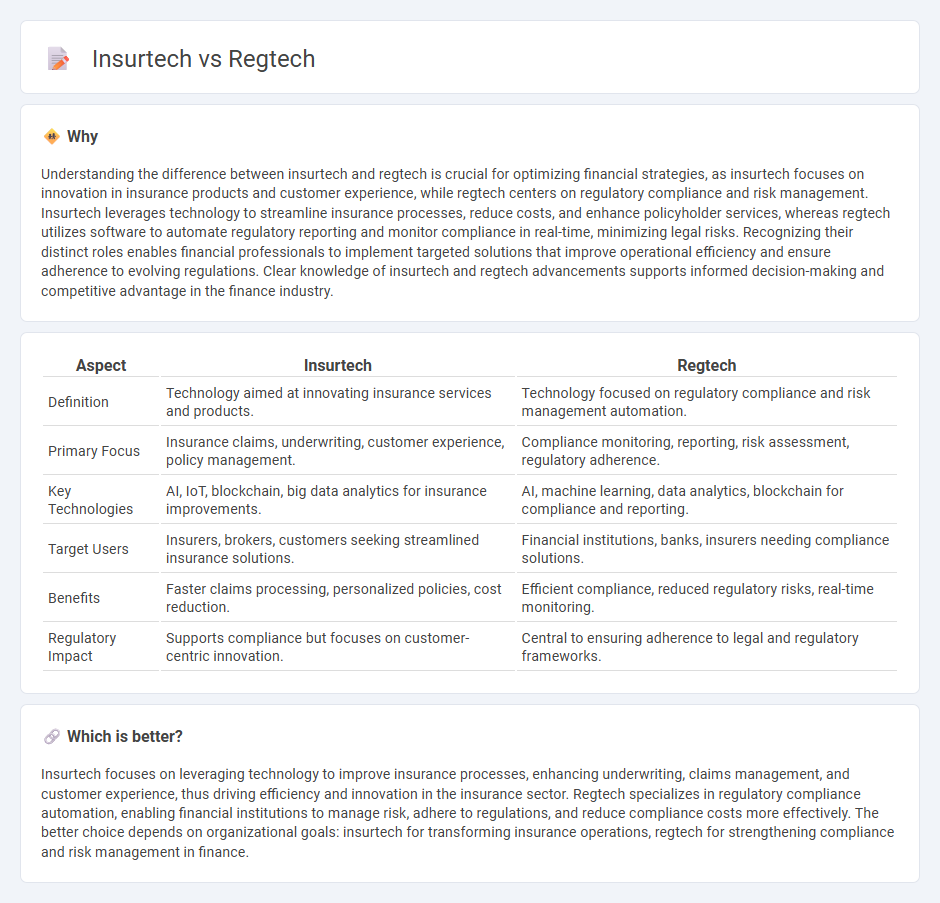

Understanding the difference between insurtech and regtech is crucial for optimizing financial strategies, as insurtech focuses on innovation in insurance products and customer experience, while regtech centers on regulatory compliance and risk management. Insurtech leverages technology to streamline insurance processes, reduce costs, and enhance policyholder services, whereas regtech utilizes software to automate regulatory reporting and monitor compliance in real-time, minimizing legal risks. Recognizing their distinct roles enables financial professionals to implement targeted solutions that improve operational efficiency and ensure adherence to evolving regulations. Clear knowledge of insurtech and regtech advancements supports informed decision-making and competitive advantage in the finance industry.

Comparison Table

| Aspect | Insurtech | Regtech |

|---|---|---|

| Definition | Technology aimed at innovating insurance services and products. | Technology focused on regulatory compliance and risk management automation. |

| Primary Focus | Insurance claims, underwriting, customer experience, policy management. | Compliance monitoring, reporting, risk assessment, regulatory adherence. |

| Key Technologies | AI, IoT, blockchain, big data analytics for insurance improvements. | AI, machine learning, data analytics, blockchain for compliance and reporting. |

| Target Users | Insurers, brokers, customers seeking streamlined insurance solutions. | Financial institutions, banks, insurers needing compliance solutions. |

| Benefits | Faster claims processing, personalized policies, cost reduction. | Efficient compliance, reduced regulatory risks, real-time monitoring. |

| Regulatory Impact | Supports compliance but focuses on customer-centric innovation. | Central to ensuring adherence to legal and regulatory frameworks. |

Which is better?

Insurtech focuses on leveraging technology to improve insurance processes, enhancing underwriting, claims management, and customer experience, thus driving efficiency and innovation in the insurance sector. Regtech specializes in regulatory compliance automation, enabling financial institutions to manage risk, adhere to regulations, and reduce compliance costs more effectively. The better choice depends on organizational goals: insurtech for transforming insurance operations, regtech for strengthening compliance and risk management in finance.

Connection

Insurtech leverages advanced technologies to innovate insurance services, while regtech focuses on automating regulatory compliance within the financial sector. Both sectors intersect by utilizing big data analytics, artificial intelligence, and machine learning to enhance risk assessment, fraud detection, and streamline regulatory reporting. Their synergy helps insurance firms improve operational efficiency, reduce compliance costs, and maintain adherence to evolving financial regulations.

Key Terms

Compliance (RegTech)

RegTech specializes in automating regulatory compliance processes through advanced technologies such as AI, blockchain, and big data analytics to reduce risk and improve reporting accuracy. In contrast, InsurTech focuses on enhancing insurance services via innovations like digital underwriting, claims automation, and customer experience personalization. Explore how RegTech solutions transform compliance management for financial institutions and insurers to stay ahead of regulatory demands.

Underwriting (InsurTech)

InsurTech leverages advanced data analytics, artificial intelligence, and machine learning to revolutionize underwriting by enabling more accurate risk assessment and personalized policy pricing. This technology streamlines traditional underwriting processes, reducing manual effort and accelerating decision-making while improving fraud detection and compliance. Explore how InsurTech solutions are transforming underwriting and reshaping the insurance industry.

Automation

Regtech leverages automation to streamline regulatory compliance through real-time monitoring, data analytics, and risk management, reducing manual errors and enhancing efficiency for financial institutions. Insurtech automates claims processing, underwriting, and customer interactions using AI-driven tools and machine learning to improve accuracy and speed in insurance services. Explore the latest advancements in automation within regtech and insurtech to understand their impact on industry transformation.

Source and External Links

What is regtech? - Moody's - Regtech (regulatory technology) refers to software solutions automating regulatory compliance, mainly in financial services, helping firms manage processes like KYC, AML, and counter-terrorist financing to prevent financial crime and fines, emerging strongly after the 2008 financial crisis to enable faster, scalable compliance in a digital-first environment.

What is RegTech (Regulatory Technology)? - Tipalti - Regtech uses technologies like machine learning, big data, and cloud computing to automate compliance and risk management in financial institutions, monitoring transactions in real time to detect fraud, data breaches, or money laundering, thus reducing costs and improving regulatory adherence.

Regulatory technology - Wikipedia - RegTech is information technology that enhances regulatory and compliance processes primarily in heavily regulated industries, focusing on monitoring, reporting, and standardizing compliance to improve transparency and reduce costs, with potential for near real-time risk management.

dowidth.com

dowidth.com