Risk parity portfolios allocate capital based on risk contribution to achieve balanced volatility across asset classes, enhancing diversification and potentially reducing drawdowns. Liability-driven investment (LDI) portfolios focus on matching assets with future liabilities, prioritizing risk management to meet specific financial obligations such as pension payouts. Explore the differences and benefits of these strategies to optimize your investment approach.

Why it is important

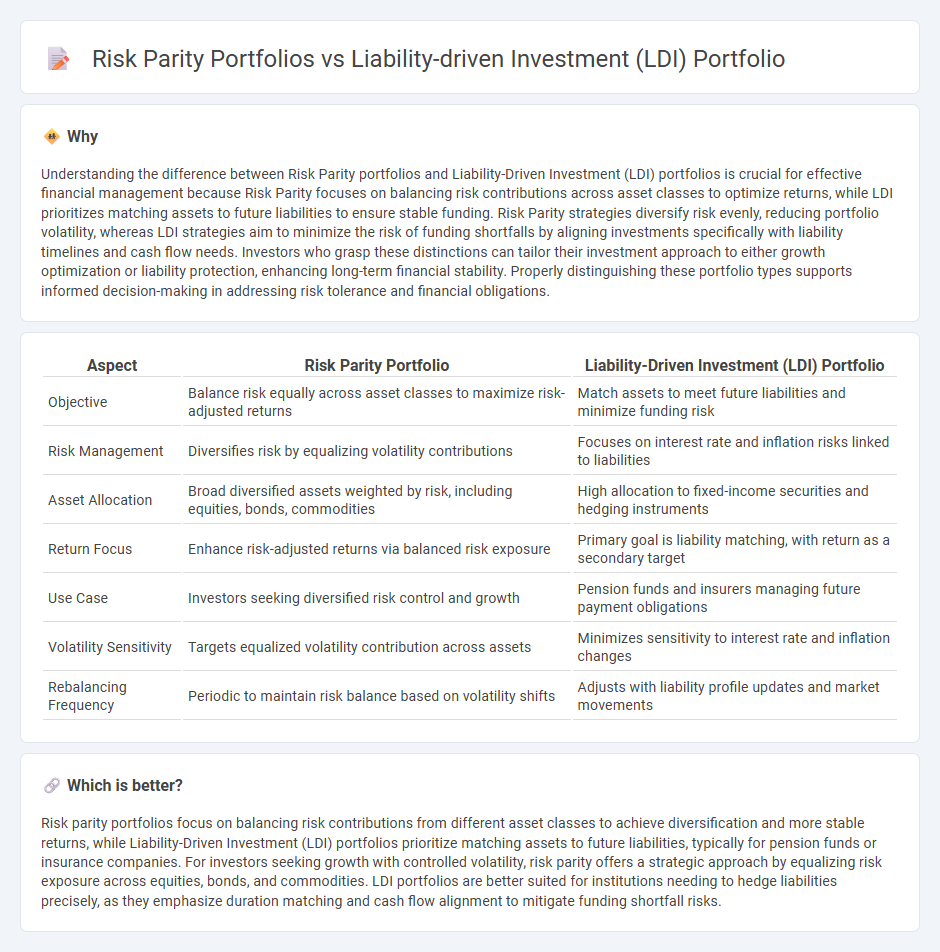

Understanding the difference between Risk Parity portfolios and Liability-Driven Investment (LDI) portfolios is crucial for effective financial management because Risk Parity focuses on balancing risk contributions across asset classes to optimize returns, while LDI prioritizes matching assets to future liabilities to ensure stable funding. Risk Parity strategies diversify risk evenly, reducing portfolio volatility, whereas LDI strategies aim to minimize the risk of funding shortfalls by aligning investments specifically with liability timelines and cash flow needs. Investors who grasp these distinctions can tailor their investment approach to either growth optimization or liability protection, enhancing long-term financial stability. Properly distinguishing these portfolio types supports informed decision-making in addressing risk tolerance and financial obligations.

Comparison Table

| Aspect | Risk Parity Portfolio | Liability-Driven Investment (LDI) Portfolio |

|---|---|---|

| Objective | Balance risk equally across asset classes to maximize risk-adjusted returns | Match assets to meet future liabilities and minimize funding risk |

| Risk Management | Diversifies risk by equalizing volatility contributions | Focuses on interest rate and inflation risks linked to liabilities |

| Asset Allocation | Broad diversified assets weighted by risk, including equities, bonds, commodities | High allocation to fixed-income securities and hedging instruments |

| Return Focus | Enhance risk-adjusted returns via balanced risk exposure | Primary goal is liability matching, with return as a secondary target |

| Use Case | Investors seeking diversified risk control and growth | Pension funds and insurers managing future payment obligations |

| Volatility Sensitivity | Targets equalized volatility contribution across assets | Minimizes sensitivity to interest rate and inflation changes |

| Rebalancing Frequency | Periodic to maintain risk balance based on volatility shifts | Adjusts with liability profile updates and market movements |

Which is better?

Risk parity portfolios focus on balancing risk contributions from different asset classes to achieve diversification and more stable returns, while Liability-Driven Investment (LDI) portfolios prioritize matching assets to future liabilities, typically for pension funds or insurance companies. For investors seeking growth with controlled volatility, risk parity offers a strategic approach by equalizing risk exposure across equities, bonds, and commodities. LDI portfolios are better suited for institutions needing to hedge liabilities precisely, as they emphasize duration matching and cash flow alignment to mitigate funding shortfall risks.

Connection

Risk parity portfolios and Liability-Driven Investment (LDI) portfolios are connected through their focus on balancing risk to achieve stable returns aligned with liabilities. Both strategies emphasize diversification across asset classes to mitigate risk and ensure liabilities are met, with risk parity allocating capital based on risk contribution and LDI targeting cash flows to match future obligations. The integration of risk parity principles within LDI frameworks enhances the management of interest rate and inflation risks crucial for liability matching.

Key Terms

Interest Rate Risk

Liability-driven investment (LDI) portfolios primarily aim to manage interest rate risk by matching assets to liabilities, often using duration-matched bonds and derivatives to hedge interest rate fluctuations effectively. In contrast, risk parity portfolios allocate risk equally across asset classes, which may result in less direct focus on interest rate sensitivity and potentially higher exposure to interest rate volatility. Explore further to understand how these strategies impact portfolio stability and risk management.

Leverage

Liability-driven investment (LDI) portfolios primarily use leverage to match asset durations with long-term liabilities, optimizing funding ratios and ensuring pension obligations are met under varying interest rate scenarios. Risk parity portfolios employ leverage to equalize risk contributions across asset classes, balancing volatility rather than targeting specific liability matching, enhancing diversification and risk-adjusted returns. Explore how leverage mechanisms differ in LDI and risk parity strategies to optimize portfolio objectives and risk management.

Asset Allocation

Liability-driven investment (LDI) portfolios prioritize matching assets to future liabilities using fixed income instruments to reduce funding risk, emphasizing duration and cash flow alignment. Risk parity portfolios allocate risk equally across asset classes, often leveraging a diversified mix of equities, bonds, and commodities to balance volatility contributions rather than focusing on liability matching. Explore detailed strategies and asset allocation differences between LDI and risk parity portfolios to optimize investment outcomes.

Source and External Links

Liability-Driven Investing (LDI) Strategies - Russell Investments - Liability-driven investing is an approach that focuses the investment policy and asset allocation decisions on matching the current and future liabilities of a pension plan, aiming to manage the risk of not meeting pension obligations by aligning assets to liabilities and reducing volatility in funded status.

Liability-Driven Investing | Institutional Investors - Parametric's LDI strategies help pension plans manage assets to fund future liabilities while balancing risk exposures, offering customized solutions that incorporate cash, bonds, overlays, and glide path management to hedge liabilities effectively.

Frequently asked questions: Liability-driven investing (LDI ... - Milliman - LDI is an investment strategy aimed at covering a pension plan's lifetime benefit payments by matching the duration and timing of fixed income assets to the expected cash outflows of the plan's liabilities, reducing interest rate risk while acknowledging residual credit and demographic risks.

dowidth.com

dowidth.com