Green bonds are fixed-income securities issued to fund environmentally sustainable projects, targeting investors interested in supporting eco-friendly initiatives. Municipal bonds are debt securities issued by local governments to finance public projects like schools, roads, and infrastructure, offering tax-exempt interest to investors. Explore the differences in impact, risk, and returns between green bonds and municipal bonds to make informed investment decisions.

Why it is important

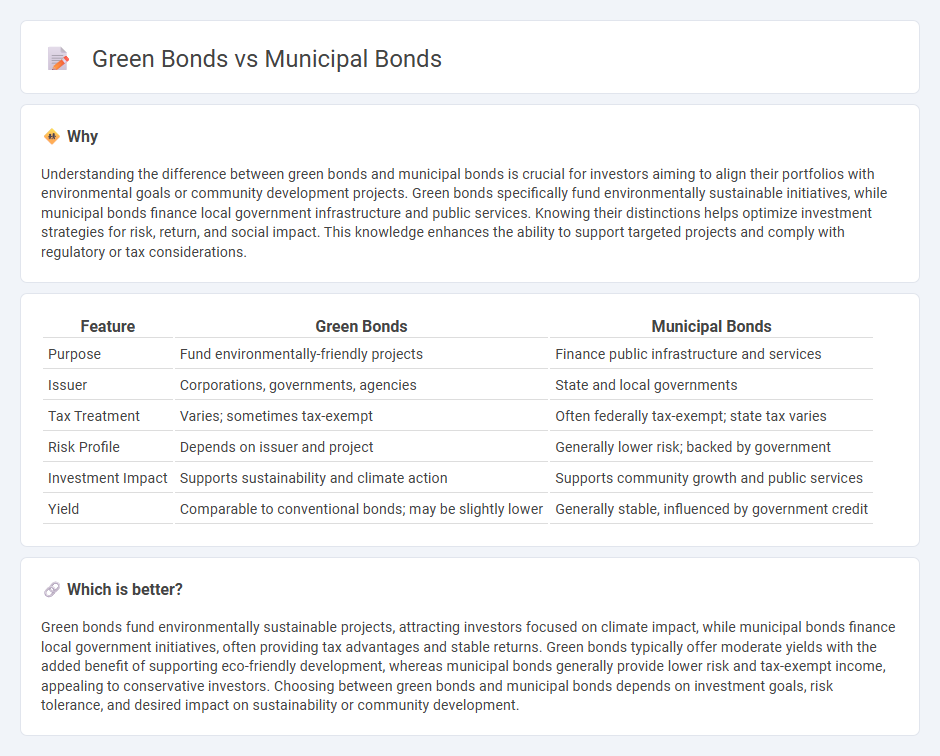

Understanding the difference between green bonds and municipal bonds is crucial for investors aiming to align their portfolios with environmental goals or community development projects. Green bonds specifically fund environmentally sustainable initiatives, while municipal bonds finance local government infrastructure and public services. Knowing their distinctions helps optimize investment strategies for risk, return, and social impact. This knowledge enhances the ability to support targeted projects and comply with regulatory or tax considerations.

Comparison Table

| Feature | Green Bonds | Municipal Bonds |

|---|---|---|

| Purpose | Fund environmentally-friendly projects | Finance public infrastructure and services |

| Issuer | Corporations, governments, agencies | State and local governments |

| Tax Treatment | Varies; sometimes tax-exempt | Often federally tax-exempt; state tax varies |

| Risk Profile | Depends on issuer and project | Generally lower risk; backed by government |

| Investment Impact | Supports sustainability and climate action | Supports community growth and public services |

| Yield | Comparable to conventional bonds; may be slightly lower | Generally stable, influenced by government credit |

Which is better?

Green bonds fund environmentally sustainable projects, attracting investors focused on climate impact, while municipal bonds finance local government initiatives, often providing tax advantages and stable returns. Green bonds typically offer moderate yields with the added benefit of supporting eco-friendly development, whereas municipal bonds generally provide lower risk and tax-exempt income, appealing to conservative investors. Choosing between green bonds and municipal bonds depends on investment goals, risk tolerance, and desired impact on sustainability or community development.

Connection

Green bonds and municipal bonds are often interconnected as municipalities issue green bonds to finance environmentally sustainable projects such as renewable energy, waste management, and infrastructure improvements. These bonds attract investors seeking both financial returns and positive environmental impact, aligning public sector funding with climate goals. The growing market for green municipal bonds reflects increased demand for transparent, impact-driven investments in public finance.

Key Terms

Tax-exempt status

Municipal bonds offer tax-exempt interest income at the federal level and often at the state and local levels, making them attractive for investors seeking tax savings. Green bonds, issued to fund environmentally sustainable projects, may or may not have tax-exempt status depending on the issuer and specific bond terms. Explore the unique tax benefits and investment opportunities each bond type provides to align with your financial goals.

Use of proceeds

Municipal bonds allocate proceeds primarily to public infrastructure projects such as schools, roads, and water systems, providing essential community services and improvements. Green bonds, a subset of municipal or corporate bonds, channel funds exclusively toward environmentally sustainable projects like renewable energy, energy efficiency, and climate resilience initiatives. Discover more about how these bond types target funding and impact investment strategies.

Environmental impact

Green bonds specifically fund projects with positive environmental impacts, such as renewable energy, pollution reduction, and climate change mitigation, while municipal bonds finance broader public infrastructure needs without strict environmental criteria. The environmental impact of green bonds is measurable through sustainability reports and verified by third-party certifications like the Climate Bonds Initiative. Discover more about how green bonds drive sustainable investments and compare their benefits to traditional municipal bonds.

Source and External Links

Municipal bond - Municipal bonds, or "munis," are debt securities issued by state or local governments (or their agencies) to finance public projects; main types include general obligation bonds backed by taxing power and revenue bonds backed by specific income sources like utilities.

Municipal Bonds - Municipal bonds can be general obligation bonds supported by full faith and credit of issuer taxing power or revenue bonds paid from project income, with varying tax treatments that investors should consider.

How Are Municipal Bonds Quoted and Priced? - Municipal bonds typically are sold in denominations starting at $5,000, pay fixed interest often semiannually, and are quoted relative to a par value of $100; they may be sold directly or through underwriters in competitive or negotiated sales.

dowidth.com

dowidth.com