Sovereign debt restructuring involves altering the terms of a nation's debt obligations to achieve long-term sustainability, often through principal reduction or extended maturities, whereas debt rescheduling focuses on postponing payment deadlines without changing the original debt terms. This distinction impacts international creditors, fiscal policies, and economic stability, influencing recovery prospects in emerging markets facing liquidity crises. Explore the nuances of sovereign debt strategies to understand their implications on global finance.

Why it is important

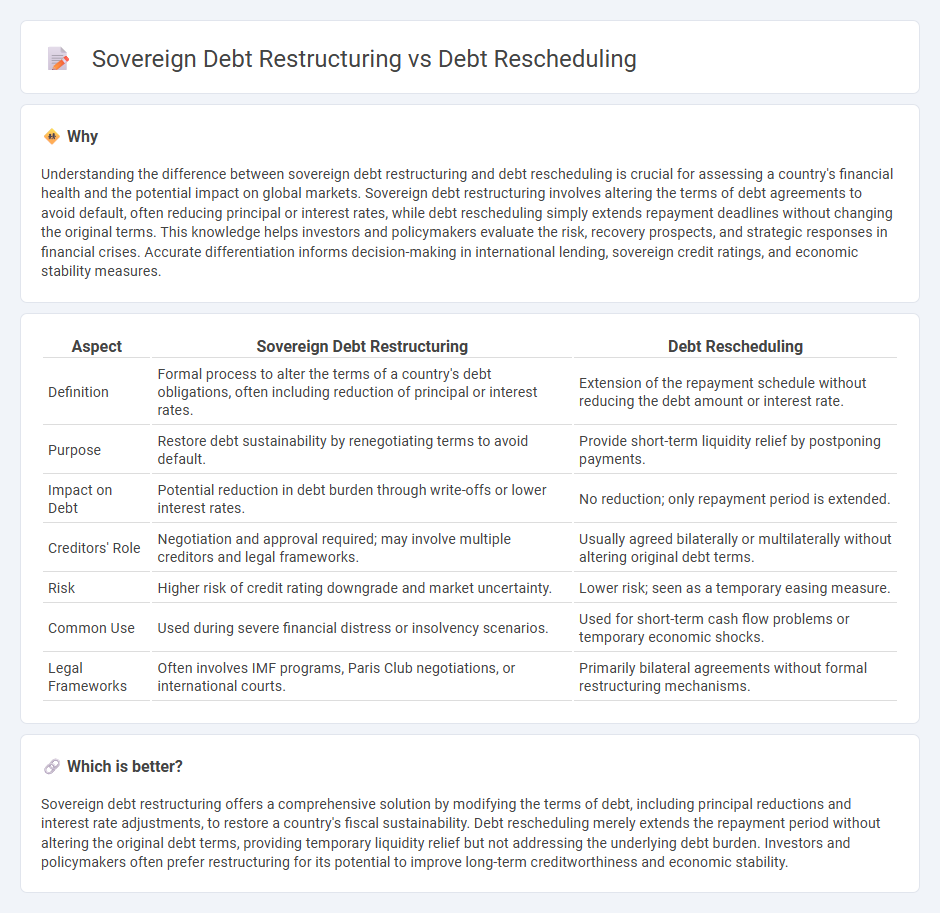

Understanding the difference between sovereign debt restructuring and debt rescheduling is crucial for assessing a country's financial health and the potential impact on global markets. Sovereign debt restructuring involves altering the terms of debt agreements to avoid default, often reducing principal or interest rates, while debt rescheduling simply extends repayment deadlines without changing the original terms. This knowledge helps investors and policymakers evaluate the risk, recovery prospects, and strategic responses in financial crises. Accurate differentiation informs decision-making in international lending, sovereign credit ratings, and economic stability measures.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Debt Rescheduling |

|---|---|---|

| Definition | Formal process to alter the terms of a country's debt obligations, often including reduction of principal or interest rates. | Extension of the repayment schedule without reducing the debt amount or interest rate. |

| Purpose | Restore debt sustainability by renegotiating terms to avoid default. | Provide short-term liquidity relief by postponing payments. |

| Impact on Debt | Potential reduction in debt burden through write-offs or lower interest rates. | No reduction; only repayment period is extended. |

| Creditors' Role | Negotiation and approval required; may involve multiple creditors and legal frameworks. | Usually agreed bilaterally or multilaterally without altering original debt terms. |

| Risk | Higher risk of credit rating downgrade and market uncertainty. | Lower risk; seen as a temporary easing measure. |

| Common Use | Used during severe financial distress or insolvency scenarios. | Used for short-term cash flow problems or temporary economic shocks. |

| Legal Frameworks | Often involves IMF programs, Paris Club negotiations, or international courts. | Primarily bilateral agreements without formal restructuring mechanisms. |

Which is better?

Sovereign debt restructuring offers a comprehensive solution by modifying the terms of debt, including principal reductions and interest rate adjustments, to restore a country's fiscal sustainability. Debt rescheduling merely extends the repayment period without altering the original debt terms, providing temporary liquidity relief but not addressing the underlying debt burden. Investors and policymakers often prefer restructuring for its potential to improve long-term creditworthiness and economic stability.

Connection

Sovereign debt restructuring involves modifying the terms of a country's outstanding debt to achieve debt sustainability, often through reducing principal or lowering interest rates. Debt rescheduling is a specific form of restructuring that focuses on extending payment deadlines to provide temporary relief without reducing the overall debt burden. Both processes aim to alleviate fiscal pressure on sovereign borrowers and improve long-term financial stability.

Key Terms

Maturity Extension

Debt rescheduling primarily involves extending the maturity of existing sovereign debt to provide the borrower with more time to meet repayment obligations, often without altering the principal or interest rates. Sovereign debt restructuring, however, is a broader process that may include maturity extension alongside reductions in principal, interest rate adjustments, or other changes to terms aimed at restoring debt sustainability. Explore more about how maturity extension shapes sovereign debt management strategies and impacts financial stability.

Haircut

Debt rescheduling involves extending the repayment period of sovereign debt without reducing the principal amount, whereas sovereign debt restructuring often includes a "haircut," a negotiated reduction in the debt's face value to alleviate the debtor country's financial burden. Haircuts can vary widely--from 10% to over 50%--and are critical in restoring debt sustainability by lowering the debt-to-GDP ratio. Explore more to understand how haircuts impact international finance and sovereign credit ratings.

Debt-for-Equity Swap

Debt rescheduling involves extending the payment period of sovereign debt without reducing the principal amount, improving short-term liquidity for the debtor nation. Sovereign debt restructuring, including strategies like Debt-for-Equity Swaps, entails modifying debt terms to reduce the overall debt burden, often exchanging debt obligations for equity in state-owned enterprises. Explore how Debt-for-Equity Swaps can transform debt liabilities into investment opportunities for deeper insights.

Source and External Links

Debt rescheduling: what does it mean? in - IMF E-Library - Debt rescheduling is the rearrangement or restructuring of the original repayment schedule of a debt, often involving a grace period and spreading repayments that were originally due in one year over several subsequent years, with interest cost implications.

What is Debt Rescheduling: How it Works - Bajaj Finserv - Debt rescheduling modifies the terms of an existing loan to make repayments more manageable, often by extending the repayment period, lowering interest burden, improving cash flow, and preventing default.

Debt rescheduling - Wikipedia - Debt rescheduling is the lengthening of the time of debt repayment by restructuring the existing loan terms, including approaches such as extending payment periods or pausing payments temporarily to relieve the borrower's financial pressure.

dowidth.com

dowidth.com