Altcoins staking allows investors to earn passive income by locking their digital assets in blockchain networks to support operations and validate transactions, often yielding attractive annual percentage rates (APRs). Crypto lending involves lending digital currencies to borrowers through decentralized or centralized platforms, generating returns from interest payments while maintaining asset liquidity. Discover the key differences and benefits of altcoins staking versus crypto lending to optimize your cryptocurrency portfolio.

Why it is important

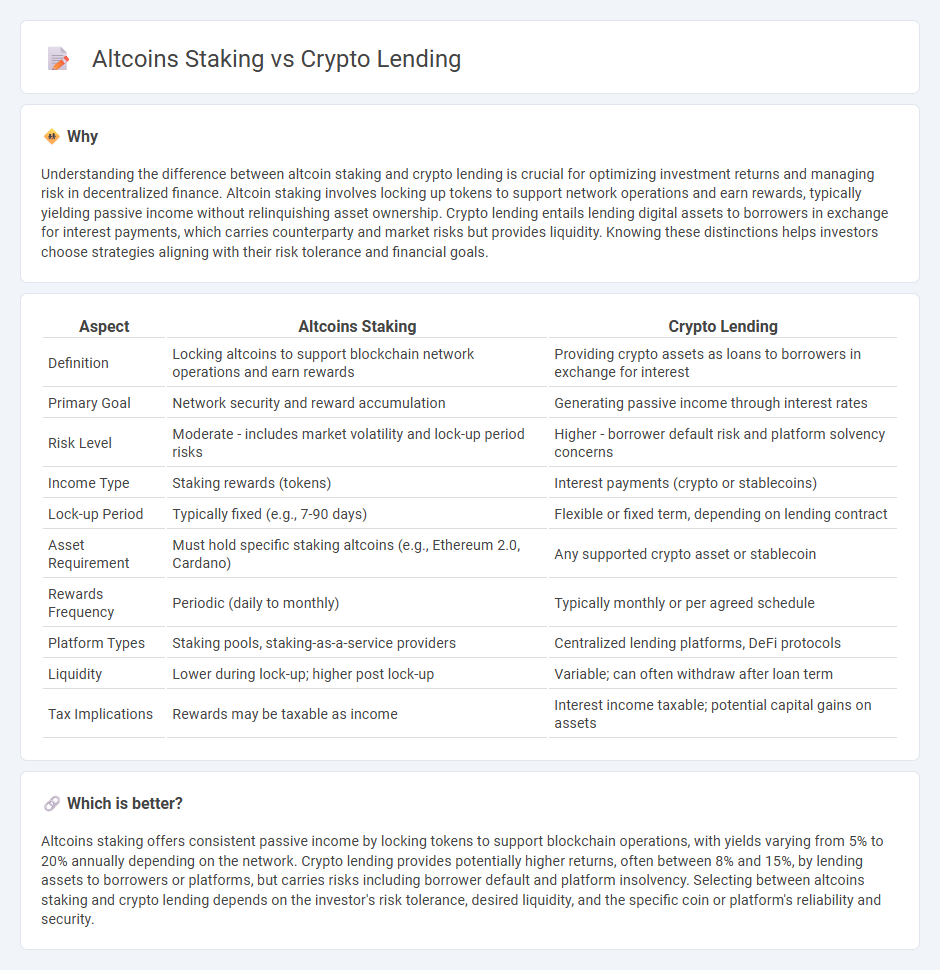

Understanding the difference between altcoin staking and crypto lending is crucial for optimizing investment returns and managing risk in decentralized finance. Altcoin staking involves locking up tokens to support network operations and earn rewards, typically yielding passive income without relinquishing asset ownership. Crypto lending entails lending digital assets to borrowers in exchange for interest payments, which carries counterparty and market risks but provides liquidity. Knowing these distinctions helps investors choose strategies aligning with their risk tolerance and financial goals.

Comparison Table

| Aspect | Altcoins Staking | Crypto Lending |

|---|---|---|

| Definition | Locking altcoins to support blockchain network operations and earn rewards | Providing crypto assets as loans to borrowers in exchange for interest |

| Primary Goal | Network security and reward accumulation | Generating passive income through interest rates |

| Risk Level | Moderate - includes market volatility and lock-up period risks | Higher - borrower default risk and platform solvency concerns |

| Income Type | Staking rewards (tokens) | Interest payments (crypto or stablecoins) |

| Lock-up Period | Typically fixed (e.g., 7-90 days) | Flexible or fixed term, depending on lending contract |

| Asset Requirement | Must hold specific staking altcoins (e.g., Ethereum 2.0, Cardano) | Any supported crypto asset or stablecoin |

| Rewards Frequency | Periodic (daily to monthly) | Typically monthly or per agreed schedule |

| Platform Types | Staking pools, staking-as-a-service providers | Centralized lending platforms, DeFi protocols |

| Liquidity | Lower during lock-up; higher post lock-up | Variable; can often withdraw after loan term |

| Tax Implications | Rewards may be taxable as income | Interest income taxable; potential capital gains on assets |

Which is better?

Altcoins staking offers consistent passive income by locking tokens to support blockchain operations, with yields varying from 5% to 20% annually depending on the network. Crypto lending provides potentially higher returns, often between 8% and 15%, by lending assets to borrowers or platforms, but carries risks including borrower default and platform insolvency. Selecting between altcoins staking and crypto lending depends on the investor's risk tolerance, desired liquidity, and the specific coin or platform's reliability and security.

Connection

Altcoins staking involves locking up digital assets to support blockchain network operations, earning rewards in return, which increases liquidity and market participation. Crypto lending platforms utilize these staked assets as collateral, enabling borrowers to secure loans without liquidating holdings, thus enhancing capital efficiency. This interconnected mechanism fosters a sustainable decentralized finance ecosystem by combining asset utilization with yield generation.

Key Terms

Collateralization

Collateralization in crypto lending involves securing loans with cryptocurrency assets, reducing lender risk and enabling borrowers to access funds without liquidating holdings. Altcoins staking typically does not require collateral but involves locking assets to support network operations and earn rewards, offering liquidity retention but often lower risk mitigation. Explore the nuances of collateralization in crypto lending versus staking to optimize your investment strategy.

Yield

Crypto lending typically offers fixed or variable interest rates ranging from 5% to 12% annually, making it a reliable source of yield through loaning digital assets on platforms like BlockFi or Celsius. Altcoins staking yields vary widely, often between 7% and 20%, depending on the blockchain protocol's consensus mechanism and network reward structure, such as Ethereum 2.0 or Cardano. Explore deeper insights into yield strategies for optimizing your crypto portfolio.

Lock-up Period

Crypto lending typically involves fixed lock-up periods ranging from a few days to several months, during which funds cannot be withdrawn without penalties. Altcoins staking lock-up durations vary widely depending on the blockchain protocol, often requiring validators to commit tokens for weeks or even years to maintain network security and earn rewards. Explore in-depth comparisons of lock-up periods and their impact on liquidity and earnings to make informed investment decisions.

Source and External Links

What is crypto lending and how does it work? - Crypto lending is a financial transaction where one party lends cryptocurrency to another in exchange for compensation, often facilitated by centralized or decentralized platforms, providing lenders with interest earnings while borrowers use crypto assets as collateral.

What Is Crypto Lending and How Does it Work? - Crypto lending allows borrowing money by using cryptocurrency as collateral, where the borrower deposits crypto to receive a loan in fiat or stablecoins and repays with interest to reclaim their collateral.

Crypto Loans: How Does Crypto Lending Work? | Gemini - Crypto lending uses digital assets as collateral for loans, often requiring over-collateralization, enabling holders to retain their crypto while accessing liquidity in fiat or other cryptocurrencies.

dowidth.com

dowidth.com