Finfluencers leverage social media platforms to simplify complex financial concepts and share investment insights with a broad audience, often focusing on real-time trends and personal finance tips. Quantitative analysts employ advanced mathematical models and statistical techniques to guide institutional investment decisions and risk management strategies. Discover the distinct roles and impacts of finfluencers and quantitative analysts in today's financial landscape.

Why it is important

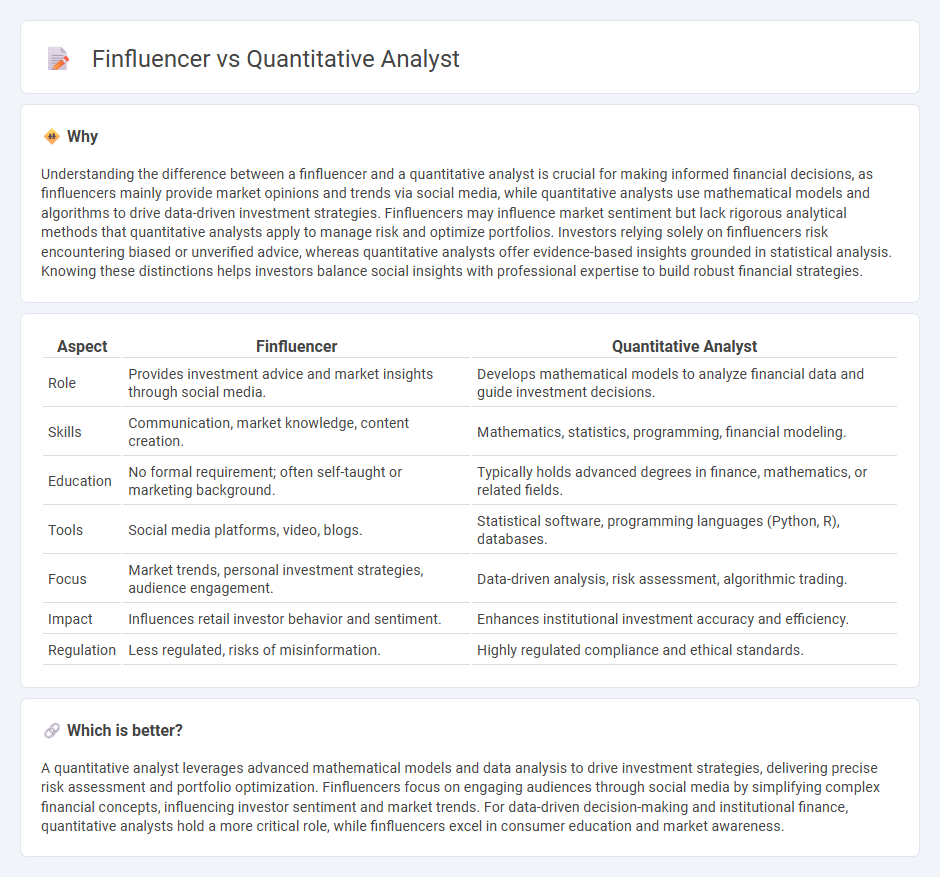

Understanding the difference between a finfluencer and a quantitative analyst is crucial for making informed financial decisions, as finfluencers mainly provide market opinions and trends via social media, while quantitative analysts use mathematical models and algorithms to drive data-driven investment strategies. Finfluencers may influence market sentiment but lack rigorous analytical methods that quantitative analysts apply to manage risk and optimize portfolios. Investors relying solely on finfluencers risk encountering biased or unverified advice, whereas quantitative analysts offer evidence-based insights grounded in statistical analysis. Knowing these distinctions helps investors balance social insights with professional expertise to build robust financial strategies.

Comparison Table

| Aspect | Finfluencer | Quantitative Analyst |

|---|---|---|

| Role | Provides investment advice and market insights through social media. | Develops mathematical models to analyze financial data and guide investment decisions. |

| Skills | Communication, market knowledge, content creation. | Mathematics, statistics, programming, financial modeling. |

| Education | No formal requirement; often self-taught or marketing background. | Typically holds advanced degrees in finance, mathematics, or related fields. |

| Tools | Social media platforms, video, blogs. | Statistical software, programming languages (Python, R), databases. |

| Focus | Market trends, personal investment strategies, audience engagement. | Data-driven analysis, risk assessment, algorithmic trading. |

| Impact | Influences retail investor behavior and sentiment. | Enhances institutional investment accuracy and efficiency. |

| Regulation | Less regulated, risks of misinformation. | Highly regulated compliance and ethical standards. |

Which is better?

A quantitative analyst leverages advanced mathematical models and data analysis to drive investment strategies, delivering precise risk assessment and portfolio optimization. Finfluencers focus on engaging audiences through social media by simplifying complex financial concepts, influencing investor sentiment and market trends. For data-driven decision-making and institutional finance, quantitative analysts hold a more critical role, while finfluencers excel in consumer education and market awareness.

Connection

Finfluencers leverage social media platforms to simplify complex financial concepts, often incorporating data-driven insights derived from quantitative analysis techniques. Quantitative analysts develop models and algorithms that predict market trends, providing the foundational data that finfluencers interpret and communicate to a broader audience. This symbiotic relationship enhances public understanding of financial markets through accessible, analytics-based content.

Key Terms

Quantitative Analyst:

A Quantitative Analyst specializes in developing mathematical models to analyze financial data, optimize trading strategies, and assess risk using advanced statistical techniques and programming skills. Their expertise in econometrics, machine learning, and data analysis drives data-informed decision-making within investment banks, hedge funds, and asset management firms. Discover how quantitative analysts shape modern finance and distinguish their role from emerging finfluencers.

Algorithmic Trading

Quantitative analysts utilize advanced mathematical models and statistical techniques to develop and optimize algorithmic trading strategies, ensuring efficient market predictions and risk management. Finfluencers, while often providing market insights and trading tips on social platforms, rely more on social engagement and less on rigorous quantitative analysis. Discover how these distinct roles impact algorithmic trading by exploring their methodologies and market influences.

Risk Modeling

Quantitative analysts specialize in developing sophisticated risk models using statistical techniques and financial theories to predict market behavior and manage portfolio risks effectively. Finfluencers, while knowledgeable about finance, primarily focus on educating and influencing their audience through accessible content rather than creating or implementing complex risk modeling frameworks. Explore deeper insights into the distinct roles and methodologies in risk modeling by quantitative analysts compared to finfluencers.

Source and External Links

Quantitative Analyst Career Guide - Quantitative analysts, or "quants," use statistical and mathematical methods to assess financial and risk management problems, design asset pricing and risk models, and have a strong career outlook with about 9% job growth expected through 2033.

Quantitative analysis (finance) - Wikipedia - Quantitative analysts specialize in mathematical and statistical applications in finance, including derivative pricing, risk management, and quantitative investment management methods such as algorithmic trading.

How To Become A Quant | Quantitative Finance Careers - Becoming a quant involves strong skills in mathematics, programming, financial technology, and business; job growth is predicted at nearly 10% through 2026, driven by advances in big data and computing.

dowidth.com

dowidth.com