Catastrophe bonds (cat bonds) are risk-linked securities that transfer catastrophe risk from insurers to investors, offering high yields in exchange for potential principal loss if a specified disaster occurs. Insurance-linked securities (ILS) encompass various financial instruments, including cat bonds, that enable the transfer of insurance risks to capital markets, enhancing risk diversification and providing liquidity. Explore the distinct benefits and mechanisms behind catastrophe bonds and insurance-linked securities to better understand their role in modern finance.

Why it is important

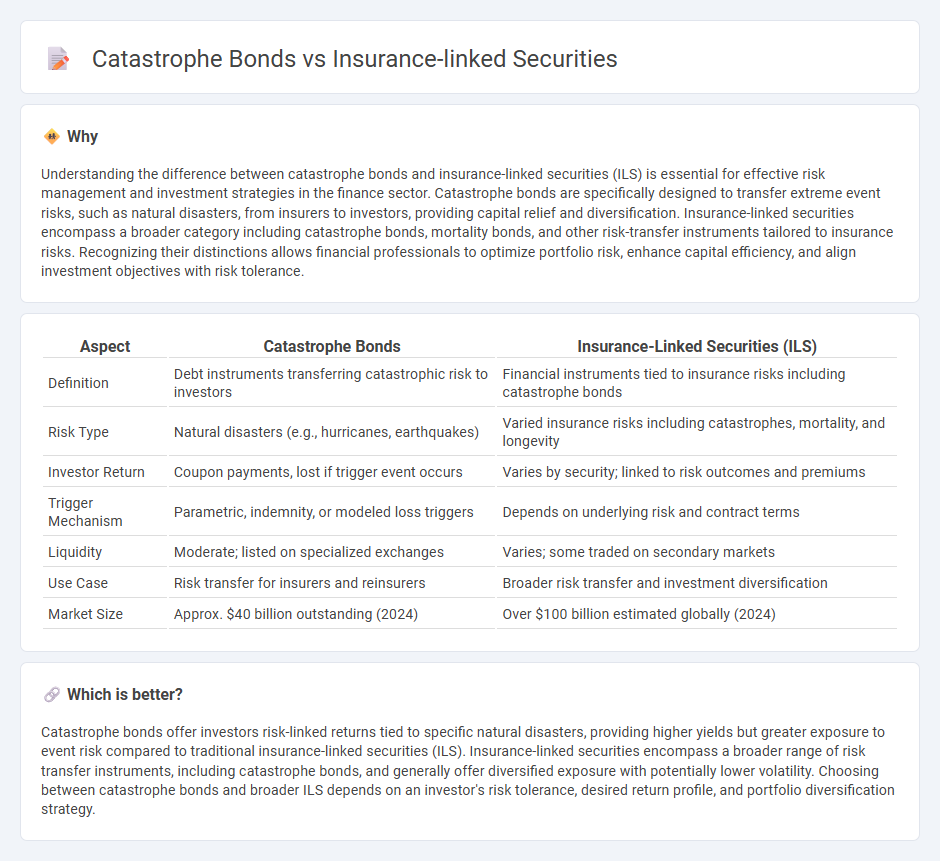

Understanding the difference between catastrophe bonds and insurance-linked securities (ILS) is essential for effective risk management and investment strategies in the finance sector. Catastrophe bonds are specifically designed to transfer extreme event risks, such as natural disasters, from insurers to investors, providing capital relief and diversification. Insurance-linked securities encompass a broader category including catastrophe bonds, mortality bonds, and other risk-transfer instruments tailored to insurance risks. Recognizing their distinctions allows financial professionals to optimize portfolio risk, enhance capital efficiency, and align investment objectives with risk tolerance.

Comparison Table

| Aspect | Catastrophe Bonds | Insurance-Linked Securities (ILS) |

|---|---|---|

| Definition | Debt instruments transferring catastrophic risk to investors | Financial instruments tied to insurance risks including catastrophe bonds |

| Risk Type | Natural disasters (e.g., hurricanes, earthquakes) | Varied insurance risks including catastrophes, mortality, and longevity |

| Investor Return | Coupon payments, lost if trigger event occurs | Varies by security; linked to risk outcomes and premiums |

| Trigger Mechanism | Parametric, indemnity, or modeled loss triggers | Depends on underlying risk and contract terms |

| Liquidity | Moderate; listed on specialized exchanges | Varies; some traded on secondary markets |

| Use Case | Risk transfer for insurers and reinsurers | Broader risk transfer and investment diversification |

| Market Size | Approx. $40 billion outstanding (2024) | Over $100 billion estimated globally (2024) |

Which is better?

Catastrophe bonds offer investors risk-linked returns tied to specific natural disasters, providing higher yields but greater exposure to event risk compared to traditional insurance-linked securities (ILS). Insurance-linked securities encompass a broader range of risk transfer instruments, including catastrophe bonds, and generally offer diversified exposure with potentially lower volatility. Choosing between catastrophe bonds and broader ILS depends on an investor's risk tolerance, desired return profile, and portfolio diversification strategy.

Connection

Catastrophe bonds are a type of insurance-linked security (ILS) designed to transfer risks from natural disasters to capital markets, providing insurers with additional capital during extreme events. These bonds pay high yields to investors in exchange for the risk that they may lose principal if predefined catastrophe triggers, such as hurricanes or earthquakes, occur. The connection lies in their role in risk diversification, enhancing financial stability for insurers while offering investors unique risk-return profiles uncorrelated with traditional markets.

Key Terms

Securitization

Insurance-linked securities (ILS) represent financial instruments that transfer insurance risk to capital markets, with securitization enabling the pooling and tranching of these risks to enhance investor access and liquidity. Catastrophe bonds, a primary type of ILS, use securitization by packaging specific catastrophe risks into tradable bonds, providing insurers with upfront capital while linking repayment to predefined natural disaster events. Explore detailed insights on how securitization mechanisms drive innovation and risk management in insurance-linked securities.

Risk Transfer

Insurance-linked securities (ILS) and catastrophe bonds (cat bonds) are financial instruments designed for risk transfer in the insurance industry, allowing insurers to offload catastrophe risks to capital markets. ILS encompass various types of securities, including cat bonds, which specifically provide coverage against defined catastrophe events such as earthquakes or hurricanes. Explore the mechanisms and benefits of risk transfer through these instruments to understand their impact on the insurance sector.

Trigger Event

Insurance-linked securities (ILS) transfer insurance risks to investors, with payouts triggered by specific loss events such as hurricanes or earthquakes. Catastrophe bonds, a key type of ILS, activate their trigger event based on predefined parameters like insured loss levels, parametric measures, or industry loss indices, ensuring clear, objective criteria for repayment suspension. Explore more about how trigger event structures impact risk management strategies in insurance-linked financial markets.

Source and External Links

What are insurance-linked securities (or ILS)? - Artemis.bm - Insurance-linked securities (ILS) are financial instruments whose value is affected by insured loss events, enabling insurance and reinsurance firms to transfer risk to capital markets and allowing institutional investors to access a unique asset class mostly uncorrelated with traditional financial markets.

What are insurance linked securities (or ILS)? - Schroders Capital - ILS are investments transferring insurance risk from (re)insurance companies to capital markets in exchange for premium returns, offering inflation-shielded, risk-managed yields that are generally uncorrelated to other asset classes and resilient to climate change effects.

Insurance-linked security - Wikipedia - Insurance-linked securities (ILS) are financial assets whose returns depend on insurance loss events, particularly natural catastrophes, providing a unique asset class whose risks are diversified and whose returns are uncorrelated with traditional marketable assets.

dowidth.com

dowidth.com