Quantamental investing combines quantitative analysis with fundamental stock evaluation to identify undervalued securities based on financial metrics and market data patterns. Momentum investing focuses on capitalizing on existing market trends by purchasing assets that exhibit strong recent performance, aiming for short- to medium-term gains. Explore more to understand which investment strategy aligns best with your portfolio goals and risk tolerance.

Why it is important

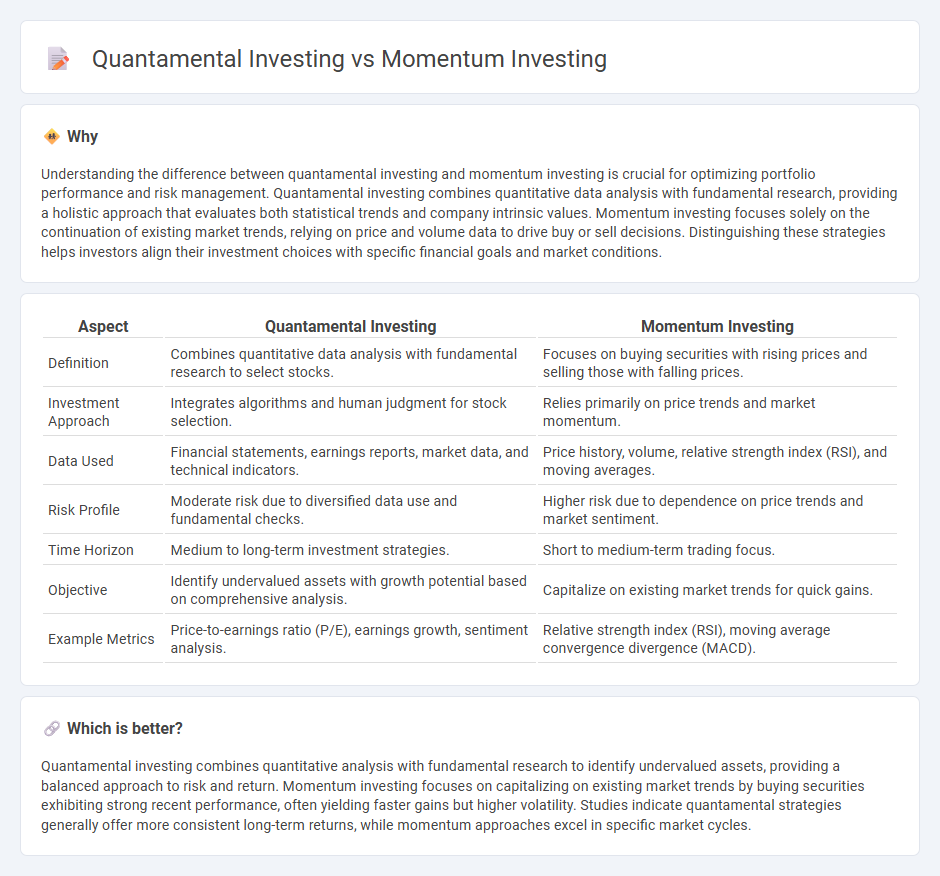

Understanding the difference between quantamental investing and momentum investing is crucial for optimizing portfolio performance and risk management. Quantamental investing combines quantitative data analysis with fundamental research, providing a holistic approach that evaluates both statistical trends and company intrinsic values. Momentum investing focuses solely on the continuation of existing market trends, relying on price and volume data to drive buy or sell decisions. Distinguishing these strategies helps investors align their investment choices with specific financial goals and market conditions.

Comparison Table

| Aspect | Quantamental Investing | Momentum Investing |

|---|---|---|

| Definition | Combines quantitative data analysis with fundamental research to select stocks. | Focuses on buying securities with rising prices and selling those with falling prices. |

| Investment Approach | Integrates algorithms and human judgment for stock selection. | Relies primarily on price trends and market momentum. |

| Data Used | Financial statements, earnings reports, market data, and technical indicators. | Price history, volume, relative strength index (RSI), and moving averages. |

| Risk Profile | Moderate risk due to diversified data use and fundamental checks. | Higher risk due to dependence on price trends and market sentiment. |

| Time Horizon | Medium to long-term investment strategies. | Short to medium-term trading focus. |

| Objective | Identify undervalued assets with growth potential based on comprehensive analysis. | Capitalize on existing market trends for quick gains. |

| Example Metrics | Price-to-earnings ratio (P/E), earnings growth, sentiment analysis. | Relative strength index (RSI), moving average convergence divergence (MACD). |

Which is better?

Quantamental investing combines quantitative analysis with fundamental research to identify undervalued assets, providing a balanced approach to risk and return. Momentum investing focuses on capitalizing on existing market trends by buying securities exhibiting strong recent performance, often yielding faster gains but higher volatility. Studies indicate quantamental strategies generally offer more consistent long-term returns, while momentum approaches excel in specific market cycles.

Connection

Quantamental investing integrates quantitative analysis with fundamental research to identify stocks exhibiting strong financial health and growth potential, often leveraging momentum indicators to time entry and exit points. Momentum investing focuses on capitalizing on existing market trends by buying securities with upward price momentum and selling those with downward trends, aligning with quantamental strategies that utilize momentum signals to enhance portfolio returns. Both approaches harness data-driven insights and market behavior patterns, combining fundamental valuation metrics with momentum factors to optimize investment decisions.

Key Terms

**Momentum Investing:**

Momentum investing capitalizes on the tendency of assets with rising prices to continue gaining value by analyzing historical price trends and trading volume. This strategy leverages technical indicators and market sentiment to identify stocks exhibiting strong upward momentum for potential gains. Explore this approach further to understand how momentum investing can enhance portfolio performance.

Relative Strength

Momentum investing leverages the concept of relative strength by targeting stocks with strong recent price performance, aiming to capitalize on continued upward trends. Quantamental investing combines quantitative models and fundamental analysis, enhancing relative strength evaluation with financial metrics for a more comprehensive stock selection. Discover how blending momentum strategies with fundamental insights can optimize investment returns.

Trend Analysis

Momentum investing capitalizes on identifying stocks exhibiting strong recent performance trends, leveraging price momentum to predict continued gains. Quantamental investing combines traditional fundamental analysis with quantitative models, incorporating trend analysis alongside financial metrics to enhance decision-making accuracy. Explore how these strategies use trend data differently to optimize investment outcomes.

Source and External Links

Strategies and Types of Momentum Investing - Momentum investing is a strategy that buys securities showing upward price trends and sells those with downward trends, relying on the idea that established trends tend to continue, and uses technical analysis rather than fundamental company performance.

Growth vs. Momentum Investing - Diversiview - Momentum investing capitalizes on the continuation of recent market trends by buying stocks that have performed well recently and selling underperforming stocks, focusing on price patterns rather than company fundamentals.

Momentum investing - Wikipedia - Momentum investing involves buying securities with high returns over the past 3 to 12 months and selling those with poor returns, explained by theories involving either compensation for risk or exploitation of behavioral biases like herding and overreaction.

dowidth.com

dowidth.com