Fractional shares allow investors to purchase a portion of a single company's stock, enabling diversified investment with smaller capital, while exchange-traded funds (ETFs) bundle multiple securities into one tradable asset, offering broad market exposure and liquidity. Fractional shares provide direct ownership in specific companies, whereas ETFs facilitate a diversified portfolio through a single investment vehicle. Explore the differences and benefits of fractional shares and ETFs to optimize your investment strategy.

Why it is important

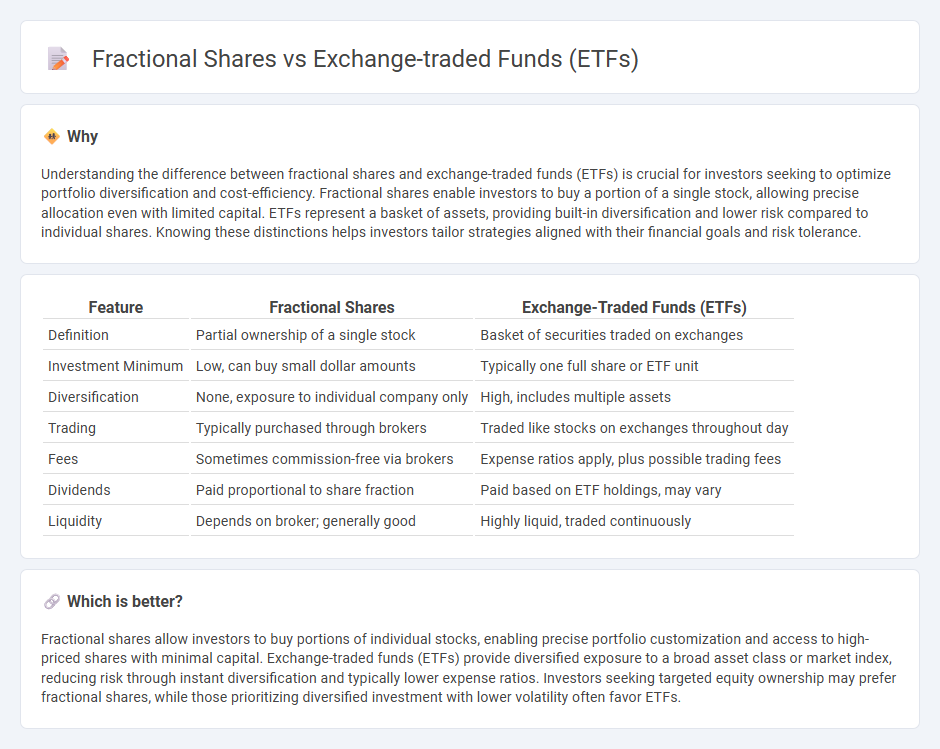

Understanding the difference between fractional shares and exchange-traded funds (ETFs) is crucial for investors seeking to optimize portfolio diversification and cost-efficiency. Fractional shares enable investors to buy a portion of a single stock, allowing precise allocation even with limited capital. ETFs represent a basket of assets, providing built-in diversification and lower risk compared to individual shares. Knowing these distinctions helps investors tailor strategies aligned with their financial goals and risk tolerance.

Comparison Table

| Feature | Fractional Shares | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Partial ownership of a single stock | Basket of securities traded on exchanges |

| Investment Minimum | Low, can buy small dollar amounts | Typically one full share or ETF unit |

| Diversification | None, exposure to individual company only | High, includes multiple assets |

| Trading | Typically purchased through brokers | Traded like stocks on exchanges throughout day |

| Fees | Sometimes commission-free via brokers | Expense ratios apply, plus possible trading fees |

| Dividends | Paid proportional to share fraction | Paid based on ETF holdings, may vary |

| Liquidity | Depends on broker; generally good | Highly liquid, traded continuously |

Which is better?

Fractional shares allow investors to buy portions of individual stocks, enabling precise portfolio customization and access to high-priced shares with minimal capital. Exchange-traded funds (ETFs) provide diversified exposure to a broad asset class or market index, reducing risk through instant diversification and typically lower expense ratios. Investors seeking targeted equity ownership may prefer fractional shares, while those prioritizing diversified investment with lower volatility often favor ETFs.

Connection

Fractional shares enable investors to buy partial units of exchange-traded funds (ETFs), making diversified portfolios accessible with smaller capital. ETFs, which pool various assets into a single security, benefit from fractional investing by increasing liquidity and broadening investor participation. This connection democratizes investment opportunities and fosters more efficient market allocation of capital.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity due to their ability to be bought and sold on stock exchanges throughout the trading day at market prices, providing investors with flexibility and real-time pricing. Fractional shares, although allowing investors to own portions of expensive stocks, often rely on the brokerage's platform for liquidity and might not be tradable in the same seamless manner as full shares or ETFs. Explore more to understand how liquidity impacts your investment strategy between ETFs and fractional shares.

Diversification

Exchange-traded funds (ETFs) provide instant diversification by pooling assets from multiple companies or sectors, reducing individual stock risk. Fractional shares allow investors to buy portions of high-priced stocks, enabling diversification even with limited capital, but require assembling a varied portfolio manually. Explore how each method supports your investment goals in diversifying risk and maximizing returns.

Accessibility

Exchange-traded funds (ETFs) offer broad market exposure and diversification with the ability to buy whole shares on major stock exchanges, often requiring a minimum investment amount. Fractional shares enable investors to purchase partial ownership of individual stocks or ETFs, lowering the barrier of entry by allowing investments with minimal capital. Explore the benefits and limitations of both options to determine which accessibility solution fits your investment goals.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - ETFs are investment products that pool money from many investors to buy stocks, bonds, or other assets and are traded on stock exchanges like individual stocks, offering tax efficiency and portfolio diversification.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the flexibility of stocks with diversification benefits of mutual funds, allowing investors to trade diversified portfolios during market hours with generally lower costs and greater tax efficiency than mutual funds.

Exchange-Traded Funds and Products | FINRA.org - ETFs are pooled investment products traded on exchanges that either track an index or are actively managed, with shares issued and redeemed through authorized participants to enable stock-like trading.

dowidth.com

dowidth.com